Table of Contents

- The Securities and Exchange Commission (SEC) has filed a lawsuit against Binance, a cryptocurrency exchange, and its CEO Changpeng Zhao

- Atomic Wallet users experience a security breach resulting in the theft of Bitcoin, Ether, Tether, and various other tokens valued at approximately $35 million

- Binance’s current withdrawal volume is set to surpass the levels seen during the crypto banking crisis in March, marking it as the largest withdrawal event in that timeframe

- BNB and CAKE experienced significant declines after the SEC takes action against Binance

- Cryptocurrencies experience a sharp decline following the SEC’s accusation of Binance for selling unregistered securities

- DYdX’s token experiences a nearly 10% surge following the SEC’s lawsuit against Binance

- According to Reuters, bank accounts belonging to the U.S. branch of Binance were under the control of Binance executives during the period of 2019-20

The Securities and Exchange Commission (SEC) has filed a lawsuit against Binance, a cryptocurrency exchange, and its CEO Changpeng Zhao

The U.S. Securities and Exchange Commission (SEC) has taken legal action against Binance, a cryptocurrency exchange, as well as its CEO Changpeng “CZ” Zhao.

The lawsuit accuses them of violating federal securities laws.

The allegations include the offering of unregistered securities, such as the BNB token and Binance-linked BUSD stablecoin, to the general public.

The suit also claims that Binance’s staking service breached securities regulations. Additionally, BAM Trading, the operating company for Binance.US, and Binance itself face similar charges for failing to register as a clearing agency, broker, and exchange.

The SEC further alleges that Binance allowed the mixing of customer funds, that CZ secretly controlled Binance.US, and that a CZ-owned entity artificially inflated Binance.US’s trading volume.

The lawsuit repeatedly asserts that Binance permitted U.S. individuals to trade on its platform despite stating otherwise.

According to the suit, CZ and Binance intentionally misled the public by claiming that the Binance.com Platform did not serve U.S. customers while covertly assisting high-value U.S. customers in bypassing controls.

The SEC also contends that various tokens, including those associated with Solana, Cardano, Polygon, Coti, Algorand, Filecoin, Cosmos, Sandbox, Axie Infinity, and Decentraland, qualify as securities.

Notably, the suit cites a statement made by Binance’s Chief Compliance Officer in 2018, acknowledging their operation as an unlicensed securities exchange in the USA.

Atomic Wallet users experience a security breach resulting in the theft of Bitcoin, Ether, Tether, and various other tokens valued at approximately $35 million

Over the weekend, Atomic Wallet, a centralized storage and wallet service, suffered a significant loss in the crypto industry.

Approximately $35 million worth of various tokens, including bitcoin (BTC), ether (ETH), tether (USDT), dogecoin (DOGE), litecoin (LTC), BNB coin (BNB), and polygon (MATIC), were stolen. Notably, the largest stolen stash seemed to be Tron-based USDT, according to on-chain analytics cited by blockchain sleuth ZachXBT.

Concerns about the security of funds held in Atomic Wallet were previously raised by security audit company Least Authority in a blog post in 2022.

On Monday, Atomic Wallet acknowledged that the affected users constituted less than 1% of their monthly active users, and the last drained transaction occurred on Saturday.

Atomic Wallet has been actively investigating and analyzing the attack, although specific details of the incident have not been disclosed as of Monday morning.

The affected victims have been requested to provide information through a Google Docs form, which Atomic Wallet is utilizing for its investigations.

Messages from Atomic Wallet’s official Telegram channel indicate that some users had their cryptocurrencies stolen after a recent software update, while others were impacted despite not having updated to the latest version.

Binance’s current withdrawal volume is set to surpass the levels seen during the crypto banking crisis in March, marking it as the largest withdrawal event in that timeframe

In the wake of the U.S. Securities and Exchange Commission (SEC) filing a lawsuit against Binance and its CEO Changpeng “CZ” Zhao for violating federal securities law, cryptocurrency traders are withdrawing their funds from the Binance exchange at levels not seen since the banking crisis in March.

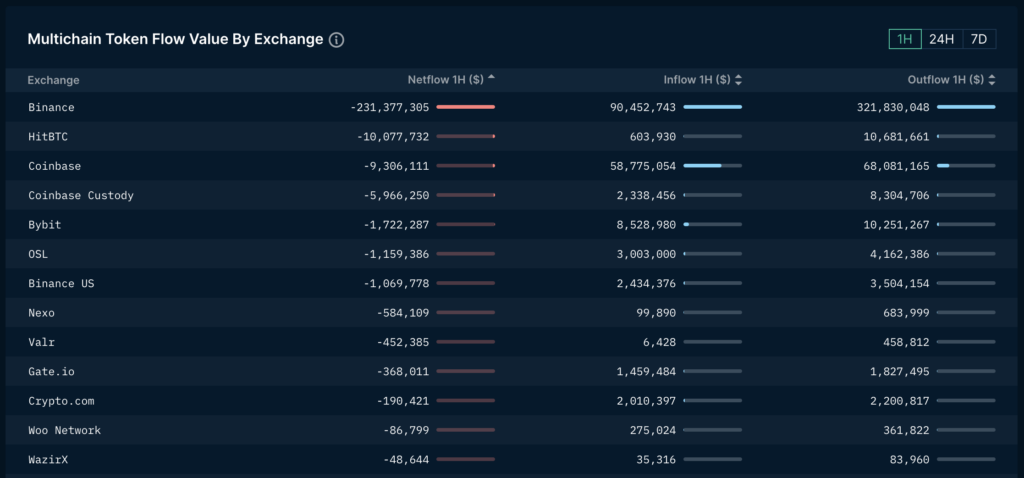

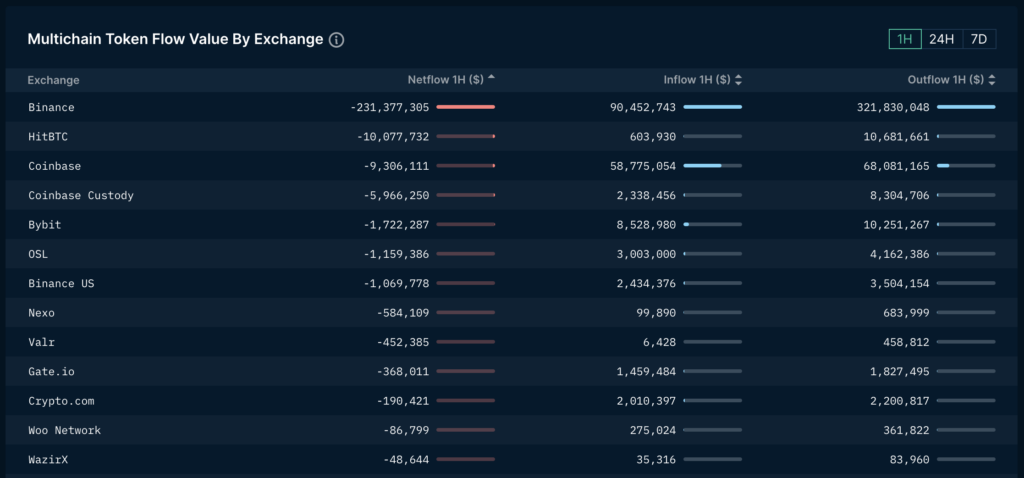

According to blockchain data provided by 21Shares, Binance experienced a net outflow of approximately $503 million on Monday, with traders withdrawing over $1 billion in digital assets during this period, while deposits amounted to $546 million.

This trend indicates that it is on track to become the largest daily net outflow since mid-March, when concerns about the instability of crypto-friendly banks affecting crypto exchanges were prevalent.

Nansen, a crypto intelligence firm, reported that Binance recorded withdrawals exceeding deposits by $231 million within a one-hour timeframe following the news of the SEC lawsuit, excluding bitcoin transfers.

While the increase in outflows is notable, it is not entirely unprecedented.

In February, Binance faced net outflows of around $830 million over a 24-hour period when New York state regulators targeted Binance-associated stablecoin BUSD.

According to Nansen’s data on exchange reserves, Binance’s crypto wallets currently hold approximately $55 billion worth of digital assets.

The surge in outflows coincides with the SEC’s allegations that Binance, the world’s largest crypto exchange by trading volume, violated multiple federal securities laws.

The lawsuit asserts that Binance offered unregistered crypto securities, including BNB and BUSD tokens, to the general public and permitted the mingling of customer funds. Additionally, the SEC claims that CZ, the CEO of Binance, maintained “secret” control over Binance.US, an ostensibly separate entity operating in the United States, and that a CZ-owned entity artificially inflated Binance.US’s trading volume.

BNB and CAKE experienced significant declines after the SEC takes action against Binance

According to data from blockchain analytics firm Cryptowatch, the prices of BNB and CAKE, two significant tokens within the Binance ecosystem, have experienced a sharp decline in the four hours following the Securities and Exchange Commission’s (SEC) legal action against the centralized exchange.

CoinGecko reports that BNB, with a total market dominance of 3.86%, has dropped more than 8% from $300 to $276, while CAKE has fallen approximately 9% from $1.70 to $1.54 at the time of writing.

These recent drops in BNB and CAKE value come in response to the SEC’s accusations that Binance mingled customer funds and operated as an unregistered securities exchange.

Binance responded to these allegations, stating that BNB coin is not considered a security but rather a native token designed to facilitate an internal economy, deriving its value from the participants involved.

On the other hand, CAKE serves as the token powering PancakeSwap, an alternative decentralized exchange on the BNB Chain similar to Uniswap and SushiSwap.

CAKE is used for liquidity mining rewards and grants holders governance rights over the protocol.

Over the past seven days, the total value locked on PancakeSwap has decreased by approximately 9% to $1.81 billion, according to DeFi Llama.

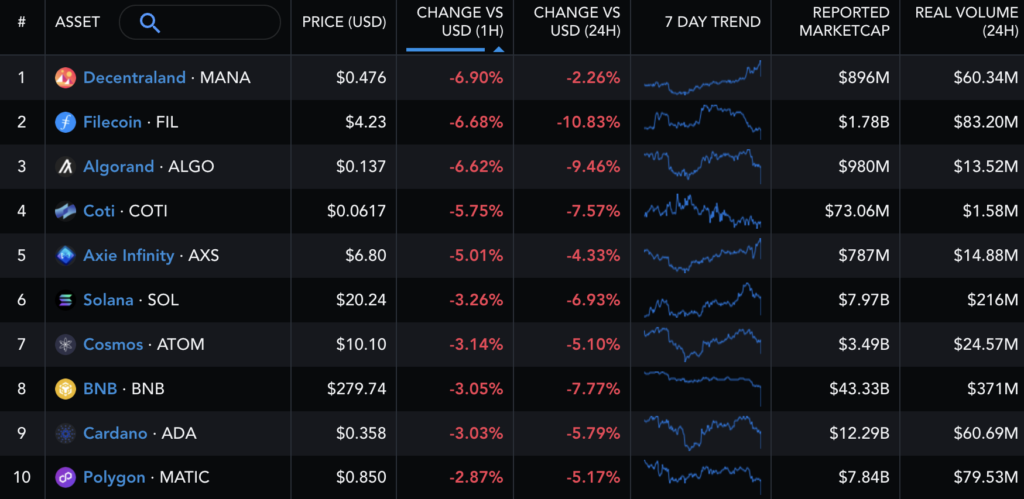

Cryptocurrencies experience a sharp decline following the SEC’s accusation of Binance for selling unregistered securities

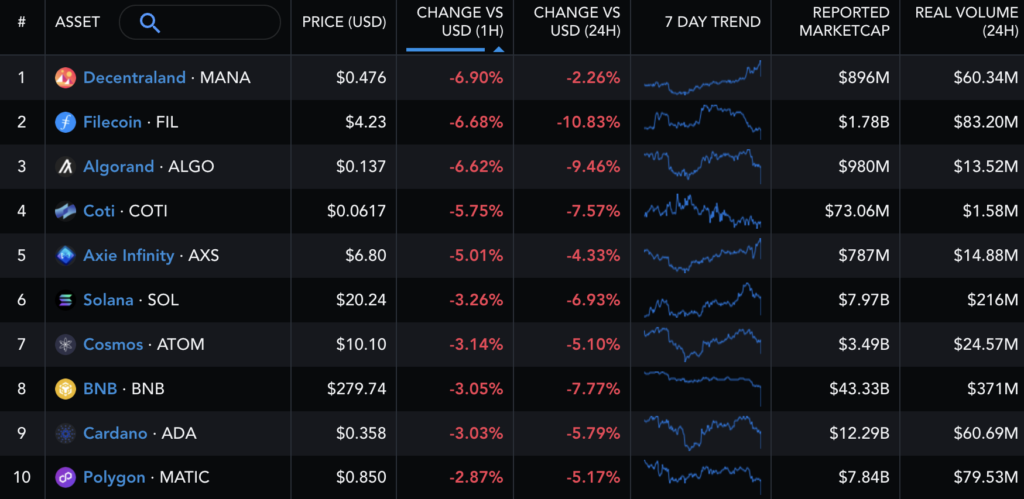

Altcoins are facing significant losses in the aftermath of the SEC’s legal action against Binance and its CEO Changpeng “CZ” Zhao.

The lawsuit accuses Binance of offering several unregistered securities to the public, including Binance’s BNB token, BUSD stablecoin, as well as Solana (SOL), Cardano (ADA), Polygon (MATIC), Coti (COTI), Algorand (ALGO), Axie Infinity (AXS), Filecoin (FIL), Cosmos (ATOM), Sandbox (SAND), and Decentraland (MANA).

The entire cryptocurrency market is experiencing negative performance in response to this news, with most of the mentioned tokens witnessing declines ranging from 5% to 10%. When asked about the potential regulatory implications for Sky Mavis, the developer of the popular play-to-earn game Axie Infinity, CEO Aleksander Leonard Larsen stated that they are currently investigating the matter and emphasized their commitment to continuing their product development.

Polygon declined to provide a comment regarding the situation, and the other tokens mentioned were unavailable for comment at the time of publication.

Bitcoin (BTC), the largest cryptocurrency by market capitalization, recently recorded a 5% decrease, trading at $25,800, while Ether (ETH) experienced a 4.5% decline, reaching $1,811.

DYdX’s token experiences a nearly 10% surge following the SEC’s lawsuit against Binance

At the present moment, DYDX, the native token of the decentralized exchange platform sharing the same name, saw a surge to $2.23 following an announcement from the U.S. Securities and Exchange Commission regarding its lawsuit against Binance, the largest cryptocurrency exchange in terms of trading volume, for alleged violations of federal law.

According to CryptoWatch, the governance token reached a peak of $2.26, marking an approximate 10% increase from its lowest price of $2.04.

This price movement follows the SEC’s statement that BNB and BUSD, tokens associated with the centralized exchange Binance, are unregistered security offerings.

Over the past 24 hours, the dYdX platform has witnessed a trading volume exceeding $939 million, involving approximately 281,500 traders, as reported by data from its website.

According to Reuters, bank accounts belonging to the U.S. branch of Binance were under the control of Binance executives during the period of 2019-20

According to a Reuters report, it was revealed that a Binance executive served as the primary controller for five bank accounts linked to Binance’s supposedly independent U.S. unit.

The executive, Guangying Chen, was granted authorization by Silvergate Bank, a now-bankrupt crypto lender, to manage these accounts between 2019 and 2020.

The report states that Binance.US had to rely on Chen and her team to handle various payments, including the company’s payroll, as indicated by internal company messages. Despite Binance.US claiming independence from Binance, this revelation raises questions about the extent of control exerted by Binance executives.

In response to the report, Christian Hertenstein, spokesperson for Binance.US, informed Reuters that since the appointment of Brian Schroder as CEO in late 2021, only Binance.US officials have had control and access to their accounts, emphasizing a shift in control. Binance CEO Zhao, who serves as Binance.US’s chair and majority shareholder, has been exploring methods to reduce his stake to improve the exchange’s standing with U.S. regulatory authorities.