Blockchain technology has revolutionized the way we conduct transactions. Its decentralized and transparent nature ensures secure and efficient transfers of assets. However, as more blockchains emerge, the need for interoperability between them becomes apparent. This is where blockchain bridges come into play – acting as essential links for seamless transactions.

What is a Blockchain Bridge?

In order to grasp the concept of a blockchain bridge, it’s necessary to initially acquire comprehension regarding the nature of a blockchain. Noteworthy blockchain ecosystems encompass Bitcoin, Ethereum, and BNB Smart Chain, each reliant on distinctive consensus protocols, programming languages, and system regulations.

A blockchain bridge can be defined as a protocol that establishes a connection between two blockchains that are economically and technologically segregated. Its primary purpose is to facilitate interactions between these blockchains, functioning akin to a tangible bridge that joins two separate islands – in this context, the islands represent distinct blockchain ecosystems.

Consequently, the role of blockchain bridges is to enable what is commonly referred to as interoperability. This refers to the capability of digital assets and data residing within one blockchain to engage with another blockchain. Interoperability plays a pivotal role in the realm of the internet, where global machines communicate using a shared set of open protocols. Similarly, within the blockchain domain, which features a multitude of diverse protocols, blockchain bridges play a crucial role in enabling comparable fluidity in the exchange of data and value.

How Do Blockchain Bridges Work?

The primary and most frequently encountered utilization of a blockchain bridge pertains to the transfer of tokens. To illustrate, envision a scenario where you intend to transfer your Bitcoin (BTC) holdings to the Ethereum network. One viable approach involves liquidating your BTC and subsequently acquiring Ether (ETH). Nonetheless, this course of action would result in transaction fees and make you susceptible to fluctuations in market prices.

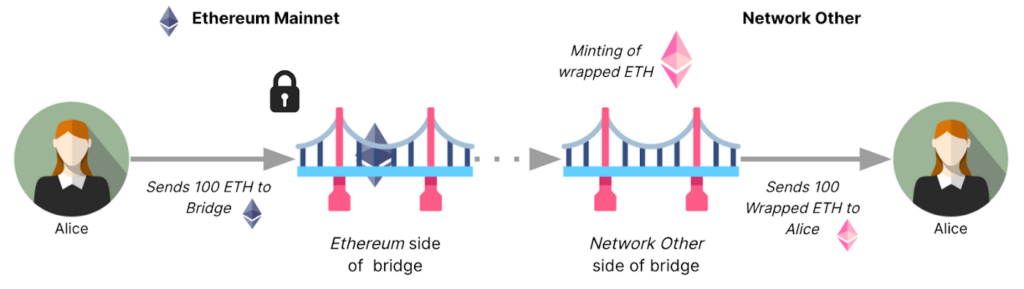

Conversely, an alternative means to accomplish this objective is by leveraging a blockchain bridge, all the while avoiding the need to divest your cryptocurrency assets. Upon employing a blockchain bridge to migrate 1 BTC into an Ethereum wallet, an associated contract specifically designed for bridging blockchains will secure your BTC holdings and simultaneously generate an equivalent measure of Wrapped BTC (WBTC). This WBTC is structured as an ERC20 token, seamlessly compatible with Ethereum’s network. The quantity of BTC you aim to transport becomes locked within an intelligent contract, prompting the issuance or creation of equivalent tokens on the target blockchain network. Notably, a wrapped token embodies a tokenized rendition of an alternative cryptocurrency. Its valuation is linked to the underlying asset it represents, usually permitting conversion back to the original form by redemption at any given point.

Adopting the viewpoint of a user engaging in this procedure, several sequential steps come into play. In an instance where the Binance Bridge is employed, the initial phase entails opting for the source chain and stipulating the precise quantity for bridging purposes. Subsequent to this, you will channel the cryptocurrency toward an address that’s generated by the Binance Bridge platform. During a designated time frame, once the cryptocurrency is successfully conveyed to the provided address, Binance Bridge takes on the responsibility of dispatching a corresponding quantity of wrapped tokens on the alternate blockchain. Should you desire to convert your assets back to their original state, the process can be effortlessly reversed by following the same set of steps in the opposite direction.

Types of Blockchain Bridges

Blockchain bridges can be sorted and grouped based on a variety of factors, including their operational functions, inherent mechanisms, and the degree of centralization involved.

In the realm of categorizing blockchain bridges, a pivotal distinction can be drawn between custodial bridges, those governed by a central authority, and non-custodial bridges, characterized by decentralized governance.

Custodial Bridges

In the case of custodial bridges, users must place their trust and confidence in a central entity that oversees the proper and secure functioning of the bridge. It is imperative for users to conduct comprehensive research to ensure the credibility and reliability of this central entity.

Non-Custodial Bridges

On the contrary, non-custodial bridges operate in a manner that reflects decentralization. These bridges rely on intelligent contracts to oversee the processes of crypto locking and minting. Consequently, the necessity to repose trust in a bridge operator is eliminated. The robustness of the system’s security is contingent upon the quality of the underlying code.

Another classification strategy hinges on the operational functions of blockchain bridges. This approach encompasses various types, such as wrapped asset bridges and sidechain bridges.

Wrapped Asset Bridges

Wrapped asset bridges facilitate the achievement of crypto interoperability. For instance, the process of migrating bitcoins to the Ethereum network entails wrapping BTC into Wrapped BTC (WBTC), an ERC20 token compatible with Ethereum. This illustrates the potential of wrapped asset bridges to foster seamless interaction between diverse blockchain networks.

Sidechain Bridges

In a similar vein, sidechain bridges establish a link between a parent blockchain and its corresponding child sidechain. This linkage facilitates the seamless exchange of data and assets between the two. The necessity for sidechain bridges arises from the potential disparities in consensus mechanisms between the parent and the sidechain. An exemplary instance of this is the xDai Bridge, which forges a connection between the Ethereum mainnet and Gnosis Chain (formerly xDai blockchain), a sidechain specializing in stable payments. Notably, the validators responsible for the security of xDai differ from those maintaining the Ethereum network. The xDai Bridge streamlines the process of transferring value between these distinct chains.

Moreover, the classification based on mechanisms yields a distinction between one-way (unidirectional) bridges and two-way (bidirectional) bridges.

One-Way (Unidirectional) Bridges

In the context of one-way bridges, users possess the capability to migrate assets to a destination blockchain. However, the reverse journey, from the destination blockchain back to the native blockchain, is precluded.

Two-Way (Bidirectional) Bridges

Conversely, two-way bridges usher in a new level of functionality by enabling asset migration in both directions. This means that users can seamlessly bridge assets between two distinct blockchains, ensuring a higher degree of flexibility and interconnectivity.

Benefits of Blockchain Bridges

The primary and foremost advantage offered by blockchain bridges lies in their capability to enhance interoperability. These bridges play a pivotal role in facilitating the seamless exchange of tokens, assets, and data among distinct blockchains. This extends to connections between layer 1 and layer 2 protocols, as well as various sidechains. A prime illustration of this concept is WBTC, which empowers users of Bitcoin to partake in the decentralized applications (dapps) and services within the Ethereum ecosystem. The establishment of a blockchain sector that boasts true interoperability stands as an indispensable element for the industry’s prospective triumph.

An additional merit presented by blockchain bridges is their contribution to bolstering scalability. Certain bridges within the blockchain realm exhibit an impressive capacity to process a substantial volume of transactions, thereby enhancing overall operational efficiency. A notable instance in this regard is the Ethereum-Polygon Bridge, a decentralized bidirectional bridge engineered to function as a scaling solution for the Ethereum network. Consequently, users reap the rewards of expedited transaction speeds and reduced transaction costs, further augmenting the appeal of such bridges.

Challenges of Blockchain Bridges

Simultaneously, it’s worth noting that there are certain limitations associated with blockchain bridges. These limitations stem from the fact that attackers have managed to exploit vulnerabilities within the smart contracts of some of these bridges. This exploitation has led to substantial amounts of cryptocurrency being wrongfully seized by malicious individuals who utilize cross-chain bridges.

Furthermore, it’s important to recognize that custodial bridges introduce the potential for users to be exposed to custodial risks. The centralized entity responsible for a custodial bridge theoretically possesses the ability to abscond with users’ funds. Therefore, when opting for custodial bridges, it is advisable to opt for well-established brands with proven long-term performance records.

Another limitation that warrants consideration pertains to transaction rate bottlenecks. The limited throughput capacity of a single chain can act as a bottleneck, impeding comprehensive blockchain interoperability at a larger scale.

Although a bridge can certainly alleviate congestion on a busy network, transferring assets to another chain does not necessarily resolve the issue of scalability. This is because users might not always have access to the same array of decentralized applications (dapps) and services on the alternative chain. For instance, the Polygon Bridge does not support certain Ethereum dapps, thereby placing constraints on its effectiveness in terms of scaling. Lastly, it’s essential to acknowledge that blockchain bridges could potentially expose the underlying protocols to risks linked to the variance in trust levels. The overall security of the interconnected networks via blockchain bridges is inherently as robust as the weakest link in the chain of blockchains being connected.

Future of Blockchain Bridges

The internet stands as a truly revolutionary system, owed in part to its exceptional interoperability. In the realm of revolutionizing the blockchain industry’s operability and driving widespread adoption, blockchain bridges emerge as indispensable. By facilitating crucial innovations, these bridges empower users to seamlessly exchange assets across numerous blockchain protocols. Witnessing a substantial surge in both their quantity and usage, blockchain bridges have also seen a remarkable uptick in total transaction volume.

The demand for blockchain bridges appears poised to rise steadily, particularly with the internet’s evolution into the realm of Web3. Anticipated advancements hold the promise of heightened scalability and efficiency for both users and developers. Moreover, ingenious solutions might emerge to effectively tackle the security concerns that often accompany bridge functionality. Ultimately, the significance of blockchain bridges remains paramount in the construction of an interoperable, inclusive, and decentralized blockchain ecosystem.

Conclusion

The dynamic evolution of the blockchain industry is primarily steered by a continuous stream of innovative breakthroughs. At its forefront stand the pioneering protocols such as the Bitcoin and Ethereum networks, which are then succeeded by a multitude of alternative layer 1 and layer 2 blockchains. This has led to an exponential surge in the count of crypto coins and tokens.

Due to their distinct regulations and technologies, these blockchains necessitate the establishment of blockchain bridges to facilitate interconnection. By interlinking various blockchains through bridges, an integrated and harmonious blockchain ecosystem emerges. This interconnectedness not only enhances cohesiveness and interoperability but also unlocks new avenues for superior scalability and efficiency. However, it’s important to note that with the rise in attacks targeting cross-chain bridges, the quest for a bridge design that prioritizes security and resilience remains ongoing.