What Does HODL Mean in the World of Cryptocurrency?

If you’ve spent any significant time exploring the vast realm of cryptocurrency, chances are you’ve encountered the term “HODL.” It’s more than just a misspelled word-turned-viral meme—it has evolved into a widely embraced investment strategy that many die-hard crypto enthusiasts swear by. But what exactly does HODL mean, and how did a simple typo transform into such a major phenomenon? Let’s dive into the fascinating story behind it and uncover why this concept has endured in the crypto community.

The History of HODL

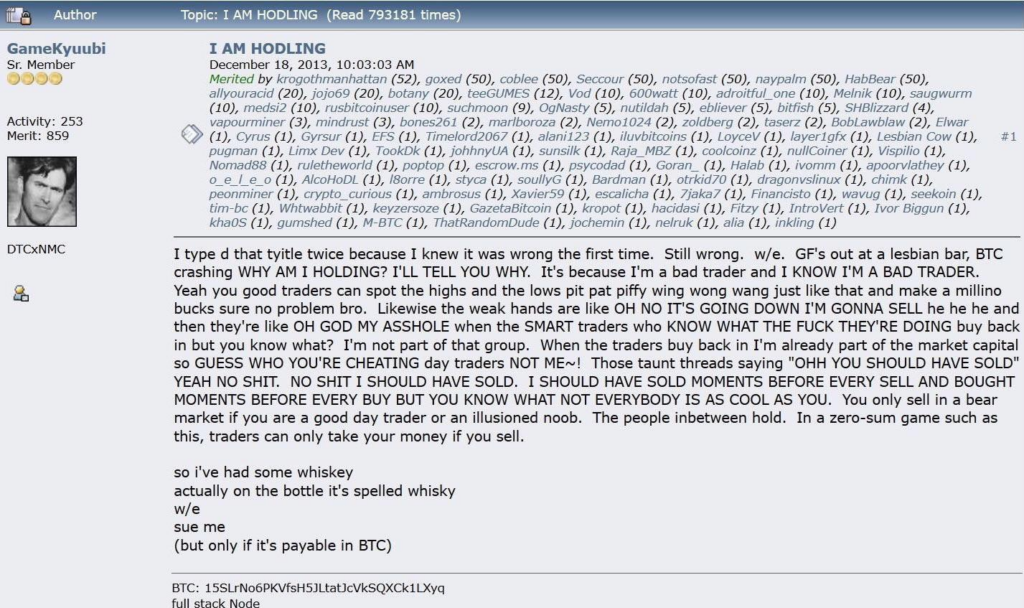

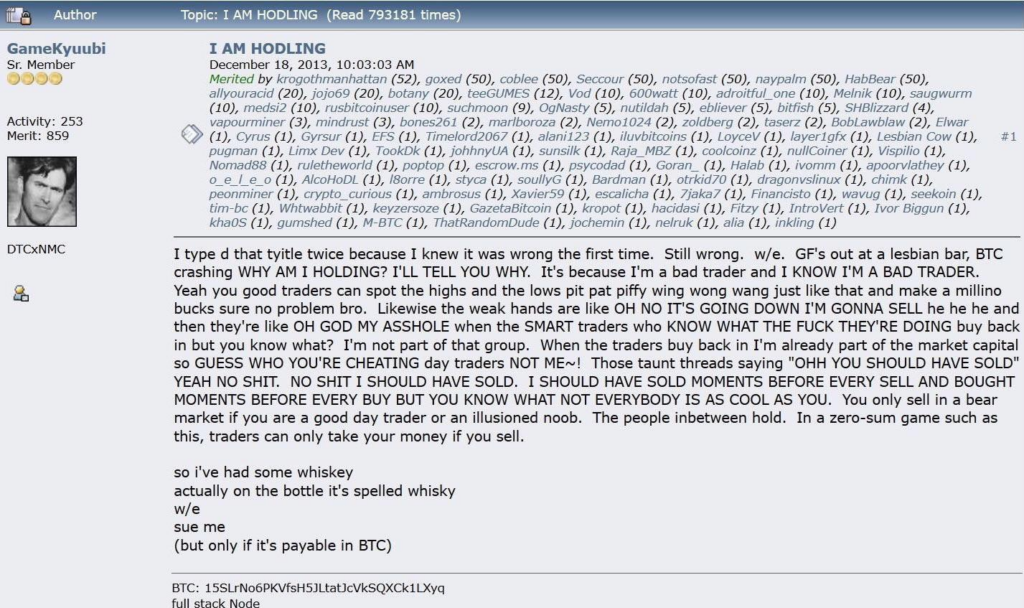

In 2013, Bitcoin was experiencing one of its infamous rollercoaster moments. After a dramatic 39% plunge in a single day, a frustrated user by the name of GameKyuubi turned to the BitcoinTalk forum to express his exasperation. In a post fueled by whiskey and frustration, titled “I AM HODLING,” GameKyuubi vented his thoughts with raw honesty:

I type d that tyitle twice because I knew it was wrong the first time. Still wrong. w/e. GF’s out at a lesbian bar, BTC crashing WHY AM I HOLDING? I’LL TELL YOU WHY. It’s because I’m a bad trader and I KNOW I’M A BAD TRADER.

He didn’t take the time or effort to correct the typos, and within just a few short hours of boldly proclaiming, “I AM HODLING,” the term “HODL” spread across the crypto community like wildfire.

GameKyuubi’s impassioned rant was not only humorous—it resonated deeply with many individuals. The essence of his message? Don’t be quick to sell when the market gets turbulent. Instead, embrace the philosophy of HODL—hold on to your cryptocurrency and weather the storm. What began as a simple typographical error quickly transformed into an iconic mantra for crypto investors who are convinced that, despite the unpredictable and often tumultuous price fluctuations, retaining your assets will ultimately yield significant rewards in the long term.

Why HODL?

The core concept behind HODL is quite straightforward: resist the urge to panic sell when the market experiences a sharp decline. If you’ve navigated the world of cryptocurrency for a while, you’re likely aware that prices can fluctuate dramatically. What may be a peak today could very well become a trough tomorrow, and when conditions begin to appear precarious, it can be all too tempting to cash out. However, individuals who identify as HODLers possess a distinctly different mentality. They maintain the belief that by steadfastly holding on through both the market’s highs and lows, they will ultimately reap significant rewards once the market begins to recover.

The tumultuous history of Bitcoin serves as a testament to this approach. From the soaring prices witnessed in 2017 and 2021 to the infamous “crypto winters,” those who chose to endure the volatility and refrain from selling saw their investments appreciate once again over time. It’s fundamentally about maintaining composure amid the chaos, with the understanding that the storm will pass and the sun will eventually shine through.

HODLing During Market Fluctuations

The cryptocurrency market is widely recognized for its remarkable and extreme volatility. This is evident from the record-breaking highs of Bitcoin achieved in both 2017 and 2021, contrasted with the sharp and significant declines observed in 2018, alongside the periods commonly referred to as “crypto winters.” Throughout these tumultuous times, investors have had to navigate drastic price fluctuations.

The fundamental principle behind the HODL strategy is quite straightforward: it encourages investors to resist the urge to panic sell during downturns and instead hold onto their assets, anticipating a future appreciation in value over the long term.

Many crypto community members contend that successfully timing the market—meaning accurately predicting the lows to buy and the highs to sell—is an incredibly challenging endeavor that often leads to losses. By maintaining their holdings through both bull and bear markets, HODLers strive to endure the market’s ups and downs, positioning themselves to reap substantial rewards when the market eventually rebounds.

HODL: Beyond a Simple Strategy

At this stage, HODL transcends the simple concept of making money; it has evolved into an entire mindset and philosophy. For a significant number of enthusiasts, it embodies a deep-seated belief in the future potential of cryptocurrencies, such as Bitcoin, and the transformative power of blockchain technology. Dedicated HODLers, often called Bitcoin maximalists, believe that cryptocurrencies represent the future of finance and will ultimately supplant traditional fiat currencies. This unwavering conviction motivates them to retain their digital assets, regardless of the market’s volatility or challenges they may face.

In addition to the HODL philosophy, the crypto community is rich with terminology, including terms like FUD, which stands for Fear, Uncertainty, and Doubt. FUD encompasses all the negative media coverage and rumors that can create anxiety and prompt investors to consider selling their holdings. HODLers take pride in their ability to disregard such distractions, maintaining their focus on long-term goals and the potential rewards that lie ahead.

When Is the Right Time to HODL?

What’s the overarching guideline for HODLing, you ask? It’s a steadfast commitment to always hold—at least, that’s the mantra you’ll hear from devoted HODLers. The essence of HODLing is to maintain your holdings regardless of market fluctuations, whether the prices are soaring to new heights or plummeting dramatically. However, let’s be honest—not everyone has the nerves of steel required to endure watching their investments dive without impulsively hitting that sell button.

If you’re fully dedicated to the long-term prospects of the cryptocurrency market and truly believe it will rebound eventually, then embracing HODLing is a logical strategy. Yet, for those who are not quite prepared to take that leap of faith, the journey becomes considerably riskier. The crucial takeaway is that HODLing is not merely a shortcut to rapid wealth; rather, it’s about strategically playing the long game and weathering the storm as it unfolds.

HODL Compared to Traditional Investing

HODLing can seem like a rollercoaster ride when compared to conventional buy-and-hold strategies in the stock market, but the underlying principle is quite similar. In the stock market, investors purchase shares and hold onto them, even during declines, because they trust that their value will increase over time. However, the key distinction is that cryptocurrency markets are significantly more volatile, requiring much more courage to HODL through the turmoil.

The Terminology: Diamond Hands, Paper Hands, and Beyond

In the vibrant and ever-evolving world of HODLing, a rich vocabulary is designed to categorize the various types of investors. If you have what many call ‘diamond hands,’ you are the kind of investor who steadfastly holds onto your assets regardless of how bleak the market conditions appear. Conversely, individuals with ‘paper hands’ tend to panic and sell at the first hint of trouble or a market downturn. This distinction plays a crucial role in the unique culture surrounding HODLing, where many believe that only the strongest investors will endure and thrive—or at the very least, they hold onto the hope of doing so.

Conclusion

As larger entities, such as major financial institutions and governmental organizations, increasingly engage with the world of cryptocurrency, the prospects for HODLing appear to be quite promising—at least according to the staunch advocates who firmly believe in this approach. The recent emergence of Bitcoin ETFs, coupled with significant regulatory advancements, has led long-term HODLers to feel a greater sense of validation and confidence in their investment strategy.