Traditional markets typically enable the buying and selling of assets within designated trading hours. However, transactions can also take place outside these established times. In this comprehensive article, we will delve into the concept of pre-markets, examine their operational mechanisms, and discuss their associated benefits and risks in detail.

What Are Pre-Markets?

Pre-markets refer to the trading activities that take place before the official trading hours commence. These typically occur in the early morning hours, leading up to the opening of major stock exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ. It’s important to note that pre-markets might not always be available for all listed stocks.

Engaging in pre-market trading can offer valuable insights into market sentiment and potential price movements. This is often based on activities such as earnings reports or macroeconomic events that occur after the previous day’s market close.

What Are Pre-Markets in Crypto?

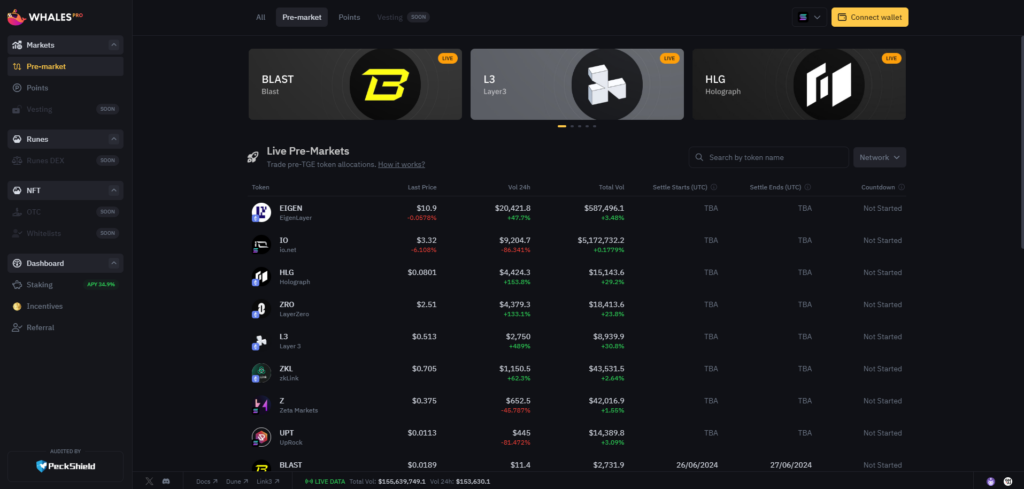

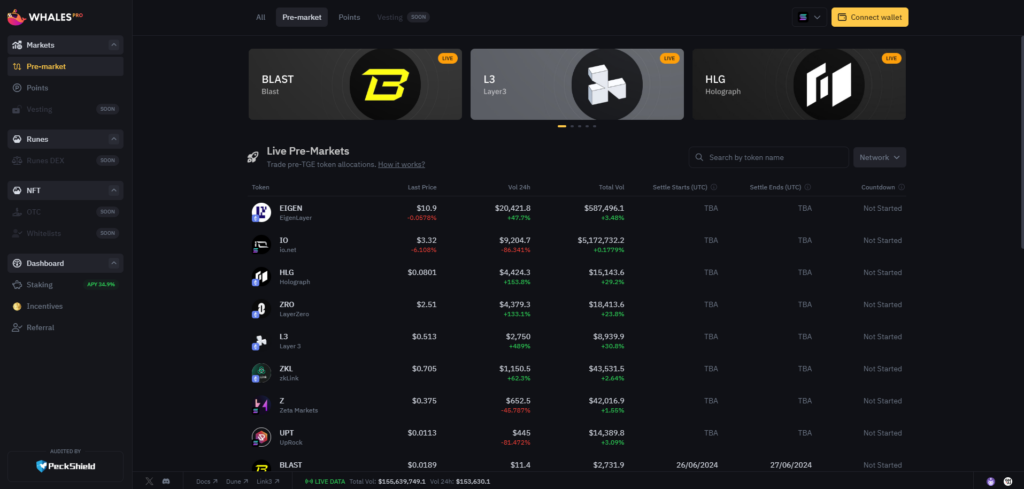

Because the cryptocurrency markets operate continuously around the clock, the term “pre-market” holds a distinct meaning within this context. In the realm of cryptocurrencies, pre-markets refer to specific trading platforms where investors can engage in the trading of tokens before these tokens are officially launched or made available to the broader public.

In general, traders utilize crypto pre-markets to speculate on the future value of tokens, engaging in buying and selling activities based on their anticipated worth following the official launch. Nevertheless, the scope of crypto pre-markets extends beyond just tokens. In certain instances, these platforms also facilitate the trading of “protocol points,” which may be used as criteria for determining eligibility for future airdrops.

How Do Pre-Markets Work?

In traditional financial markets, pre-market trading occurs via electronic communication networks (ECNs), which facilitate transactions by matching potential buyers and sellers. These trades are executed according to different regulations than those governing regular market hours, leading to variations in factors such as available liquidity and price volatility. The prices set during pre-market trading can significantly impact the opening price of a stock, often serving as a predictor for the day’s trading direction.

To illustrate, consider a company poised to release its quarterly earnings report after the market’s closing bell. Suppose the company announces earnings that surpass expectations, prompting investors to predict a favorable market response. In anticipation, investors begin purchasing shares of the company during the pre-market trading session before the official market opening the following day. Consequently, the increased demand for the company’s shares can drive up the stock price even before the standard trading hours commence.

How Do Pre-Markets Work in Crypto?

Crypto pre-markets function like peer-to-peer (P2P) trading platforms, yet they are distinct in their emphasis on tokens that have not yet been launched. These pre-markets provide investors with the opportunity to trade tokens in the period between the announcement of token allocation, the distribution of the tokens, and their official listing on a trading platform.

For example, imagine a new cryptocurrency project that announces the release of its token through an initial exchange offering (IEO). Before the official distribution and listing of these tokens on exchanges, the project initiates a pre-market phase on a decentralized platform. During this phase, early investors have the chance to trade the unreleased tokens. This trading activity enables early price discovery and liquidity, allowing traders to assess market sentiment and establish preliminary valuations for the project’s token. Additionally, centralized exchanges (CEXes) can facilitate crypto pre-market trading, serving as custodians for these transactions.

Advantages of Pre-Markets

Initial Price Determination

Pre-markets can significantly aid in early price discovery, allowing investors to assess the potential market impact of various external factors well before the regular trading hours commence. This capability enables market participants to analyze and interpret price fluctuations that occur outside the standard trading hours, offering valuable insights into possible market trends and the momentum that may shape the upcoming official trading session.

Adaptation of Strategy

Pre-market sessions provide investors with the valuable opportunity to finely tune and adapt their trading strategies, empowering them to react promptly to developments that unfold beyond the confines of standard trading hours. By proactively refining their approaches before the official market commencement, investors can effectively minimize the potential risks stemming from market fluctuations.

Ease of Access

Pre-market sessions serve to extend the trading windows, catering especially to market participants whose schedules don’t sync with the official trading hours. This guarantees that individuals involved in the market can actively participate in trading during hours that suit their convenience.

Risks of Pre-Markets

Low Liquidity

During the pre-market trading session, there is usually a discernible reduction in liquidity when juxtaposed with the regular market hours. As a consequence, larger bid-ask spreads tend to emerge, posing challenges for investors aiming to execute substantial trades without exerting substantial influence on market prices.

Restricted Market Involvement

Generally speaking, there tends to be a reduction in the number of traders and institutions participating in pre-market hours. Consequently, this decreased activity can lead to price fluctuations that may not fully capture the overall market dynamics, possibly confusing for early traders. Moreover, the patterns observed in pre-market trading could undergo a reversal once the regular trading session commences and experiences an influx of more participants.

Conclusion

Traditional pre-market sessions encompass trading activities occurring before the official opening hours of established stock exchanges. In the realm of cryptocurrencies, pre-market platforms emerge as avenues where investors engage in trading tokens before their official launch. These pre-market venues offer distinct advantages, such as facilitating early price discovery, enhancing accessibility, and enabling traders to refine their strategies in anticipation of regular market hours.