Table of Contents

- Introduction

- What is Tokenomics?

- Key Components of Tokenomics

- Analyzing Tokenomics Models

- Challenges in Designing Effective Tokenomics

- Successful Examples: Bitcoin vs Ethereum’s Unique Approaches to Token Economics

- The Future of Tokenomics: Trends and Innovations for Sustainable Crypto Environments

- FAQs (Frequently Asked Questions)

Introduction

Have you ever wondered why some cryptocurrencies succeed while others disappear? The answer lies in tokenomics – the driving force behind sustainable crypto ecosystems.

Think of tokenomics as the fundamental structure of a cryptocurrency project. Just like DNA determines how living organisms grow and function, tokenomics defines how digital tokens work, evolve, and retain their value within blockchain ecosystems. It combines economics, technology, and human behavior to determine the long-term success of a crypto project.

In this comprehensive guide to tokenomics, you’ll learn about:

- The key components that make up a strong tokenomics model

- The impact of different supply mechanisms on token value

- Real-world examples of successful tokenomics implementations

- Important factors to consider when evaluating cryptocurrency projects

- Future trends shaping the development of token economics

Whether you’re a crypto enthusiast, investor, or developer, understanding tokenomics is essential for navigating the complex world of digital assets. This article will equip you with the knowledge to assess the long-term viability of cryptocurrency projects and distinguish between promising innovations and potential failures.

Are you ready to discover the secrets behind sustainable crypto ecosystems? Let’s delve into the captivating realm of tokenomics together!

What is Tokenomics?

Tokenomics is the study of how a digital token behaves and functions within a cryptocurrency project. It combines the concepts of “token” and “economics” to create a framework that governs various aspects of the token, including its creation, distribution, utility, and value.

Why Tokenomics Matters

Tokenomics plays a crucial role in shaping the behavior, value, and sustainability of a token. By understanding the economic principles behind a token’s design, project teams can make informed decisions that drive its success.

The Core Components of Tokenomics

Tokenomics encompasses several key components that influence a token’s ecosystem:

- Token Creation and Distribution: This refers to how tokens are generated and allocated to different stakeholders. It includes decisions about initial supply, vesting periods, and distribution mechanisms.

- Supply Mechanisms: Tokenomics also considers how the total supply of tokens will be managed over time. This could involve strategies like token burns (permanently removing tokens from circulation) or inflationary models (increasing the supply gradually).

- Utility and Use Cases: A well-designed token should have clear utility within its ecosystem. This could include functions like accessing premium features, participating in governance votes, or earning rewards.

- Economic Incentives: Tokenomics examines the incentives that drive user behavior and participation. This might involve rewarding early adopters, incentivizing liquidity provision, or aligning interests between different stakeholders.

- Price Stability Measures: Some projects implement mechanisms to stabilize their token’s price volatility. This could include using stablecoins as collateral or introducing buyback programs.

The Evolution of Tokenomics

The concept of tokenomics gained prominence during the 2017 Initial Coin Offering (ICO) boom when projects sought structured approaches to managing their tokens. Before this period, Bitcoin’s fixed-supply model was the primary reference point.

Since then, tokenomics has evolved significantly with the emergence of new technologies and concepts:

- Smart Contracts (2015): These self-executing contracts enabled programmable behavior for tokens, allowing for more complex interactions.

- Decentralized Finance (DeFi) Protocols (2020): DeFi protocols introduced intricate token dynamics through lending, borrowing, and yield farming mechanisms.

- Decentralized Autonomous Organizations (DAOs) (2021): DAOs brought governance tokens into play, giving holders voting rights on protocol decisions.

- Non-Fungible Tokens (NFTs) (2021): NFTs expanded the utility of tokens beyond currencies by representing unique digital assets.

The Importance of Well-Designed Tokenomics

A thoughtfully crafted tokenomics model can answer critical questions about a project’s long-term viability:

“How many tokens will exist?” “Who gets these tokens and when?” “What can users do with these tokens?” “What gives these tokens value?”

Let’s take a closer look at Binance Coin (BNB), one of the most successful examples of effective tokenomics:

Binance Coin (BNB) Tokenomics Breakdown

- Utility: BNB offers trading fee discounts on the Binance exchange and grants users voting rights in platform governance decisions.

- Supply: The total supply of BNB is capped at 200 million coins, with periodic token burns reducing this number over time.

- Distribution: BNB was initially distributed through an initial coin offering (ICO) with clear allocation plans for team members, investors, and partners.

- Value Drivers: The growth of the Binance platform itself serves as a significant driver for BNB’s value appreciation.

This structured approach helped BNB evolve from being just an exchange-specific cryptocurrency into a multi-billion-dollar asset with diverse use cases across various blockchain ecosystems.

Modern Developments in Tokenomics

Today’s modern-day version goes beyond simple models; it incorporates advanced disciplines such as game theory (studying strategic decision-making), behavioral economics (understanding psychological factors influencing economic choices), and mechanism design (creating rules that lead to desired outcomes).

Projects now leverage sophisticated modeling techniques to simulate potential scenarios involving their respective cryptocurrencies before official launches occur—thereby minimizing risks associated with economic imbalances arising post-launch phase.

As we continue exploring further aspects related directly to understanding this intricate field called ‘tokenomics’, let’s delve deeper into another crucial element—namely, ‘supply mechanisms’!

Key Components of Tokenomics

A well-designed tokenomics model relies on five essential building blocks that work together to create a sustainable cryptocurrency ecosystem.

1. Token Utility

Think of token utility as the heartbeat of any crypto project – it’s what gives the token its real-world purpose and value. Just like how traditional currencies serve specific functions in our everyday lives, crypto tokens need clear use cases to thrive.

Here’s what makes token utility truly powerful:

- Access Rights: Tokens can act as digital keys, unlocking premium features or exclusive content within platforms

- Payment Methods: Users can spend tokens to purchase goods, services, or digital assets

- Governance Power: Token holders gain voting rights to influence project decisions

- Network Operation: Tokens enable essential functions like transaction validation and network security

Real-World Example: Binance Coin (BNB)

BNB showcases the power of well-designed token utility:

- Trading fee discounts on the Binance exchange

- Payment currency for Binance Smart Chain transaction fees

- Participation in token sales on Binance Launchpad

- Staking opportunities for additional rewards

The success of BNB demonstrates how multiple utility layers can create a strong demand for a token. Users who hold BNB benefit from reduced trading costs, while also gaining access to exclusive features and investment opportunities.

Creating Meaningful Utility

The strong token utility should:

- Solve real user problems

- Create natural demand

- Support the project’s long-term vision

- Encourage user participation

- Scale with ecosystem growth

When evaluating a project’s token utility, ask yourself:

“Would this ecosystem function better with this token than without it?”

If the answer isn’t a clear “yes,” the token might be forcing utility where it’s not needed. The most successful projects integrate their tokens naturally into their ecosystems, making them essential rather than optional components.

2. Token Supply Models

Token supply models shape the economic dynamics of cryptocurrency projects through carefully designed mechanisms that control token availability. Let’s dive into three primary supply models that drive value and scarcity in the crypto market:

1. Fixed Supply Model

- Bitcoin leads the fixed supply category with its 21 million coin cap

- Creates natural scarcity similar to precious metals

- Resistant to inflation, but can face liquidity challenges

2. Inflationary Model

- Allows for continuous token creation at a predetermined rate

- Example: Ethereum pre-2.0 had no supply cap, creating new tokens for mining rewards

- Supports network growth and provides sustainable rewards for validators

3. Deflationary Model

- Reduces token supply through burning mechanisms

- Case Study: Binance’s BNB implements quarterly burns based on trading volume

- Can drive price appreciation through artificial scarcity

4. Hybrid Models

- Combine multiple supply mechanisms for a balance

- Example: EIP-1559 makes ETH both inflationary and deflationary

- Allows flexibility in responding to market conditions

Each model impacts token value differently:

Fixed Supply

Creates predictable scarcity but may limit network growth

Inflationary

Supports ecosystem expansion but risks value dilution

Deflationary

Drives potential price appreciation but could face liquidity issues

Real-world performance reveals the varying effects of these models. Bitcoin’s fixed supply has contributed to its “digital gold” narrative, while Ethereum’s shift to a hybrid model demonstrates adaptation to ecosystem needs. Projects like Solana maintain controlled inflation to fund network security, proving there’s no one-size-fits-all solution in token supply design.

3. Token Distribution Strategies

A fair token distribution strategy is essential for a sustainable crypto ecosystem. It’s like dealing cards in a poker game – if one player gets all the aces, the game loses its competitive edge and appeal.

Initial Token Distribution Methods:

- Public Sale – Opens participation to retail investors

- Private Sale – Targets venture capitalists and institutional investors

- Airdrops – Rewards early adopters and community members

- Mining/Staking Rewards – Incentivizes network maintenance

- Team Allocation – Motivates project development

Smart projects implement vesting schedules – time-based restrictions on token sales. A typical vesting schedule might lock team tokens for 12 months, followed by gradual release over 2-4 years. This approach prevents market flooding and demonstrates long-term commitment.

Lock-up periods serve as another crucial safeguard. Consider Solana’s successful implementation:

“Early investors faced a 9-month lock-up period, preventing immediate token dumps and protecting SOL’s market value during its critical growth phase.”

Distribution Strategy Benefits:

- 🔒 Prevents market manipulation

- 💪 Builds investor confidence

- 🤝 Aligns stakeholder interests

- 📈 Supports price stability

- 🌱 Enables sustainable growth

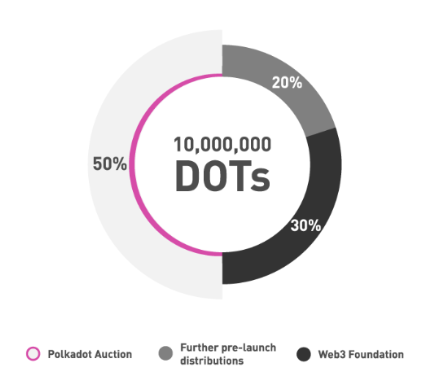

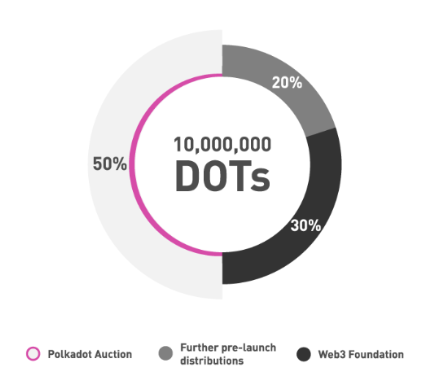

The most successful projects strike a balance between different stakeholder groups. For instance, Polkadot allocated:

- 50% to public sale participants

- 30% to ecosystem development

- 20% to early backers and team members

This balanced approach ensures no single group can dominate the ecosystem while maintaining incentives for long-term project development.

4. Governance Structures in Tokenomics Models

Governance structures serve as the backbone of crypto projects, empowering token holders to shape the future of their digital ecosystems. Think of it as a digital democracy where your tokens act as voting rights in a self-governing community.

Key Governance Models:

- Direct Token Voting: 1 token = 1 vote system, immediate implementation of approved proposals, used by projects like Uniswap and Compound

- Delegated Governance: Token holders assign voting power to trusted representatives, a streamlined decision-making process, popular in projects like EOS and Tezos

DAOs: The Future of Decentralized Governance

DAOs represent the pinnacle of community-driven governance, as detailed in this primer on DAOs. These autonomous organizations run on smart contracts, enabling:

- Transparent proposal submission

- Automated execution of approved decisions

- Equal participation opportunities for all token holders

Real-World Impact: MakerDAO demonstrates the power of decentralized governance through its successful management of the DAI stablecoin. Token holders actively participate in:

- Setting stability fees

- Managing collateral types

- Determining liquidation parameters

Stakeholder Alignment Through Governance

Effective governance models create a positive feedback loop:

Active Participation → Better Decisions → Increased Value → More Participation

Projects like Aave showcase this dynamic by allowing token holders to:

- Propose protocol upgrades

- Vote on risk parameters

- Earn rewards for active governance participation

The rise of liquid governance tokens introduces another layer of flexibility, allowing users to maintain voting power while accessing token liquidity through derivatives.

Moreover, the evolution of governance structures in web3 organizations can draw valuable lessons from historical governance models, as suggested in this insightful article about lightspeed democracy and how they can be adapted to fit the needs and challenges of decentralized systems.

5. Economic Incentives for Participation

Economic incentives are crucial for keeping users engaged in crypto ecosystems. They act as a driving force behind participation, much like fuel powering an engine – without these incentives, involvement would likely come to a standstill.

Key Reward Mechanisms:

- Staking Rewards: Users earn rewards by locking up their tokens to support the network’s security and operations.

- Liquidity Mining: Participants receive token rewards for providing liquidity to trading pairs, ensuring smooth transactions on decentralized exchanges.

- Transaction Fee Distribution: Network validators share in the gas fees generated from transactions, creating an additional income stream for those securing the blockchain.

Projects like Uniswap demonstrate the power of economic incentives through their liquidity mining programs. Users who provide liquidity receive UNI tokens, creating a win-win situation where the platform gains necessary liquidity while participants earn rewards.

Some platforms implement tiered reward systems based on participation levels. Take Binance’s BNB, where holding larger amounts unlocks higher trading fee discounts and exclusive features. This creates a natural progression that encourages users to increase their involvement over time.

Innovative Reward Structures:

- Time-weighted rewards favoring long-term participants

- Quest-based incentives for completing specific actions

- Gamified participation systems with achievement rewards

- Community contribution rewards through bounty programs

The most successful projects balance immediate rewards with long-term value creation. Curve Finance exemplifies this through its vote-escrowed CRV model, where users lock tokens for extended periods to gain enhanced rewards and voting power.

Analyzing Tokenomics Models

Want to spot a promising crypto project? Let’s dive into the key metrics you need to assess tokenomics models effectively.

Supply Metrics Analysis

- Initial token supply vs maximum supply

- Token release schedule and vesting periods

- Burn mechanisms and their impact

- Inflation/deflation rates

Distribution Health Check

- Percentage held by team/advisors

- Public allocation ratio

- Whale concentration metrics

- Lock-up period durations

Value Creation Assessment

- Revenue generation mechanisms

- Fee structures and distribution

- Token utility within the ecosystem

- Network effects potential

A robust analysis should examine the project’s token velocity – how quickly tokens change hands. High velocity often indicates speculative behavior, while lower velocity suggests stronger holding patterns.

Here’s a quick risk assessment framework:

Red Flags

- Excessive team allocation (>20%)

- Unclear utility purpose

- Short/non-existent lock-up periods

- Concentrated whale holdings

Green Flags

- Clear use cases

- Fair distribution metrics

- Long-term vesting schedules

- Active governance participation

Remember to cross-reference these metrics with the project’s stated goals and roadmap. A misalignment between tokenomics design and project objectives often signals potential sustainability issues.

The strength of a tokenomics model lies in its ability to create natural demand while maintaining price stability through carefully balanced supply mechanics.

Challenges in Designing Effective Tokenomics

Creating a balanced tokenomics model is like walking a tightrope – one wrong move can destabilize the entire ecosystem. Let’s dive into the key challenges that crypto projects face when designing their token economics:

1. Market Volatility Management

- Price swings can disrupt carefully planned incentive structures

- Maintaining token utility during bear markets becomes increasingly difficult

- Balancing short-term price stability with long-term value creation

2. Stakeholder Interest Alignment

- Early investors often seek quick returns, while long-term users need sustainable utility

- Different stakeholder groups may have conflicting priorities

- Finding an equilibrium between token appreciation and accessibility

3. Technical Implementation Hurdles

- Smart contract limitations can restrict complex tokenomics mechanisms

- Upgradeability issues may prevent necessary adjustments

- Security vulnerabilities in token distribution systems

4. Community Engagement Dynamics

- Keeping users invested beyond the initial excitement

- Creating meaningful participation incentives

- Preventing whale manipulation and concentration of power

5. Regulatory Compliance

- Adapting to evolving legal frameworks

- Meeting securities regulations without compromising decentralization

- Maintaining transparency while protecting sensitive information

The art of tokenomics design requires constant refinement and adaptation. Projects must navigate these challenges while maintaining their core value proposition. Have you noticed how successful crypto projects often iterate their tokenomics models based on real-world usage patterns?

Successful Examples: Bitcoin vs Ethereum’s Unique Approaches to Token Economics

Bitcoin and Ethereum are two successful examples of different tokenomics models that have achieved remarkable success through their unique approaches.

Bitcoin’s Fixed Supply Model:

- Maximum supply cap: 21 million BTC

- Halving events every 210,000 blocks

- Deflationary by design

- Scarcity drives the value proposition

- Mining rewards decrease over time

Bitcoin’s model creates a digital scarcity similar to precious metals, positioning it as “digital gold.” This approach has proven effective in establishing BTC as a store of value and protection against inflation.

Ethereum’s Dynamic Supply Model:

- No maximum supply cap

- Burning mechanism through EIP-1559

- Flexible issuance rate

- Proof-of-Stake rewards

- Variable transaction fees

Ethereum’s model prioritizes network utility and sustainable growth. The burning mechanism introduced in 2021 creates deflationary pressure while still allowing for flexibility in network development.

Comparative Strengths:

Bitcoin

- Predictable inflation schedule

- Strong security through mining incentives

- Clear value proposition

Ethereum

- Adaptable to network demands

- Supports complex smart contracts

- The balance between utility and value

These different approaches show how various tokenomics models can succeed when they align with specific project goals. Bitcoin’s fixed supply serves its purpose as a digital store of value, while Ethereum’s flexible model supports its role as a programmable blockchain platform.

The success of both models highlights an important insight: effective tokenomics must align with the network’s core purpose and user needs instead of following a generic approach.

The Future of Tokenomics: Trends and Innovations for Sustainable Crypto Environments

The world of tokenomics is constantly changing, with new and exciting ideas transforming our understanding of crypto ecosystems. Here’s a glimpse into what we can expect in the future:

1. Dynamic Supply Mechanisms

- Real-time supply adjustments based on market conditions

- AI-powered algorithms managing token distribution

- Elastic supply protocols responding to user demand

2. Novel Incentive Structures

- Quest-based rewards encouraging specific user behaviors

- Multi-token ecosystems with interconnected value propositions

- Gamified participation mechanisms

3. Community-Centric Models

- Decentralized governance systems with weighted voting

- Reputation-based token distribution

- Impact-driven rewards for ecosystem contributions

4. Sustainable Practices

- Energy-efficient consensus mechanisms

- Carbon-neutral token operations

- Environmental impact considerations in token design

5. Cross-Chain Integration

- Interoperable token systems

- Bridge-based liquidity solutions

- Universal governance tokens

The future of tokenomics points toward more sophisticated, user-focused systems. We’re seeing a shift from simple supply-and-demand models to complex ecosystems that balance economic incentives with environmental responsibility. Projects are experimenting with hybrid models combining fixed and flexible supplies, while others explore performance-based distribution mechanisms.

These innovations suggest a future where tokenomics becomes increasingly personalized, responsive, and sustainable. The key to success? Creating systems that adapt to changing market conditions while maintaining the core principles of decentralization and community empowerment.

FAQs (Frequently Asked Questions)

- What is tokenomics, and why is it important?

Tokenomics refers to the study of the economic principles and models governing token use and distribution within a cryptocurrency ecosystem. It is crucial for assessing the long-term viability of a cryptocurrency project, as it encompasses key components such as token utility, supply models, distribution strategies, and governance structures.

- What are the key components of a well-designed tokenomics model?

A well-designed tokenomics model includes several key components: token utility, which defines how tokens are used within ecosystems; token supply models, which can be fixed or inflationary; token distribution strategies that ensure equitable allocation among stakeholders; and governance structures that facilitate community involvement and decision-making.

- How do different token supply models affect token value?

Token supply models can significantly impact the scarcity and value of tokens. Fixed supply models limit the total number of tokens available, potentially increasing value over time. In contrast, inflationary mechanisms introduce new tokens into circulation, which can dilute value unless managed carefully. Case studies can illustrate these impacts in practice.

- What role does governance play in tokenomics?

Governance in tokenomics involves frameworks that guide decision-making processes within a project. Effective governance structures, such as Decentralized Autonomous Organizations (DAOs), ensure stakeholder alignment and community involvement, contributing to project sustainability and responsiveness to user needs.

- What are some common challenges in designing effective tokenomics?

Designing effective tokenomics can be complex due to balancing user needs with investor interests. Common challenges include avoiding pitfalls such as over-inflation of tokens or inequitable distribution methods that could harm community trust and engagement.

- What trends might shape the future of tokenomics?

The future of tokenomics may be influenced by trends such as dynamic supply mechanisms that adjust based on market conditions or innovative incentive structures designed to enhance user engagement. These innovations aim to create more sustainable crypto environments while addressing existing challenges in traditional models.