Bitcoin’s market dominance, also known as BTC dominance, is a crucial metric that helps investors and enthusiasts understand the influence of Bitcoin on the overall cryptocurrency market. In this blog post, we will delve into the concept of BTC dominance and conduct a comprehensive analysis to provide a deeper understanding of its significance.

Market Capitalization and the Prevalence of BTC in the Market

In straightforward terms, market capitalization pertains to the complete valuation of a particular asset currently in circulation. In the case of Bitcoin, determining its market capitalization involves the multiplication of the prevailing price by the total number of BTC that have been mined up to this point.

To compute Bitcoin dominance, you can utilize the following formula:

Bitcoin dominance = Bitcoin’s market capitalization / Total market capitalization of all cryptocurrencies.

Various Factors That Exert Influence on the Dominance of Bitcoin (BTC)

Evolution of Trends

Before the advent of altcoins, it was a common occurrence to witness bitcoin’s dominance persisting above the 90% mark. However, as altcoins started garnering increasing interest from users and investors, bitcoin had to share the limelight, relinquishing its near-undivided attention to other assets that promised more substantial price fluctuations and innovative use cases.

Bitcoin has become a stable crypto asset over time. However, traders may be more interested in the dramatic price swings and potential profits of newer altcoins. This can cause Bitcoin to lose its dominance as capital flows into riskier assets. In these cases, the sectors represented by altcoins may not be as important as the potential gains.

Bullish or Bearish Market

In recent years, the usage of stablecoins has witnessed a consistent uptrend, exerting continuous pressure on BTC dominance. More specifically, during a bear market or periods of market volatility, stablecoins often serve as a refuge for crypto investors, protecting their funds from declining prices. Stablecoins, designed to maintain a value pegged to a stable asset like fiat currency or a commodity, are frequently employed by crypto investors and traders to secure profits without converting their crypto holdings into fiat. When capital moves out of the BTC market into stablecoins, it can lead to a reduction in BTC dominance.

Conversely, the situation is likely to be different during a bullish market. When the market is on an upswing, traders may be incentivized to shift their assets from stablecoins to more volatile options offering greater trading opportunities, such as bitcoin. However, emboldened traders might also opt for riskier alternatives, infusing liquidity into altcoins that exhibit even higher volatility than BTC. Consequently, the overall impact of favorable market conditions on Bitcoin dominance remains highly contingent on the prevailing circumstances.

Onboarding via Stablecoins

Stablecoins provide a convenient gateway to access a diverse array of cryptocurrencies, particularly when compared to using fiat currency. This is because fiat-to-crypto exchanges, often referred to as gateway exchanges, can be somewhat restrictive, primarily offering the more popular cryptocurrencies and stablecoins. Conversely, crypto-to-crypto exchanges frequently present a more extensive range of tradable cryptocurrencies, typically paired with select stablecoins. As a result, individuals looking to engage in specific cryptocurrency trades may choose to enter the market through stablecoins. Naturally, if a significant influx of fresh funds enters the market via stablecoins rather than bitcoin, it leads to an expansion in the total value of the crypto market, diluting BTC dominance.

Emergence of Novel Coins

Occasionally, the swift rise in popularity of new coins entering the market can precipitate a decline in BTC dominance. It’s important to bear in mind that Bitcoin competes with every other cryptocurrency within the market, so the emergence of several sought-after altcoins simultaneously can exert pressure on its dominance. However, there’s also the possibility that these altcoins might lose their appeal once the initial hype subsides. In such scenarios, if funds are redirected from these altcoins to BTC or even withdrawn from the crypto market altogether, BTC dominance may experience a resurgence.

Employing BTC’s Dominance for Trading Purposes

Wyckoff Method

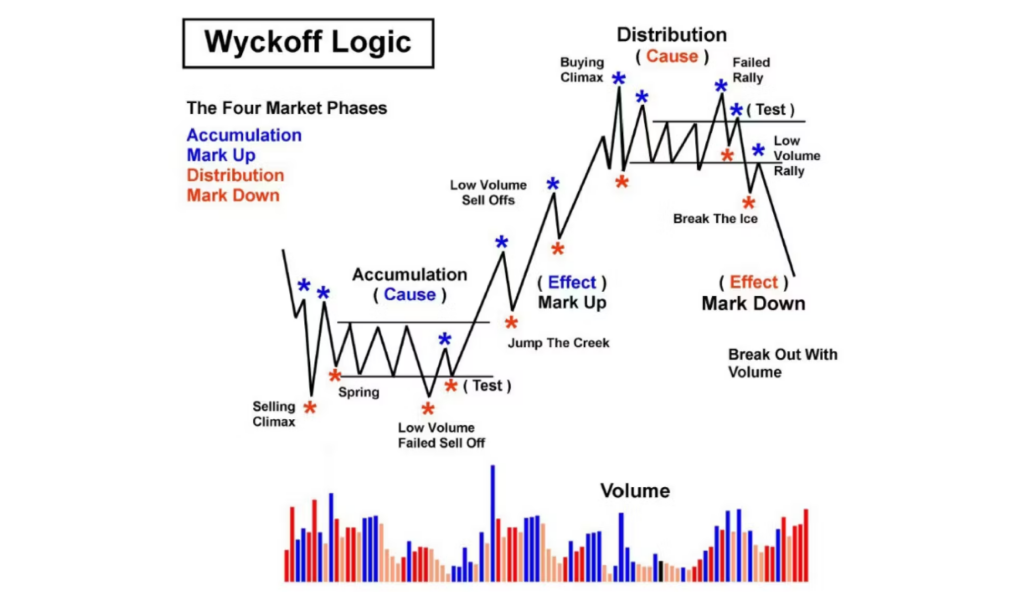

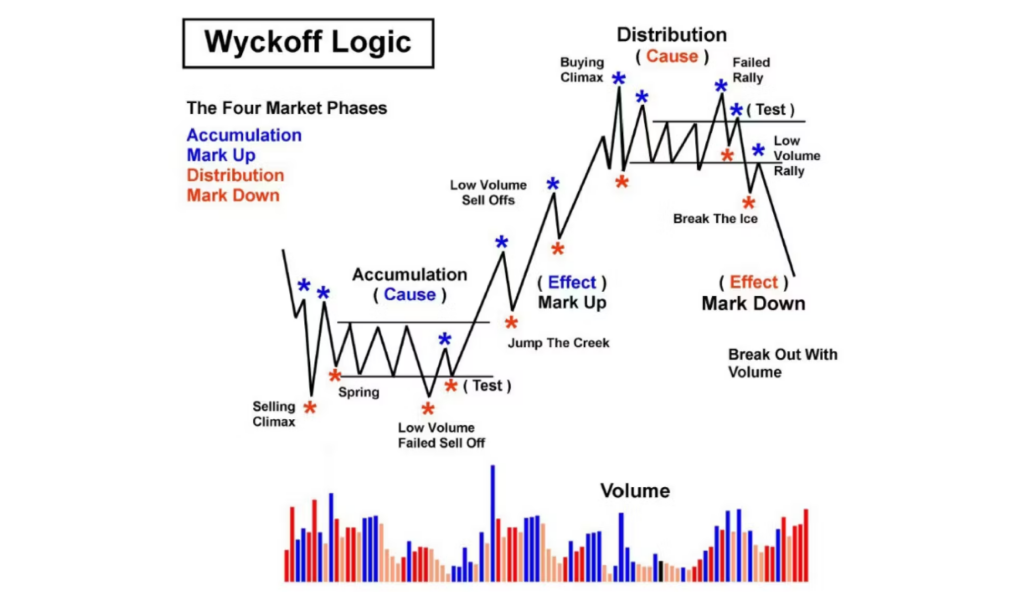

The Wyckoff Method, initially developed during the early 1930s, comprises a comprehensive set of principles specifically crafted for traders and investors engaged in traditional financial markets. Among these fundamental principles, such as the law of cause and effect, some can be effectively applied when seeking out opportunities for profit within the realm of BTC dominance.

Many traders and investors have adopted the Wyckoff Method as a valuable tool for identifying prevailing market trends, estimating the likelihood of potential trend reversals, and meticulously timing their trades. In accordance with Wyckoff’s teachings, trading behavior can be systematically categorized into four distinct phases: Accumulation, markup, distribution, and markdown. Recognizing the precise junctures where funds flow within these phases is of paramount importance, particularly for traders who heavily rely on market timing to make well-informed trading decisions.

For traders and investors with diverse portfolios, the Wyckoff Method often serves as a reliable approach for discerning the stronger prevailing trend. Below, we outline several scenarios in which the Wyckoff Method plays a pivotal role.

Utilizing BTC Dominance as an Indicator for Identifying the Onset of the Altcoin Season

Leveraging BTC dominance as a means to identify the onset of an altcoin season becomes increasingly relevant in light of the burgeoning array of altcoins within the market. It comes as no surprise that bitcoin dominance is gradually diminishing as certain altcoins gain heightened popularity, leading to instances where the cumulative market capitalization of all altcoins temporarily surpasses that of bitcoin. These periods, marked by a sustained outperformance of altcoins over bitcoin, are commonly referred to as “altcoin seasons” or “alt seasons.” According to the principles underlying the Wyckoff Method, this cyclic movement of funds from bitcoin to altcoins unfolds predictably.

Given that altcoins generally exhibit superior performance during an altcoin season, bitcoin often witnesses a weakening of its dominance during this phase of the market cycle. Consequently, individuals actively trading both bitcoin and altcoins may opt to closely monitor bitcoin dominance to make necessary adjustments to their investment portfolios.

Utilizing BTC’s Dominance Alongside the Present Bitcoin Price

Some individuals incorporate both bitcoin price and bitcoin dominance into their trading decision-making process. While these factors are not considered infallible laws, they can provide valuable insights into potential market outcomes. Here are several potential scenarios that different combinations of BTC price and dominance may suggest:

- A rising BTC price coupled with increasing BTC dominance might signify the onset of a potential bitcoin bull market.

- A rising BTC price accompanied by a declining BTC dominance could indicate the emergence of a potential altcoin bull market.

- A falling BTC price alongside a rising BTC dominance may signal the possibility of an altcoin bear market.

- A declining BTC price along with decreasing BTC dominance could point to a potential bearish trend for the entire cryptocurrency market.

While these two factors alone do not guarantee the existence of a definitive bull or bear market, historical observations strongly suggest a correlation between them.

Conclusion

BTC dominance serves as a valuable tool for illuminating shifts in market cycles. Many traders find it beneficial for fine-tuning their trading strategies, while others leverage it to effectively oversee their diversified portfolios. It’s essential to keep in mind that BTC dominance doesn’t offer a definitive guarantee of Bitcoin’s or any other cryptocurrency’s performance. Instead, it functions as an informative guide, aiding traders in crafting their trading strategies.