Table of Contents

- What Is a Smart Contract Audit?

- What is the Importance of Conducting Audits for Smart Contracts?

- What is the Process of Conducting a Smart Contract Audit?

- Approaches For Auditing Smart Contracts

- What Does The Term ‘Audit Report’ Refer to?

- Where Is It Possible to Obtain a Smart Contract Audit?

- What Is The Cost Associated With Auditing a Smart Contract?

- Conclusion

Smart contracts have gained significant popularity in recent years due to the rise of blockchain technology. These self-executing contracts have revolutionized the way transactions are conducted, offering a decentralized and trustless environment. However, as with any technology, there are inherent risks involved, especially when it comes to security.

What Is a Smart Contract Audit?

A comprehensive examination of the smart contract’s security is conducted through a meticulous audit process, wherein the project’s smart contract code is thoroughly reviewed and analyzed. This scrutiny is typically directed towards contracts coded in the Solidity programming language, which are conveniently accessible on GitHub. The significance of security audits becomes particularly pronounced in the realm of DeFi ventures that anticipate managing blockchain transactions of substantial value or accommodating a vast multitude of participants. The audit process adheres to a well-defined sequence of four fundamental steps:

- Inaugural scrutiny of the smart contracts is initiated by submitting them to the audit team.

- The audit team subsequently delivers their evaluative observations to the project stakeholders, facilitating necessary action.

- Responsive to the identified issues, the project team undertakes requisite modifications.

- A conclusive report is dispensed by the audit team, encompassing all adjustments made and any lingering discrepancies.

For a multitude of cryptocurrency enthusiasts, the undertaking of smart contract audits holds an indispensable status when contemplating investments in novel DeFi initiatives. Indeed, it has evolved into an established norm for projects aspiring to command credibility. Distinct audit service providers have emerged as frontrunners within the industry, thereby augmenting the value of their audits in the discerning eyes of potential investors.

What is the Importance of Conducting Audits for Smart Contracts?

Given the substantial value that is exchanged or secured within smart contracts, they emerge as alluring objectives for nefarious assaults carried out by hackers. Even slight inaccuracies in coding have the potential to result in the misappropriation of substantial sums of money. One illustrative instance is the DAO breach that occurred on the Ethereum blockchain, which resulted in the pilfering of approximately 60 million dollars worth of ETH and necessitated a profound modification of the Ethereum network through a hard fork.

In light of the irreversibility characterizing blockchain transactions, ensuring the impregnability of a project’s code stands as a matter of utmost importance. Owing to the formidable security inherent to blockchain technology, the retrieval of funds and rectification of predicaments subsequent to an event become arduous undertakings. Therefore, it is judicious to take all conceivable measures to avert vulnerabilities proactively.

What is the Process of Conducting a Smart Contract Audit?

The procedure for conducting a smart contract audit is fairly consistent across various audit providers. Although the specific approach of each auditor might exhibit some minor variations, the standard process can be outlined as follows:

- Initiate the definition of the audit’s scope. The smart contract itself and the specifications of the project are delineated by the project stakeholders, outlining their intended function, as well as the comprehensive architectural design. These specifications serve as a guide for the audit team to comprehend the project’s objectives while coding and implementing it.

- Furnish an initial cost estimate based on the extent of the required tasks.

- Perform testing procedures. The precise nature of these tests will vary contingent on the audit team, the tools they employ for analysis, and their methodologies. Typically, a combination of manual and automated tests is executed.

- Formulate a preliminary version of the report enumerating identified issues, subsequently delivering it to the project team for their input and subsequent rectifications.

- Disseminate the final report, taking into account any measures undertaken by the project team to rectify the highlighted concerns.

Approaches For Auditing Smart Contracts

Gas Efficiency

Gas efficiency is a crucial consideration when it comes to evaluating smart contract audits. These assessments encompass not only the security aspects of blockchain transactions but also delve into the realm of efficiency and optimization. In certain instances, intricate chains of transactions are woven together within contracts to fulfill their intended functions. Given the substantial cost associated with gas fees on platforms like Ethereum, contracts that demonstrate efficiency have the capacity to significantly curtail transaction expenses.

Furthermore, the optimization of contract performance serves as a barometer of the developer’s adeptness. Activities within contracts that lack efficiency amplify the potential for failures, and therefore, sidestepping such inefficiencies becomes imperative. Particularly when gas costs surge, the execution of smart contracts might falter, a scenario further exacerbated when employing a low gas limit.

Contract Vulnerabilities

A distinct facet of these audits pertains to the identification of contract vulnerabilities. While certain issues may manifest with relative ease, a plethora of exploits encompass sophisticated tactics and stratagems designed to siphon funds. For instance, weak smart contracts can be exploited for market manipulation, enabling the orchestration of flash loan attacks. To unearth such issues, auditors initiate a process of stress testing and replicate malevolent attacks against the smart contract. Common vulnerabilities include:

- Reentrancy issues, where a smart contract initiates an external call to another contract prior to the resolution of any effects. This external contract can subsequently cyclically invoke the initial smart contract and engage with it in manners it shouldn’t be privy to, given that the original contract’s balance remains unaltered.

- Integer overflows and underflows are situations in which a smart contract undertakes an arithmetic operation, only to yield an output surpassing the storage capacity (typically set at 18 decimal places). This can culminate in miscalculated amounts.

- Front-running opportunities, where poorly structured code can potentially foreshadow market transactions, affording early insights that enable others to capitalize on this information for personal gain.

Platform Security Vulnerabilities

Beyond the realm of contracts, audits often encompass scrutiny of the platform housing these contracts, extending to the APIs employed for interactions with the decentralized applications (DApps). Within this context, vulnerabilities might expose projects to risks like Distributed Denial of Service (DDoS) attacks or compromises to the user interface (UI) of their website. Such compromises could result in users inadvertently linking their wallets with malicious blockchain applications.

What Does The Term ‘Audit Report’ Refer to?

The comprehensive audit report is furnished upon the culmination of the audit process. In order to uphold transparency, projects are required to openly communicate their discoveries with the community. Typically, the reports classify identified issues based on their level of severity, ranging from critical to major to minor, and so forth. Additionally, the report will outline the current status of each issue, allowing projects a window to rectify these concerns prior to the ultimate publication of the final report.

In conjunction with an executive summary, a standard report will encompass recommendations, instances of superfluous code usage, and an exhaustive breakdown pinpointing the precise locations of coding errors. A window of time is extended to the project to take responsive actions addressing the findings outlined in the report, prior to the eventual release of the definitive version.

Where Is It Possible to Obtain a Smart Contract Audit?

A multitude of smart contract audit services have gained significant recognition for their exceptional offerings. Among these services, two have garnered remarkable popularity, and securing an audit from these providers entails initiating a quote request and furnishing essential information.

CertiK

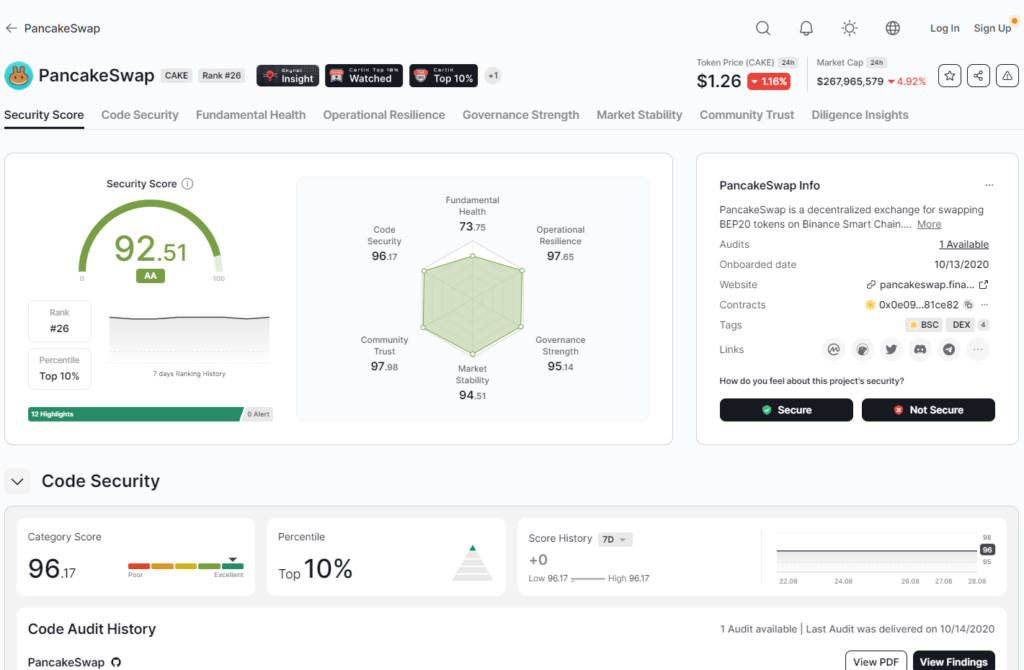

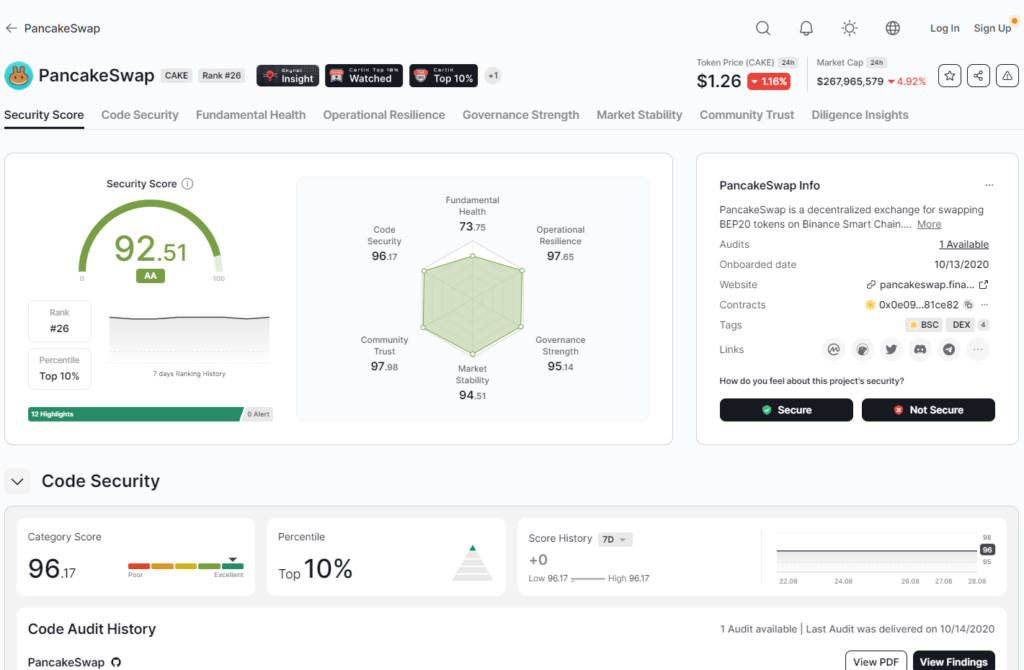

CertiK stands out as a premier player in the realm of smart contract auditing. Over the course of time, a multitude of projects have entrusted their smart contracts to CertiK for meticulous evaluation. A prominent example lies in PancakeSwap, the largest Automated Market Maker (AMM) on the Binance Smart Chain (BSC).

Furthermore, an overwhelming majority of projects that have received support from Binance Labs have opted for CertiK’s comprehensive contract audits. The projects that have undergone CertiK’s scrutiny are featured on a dynamic leaderboard, allowing for comparative analysis along with a corresponding safety score. Notably, it’s essential to recognize that CertiK extends its auditing prowess beyond Ethereum to encompass BSC and Polygon projects as well.

ConsenSys Diligence

ConsenSys Diligence, spearheaded by Joseph Lubin, a co-founder of Ethereum, emerges as a prominent entity within the cryptocurrency landscape. ConsenSys boasts a substantial reputation in the realm of blockchain development. Under the umbrella of ConsenSys Diligence, the company specializes in conducting audits for Ethereum smart contracts. Additionally, they offer an automated service tailored to scrutinizing Ethereum Virtual Machine (EVM) contracts, targeting commonly identified errors.

What Is The Cost Associated With Auditing a Smart Contract?

The precise expense associated with conducting an audit is contingent upon the number of smart contracts slated for examination. As a rule, the cost of an audit tends to amount to several thousand dollars. In the case of a notably extensive project, the expenses could effortlessly surpass the threshold of $10,000. Furthermore, the financial outlay is influenced by the reputation and identity of the audit firm selected to oversee the audit process.

Conclusion

Thankfully, to the benefit of both investors and users, smart contract audits have evolved into a widely accepted benchmark of quality. Nevertheless, in a landscape where nearly every project undergoes this process, it no longer serves as a straightforward gauge of value. Hence, the importance of delving into the audit findings yourself cannot be overstated. Even if you lack the technical expertise, perusing the comments and evaluating the seriousness of potential concerns can be insightful.

Upon encountering an audit report, you should now find comprehending its contents to be a more manageable task. As always, it is imperative that any investment choice considers the complete panorama and factors in all available information.