Investment DAOs, also known as Decentralized Autonomous Organizations, are revolutionizing the world of finance by providing a decentralized and community-driven approach to investment opportunities. In this blog post, we will explore what Investment DAOs are and how they are shaping the future of decentralized finance.

What Are Investment DAOs?

An investment DAO extends the authority to its members, enabling them to collectively determine the timing and allocation of the funds they possess for investment purposes. These funds might find placement in diverse sectors such as real estate, DeFi investment instruments, or any other preferred asset chosen by the DAO. The fundamental framework of an investment DAO revolves around the utilization of the Decentralized Autonomous Organization (DAO) concept, which serves to democratize and decentralize the entire investment trajectory.

In contrast, conventional methodologies vest the power of investment within a relatively restricted circle comprising money managers of VC funds, family offices, and hedge funds. Conversely, investment DAOs present an alternative approach by affording those in possession of its governance token the prerogative to influence determinations related to investments. Instead of relying on the proficiency of a limited cluster of individuals, this paradigm places significance on the collective intelligence of the broader community when arriving at investment verdicts.

How Do Investment DAOs Work?

An investment DAO typically operates based on a fundamental goal or guiding principle. For instance, some DAOs focus on investing in specific sectors like GameFi or DeFi protocols. The decision-making process for investments adheres to these principles and involves a proposal framework.

Individuals who hold the governance token of the investment DAO possess the capability to initiate proposals. Some DAOs may restrict this privilege to token holders surpassing a certain quantity or belonging to a specific subgroup. This measure could be in place to prevent spam or to permit participation exclusively from members who hold a substantial stake, ensuring their suggestions carry significant weight in investment choices.

Upon proposal submission, participants either lock their tokens through staking or leverage a snapshot mechanism to exercise their voting rights. The snapshot mechanism assesses the number of governance tokens held in each wallet and allocates voting rights proportionally, all without requiring the tokens to be locked. This approach prevents users from influencing the vote by purchasing additional tokens after reviewing a proposal. Once the voting phase concludes, the decision is executed in accordance with the outcomes.

Profits generated from investments are distributed either through airdrops to governance token holders or via a staking mechanism. Through staking their governance tokens, individuals become eligible to receive a portion of rewards that can subsequently be withdrawn from the smart contract.

To facilitate, coordinate, and inform about their proposals, investment DAOs frequently maintain active community channels on platforms such as Discord and Telegram. The effectiveness of a DAO is intricately tied to the vibrancy and engagement of its community, underscoring the importance of sustaining a robust and lively membership base.

From Where Does an Investment DAO Acquire Its Funding?

There are numerous pathways through which an investment DAO can effectively enhance and bolster its treasury’s resources. Among these pathways, the most frequently employed approach involves conducting a sale of governance tokens. In the case of a nascent DAO, the process entails the creation and issuance of its distinct token, subsequently presenting it to the market utilizing a diverse array of available sale mechanisms. Interested investors partake in the acquisition of these tokens, motivated by either speculative inclinations, the prospect of wielding voting privileges, or a combination of both rationales.

When an investment DAO is established under the stewardship of seasoned investors boasting a robust investment strategy, the likelihood of attracting a sizable and engaged community of potential DAO participants is significantly heightened. Following the successful sale of their governance tokens, typically exchanged for established cryptocurrencies such as Bitcoin (BTC), Ether (ETH), BUSD, or other stablecoins, the DAO is thereby infused with substantial financial resources within its treasury. It is not uncommon for a portion of these governance tokens to be retained within the treasury, reserved for potential future sales and strategic maneuvers.

An alternative and widely embraced approach involves the creation and subsequent sale of non-fungible tokens, colloquially known as NFTs. These tokens can serve as items of pure collectibility, or they can encompass additional utility functionalities. For instance, the issuance of an NFT might entail the conferment of supplementary governance rights, augmenting the token’s appeal and value proposition.

Conversely, certain investment DAOs might commence their operations already endowed with treasury funds and a repository of digital assets, stemming from prior triumphs and achievements. As a tangible illustration, a decentralized finance (DeFi) undertaking might have accrued revenue from the services it provides, thereby furnishing the DAO with a pre-existing reservoir of financial means. In such instances, the DAO possesses the autonomy to deliberate upon prudent investment strategies for these amassed resources. However, within the context of our discourse pertaining to investment DAOs, it is customary to connote those entities singularly devoted to the domain of investments.

The Benefits of Investment DAOs

Transparency is a key hallmark of Investment DAOs. Each transaction involving the treasury is meticulously recorded onto a blockchain, a record that remains open for scrutiny by every member of the DAO. This unwavering commitment to transparency stands in stark contrast to the opacity often witnessed in venture capital endeavors, where hidden charges, unclear bookkeeping, and even inadvertent errors can remain concealed from those engaged as Limited Partners, the very investors in the venture capital enterprise.

Democratization stands as another significant facet within the realm of Investment DAOs. This democratized element plays a pivotal role in dispersing the process of fundraising. In conventional investment landscapes, the lion’s share of project funding originates from a restricted pool of sources. This pattern can pave the way for undesirable accumulations of authority, potentially impeding projects hailing from marginalized communities or regions in their quest for financial support.

The emergence of virtuous cycles stems from the democratization inherent in Investment DAOs. This dynamic ushers in the decentralization of investment opportunities, creating a cycle of positivity. This transformative shift ensures that investors who have traditionally been underrepresented are now equipped with the means to invest in underserved individuals, enterprises, communities, and regions.

Beyond these merits, Investment DAOs offer a spectrum of other advantages, including diminished risk and reduced fees. Engaging with an Investment DAO permits investors to diversify their risk exposure across a multitude of asset categories and diverse projects. This approach curtails the vulnerability associated with a single project faltering. Furthermore, owing to their decentralized and self-governing nature, Investment DAOs tend to impose lower fees compared to established investment models. In theory, this fee differential has the potential to propel amplified profits.

The Risks of Investment DAOs

While the decentralization of power based on token ownership is a notable achievement of investment DAOs, it’s crucial to remain aware of the potential risks involved. It’s essential to keep in mind that the act of holding any form of cryptocurrency inherently carries certain risks. Furthermore, investment DAOs introduce their own set of specific risks that necessitate consideration:

- Vulnerability to Smart Contract Failures: The operational foundation of a DAO relies on its underlying smart contracts. However, these contracts are susceptible to various vulnerabilities such as hacks, exploits, or even flawed code. Such events have the potential to disrupt the seamless functioning of the DAO and compromise its fund management protocols.

- Prone to Poor Investment Choices: The decision-making process of an investment DAO might lead to investments that yield negative returns on investment. It’s important to recognize that the collective consensus of the majority may not always result in the most optimal investment choices.

- Risk of Inadequate Fund Supervision: Effective management of the investment DAO’s treasury is paramount. Neglecting proper diversification or failing to implement sound management practices could expose the DAO’s investment capital to elevated levels of risk.

Investment DAOs vs. Traditional VCs

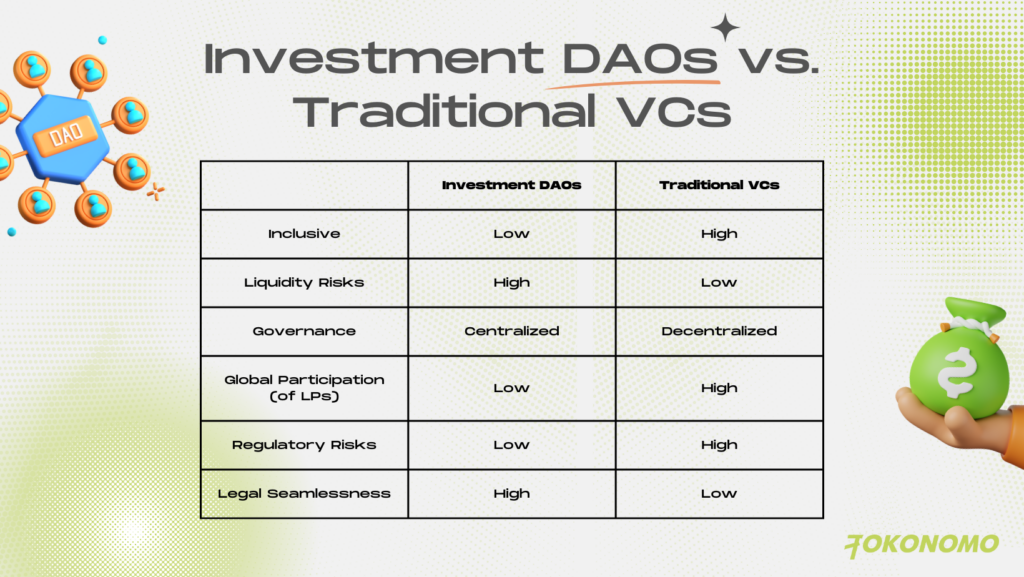

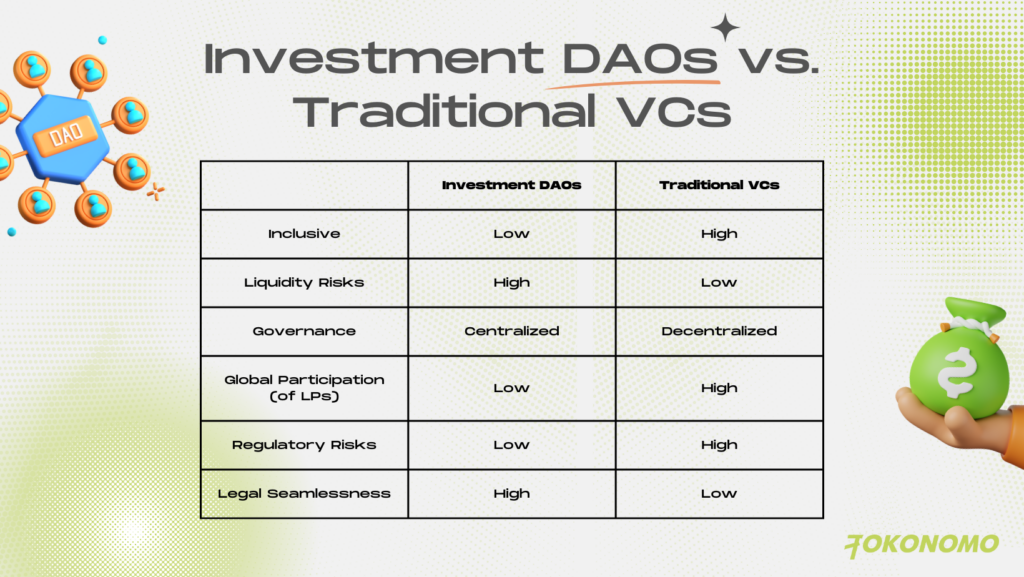

When directly comparing venture capitalists (VCs) with investment DAOs, there emerge a multitude of advantages and disadvantages to consider. The emergence of investment DAOs has remarkably democratized an industry that was conventionally exclusive. However, the somewhat ambiguous nature of their legal standing presents challenges for both investors and projects seeking funding partnerships. Given the exacting criteria prevalent in traditional investment setups, the practical collaboration of most investment DAOs seems confined to the realm of other cryptocurrency ventures.

Nevertheless, in the realm of Web3, investment DAOs exhibit distinct and noteworthy merits. While conventional VC firms express keen interest in the possibilities of Web3, they frequently impose substantial demands in exchange for their financial support and domain knowledge. Conversely, in the domain of Web3 and blockchain tech, VCs often find themselves less knowledgeable than their decentralized counterparts. Consequently, acquiring funding from an investment DAO could offer analogous benefits — a collective wellspring of expertise and a more equitable arrangement through community involvement.

In more conventional industries, the value that VCs bring to the table is considerable. These firms boast well-established networks and a suite of complementary services. Above all, they wield the legal and regulatory support essential for operating with confidence.

Conclusion

In the wake of the 2020/2021 crypto boom, the discourse surrounding Investment DAOs has gained substantial traction. The concept of potentially upending the traditional VC model holds great appeal for both individual investors with limited capital and ardent proponents of blockchain technology. The evolution of the dynamic between these two participant categories remains in its nascent stages, as the notion itself is relatively youthful. As is customary, should you opt to delve into the realm of investment DAOs and conduct experimentation, it is imperative to possess a comprehensive grasp of the associated risks, alongside a clear understanding of how such an endeavor harmonizes with your overarching portfolio strategy.