Table of Contents

- Understanding Altcoin Season

- Identifying an Approaching Altcoin Season

- Tools and Indicators to Monitor Altcoin Seasons

- Additional Features to Watch

- Combining with Other Analysis Tools

- Strategies for Successful Investing During Altcoin Seasons

- Navigating Risks and Challenges in Altcoin Investing

- The Impact of Timing and External Factors on Altcoin Seasons

- Conclusion: Embracing the Opportunities in Future Altcoin Seasons

- FAQs (Frequently Asked Questions)

Understanding Altcoin Season

Ever wondered why some cryptocurrencies suddenly skyrocket while Bitcoin stays relatively stable? That’s the magic of altcoin season – a fascinating phenomenon in the crypto world where alternative cryptocurrencies take center stage.

Think of the altcoin season as a grand party where the smaller players get their moment in the spotlight. During this period, cryptocurrencies like Ethereum, Dogecoin, and Solana experienced dramatic price increases and heightened trading activity, often outshining Bitcoin’s performance.

Why should you care about the altcoin season?

- It creates unique profit opportunities beyond Bitcoin

- Helps diversify your crypto investment strategy

- Offers early access to innovative blockchain projects

- Provides potential for higher returns (with higher risks)

The crypto market has witnessed several memorable alt seasons. Remember the ICO boom of 2017-2018? That’s when countless altcoins saw their values multiply overnight. Fast forward to early 2021, and we saw another explosive alt season driven by NFTs and DeFi projects.

These historical patterns show us that alt seasons aren’t just random events – they’re cyclical opportunities that smart investors can prepare for. When Bitcoin’s dominance in the market decreases, it often signals that capital is flowing into altcoins, creating a ripple effect of growth across the crypto ecosystem.

Understanding alt season isn’t just about chasing profits – it’s about recognizing the evolving landscape of cryptocurrency investments and positioning yourself to make informed decisions in this dynamic market.

Identifying an Approaching Altcoin Season

Spotting the next altcoin season isn’t just about luck – it’s about recognizing specific market patterns and signals. Let’s dive into the key indicators that can help you identify when altcoins are ready to take center stage.

1. Rising Altcoin Dominance

When altcoins start gaining ground against Bitcoin, it’s a strong signal that an altseason might be approaching. You can track this through the altcoin dominance metric:

- A steady increase in altcoin market share vs. Bitcoin

- Multiple altcoins showing stronger price performance than BTC

- Sustained upward trends in altcoin/BTC trading pairs

2. Trading Volume Analysis

Watch for these volume patterns that often precede an alt season:

- Significant spikes in altcoin trading activity

- Growing number of active wallets across various altcoin networks

- Increased presence of new market participants

3. Market Sentiment Indicators

The crypto community’s mood can signal an approaching alt season:

- Rising social media mentions and engagement for altcoin projects

- Increased developer activity on altcoin platforms

- Growing institutional interest in alternative blockchain solutions

Think of these signals like weather patterns – just as dark clouds might signal an approaching storm, these market indicators can help predict an incoming alt season. Keep an eye on popular crypto analytics platforms like LunarCrush and social sentiment tools to track these metrics effectively.

Remember: No single indicator guarantees an altseason. It’s the combination of rising altcoin dominance, increasing trading volumes, and positive market sentiment that creates the perfect environment for altcoins to thrive. Successful traders often create their own dashboards combining multiple indicators to get a comprehensive view of market conditions.

Tools and Indicators to Monitor Altcoin Seasons

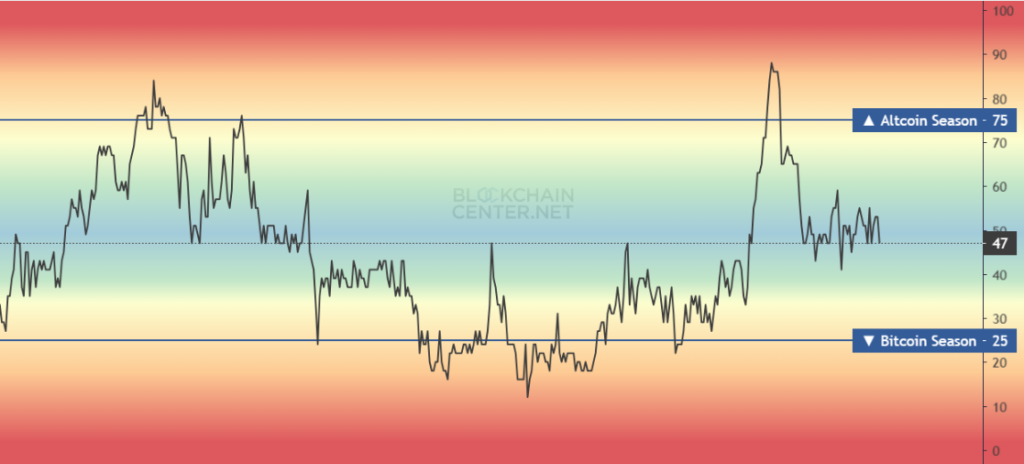

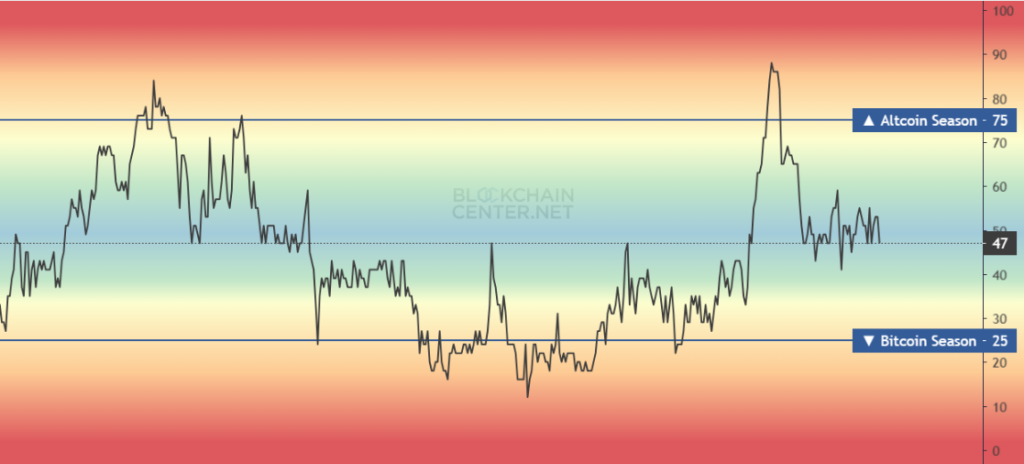

The Altcoin Season Index is a valuable tool for navigating the crypto market. It tracks the performance of the top 50 altcoins compared to Bitcoin over specific time periods, allowing you to make informed investment choices.

How the Index Works

Here’s a simple breakdown of how the index operates:

- A reading of 75% or higher indicates we’re in altcoin season

- Below 25% suggests Bitcoin’s dominance

- Between 25-75% represents a neutral market

The alt season index uses a straightforward calculation method:

“Out of the top 50 coins, if 75% have outperformed Bitcoin in the last season, we’re officially in an altcoin season”

Reading the Altcoin Season Index Chart

Understanding the chart is key to making informed decisions. Here’s what each zone signifies:

- Green Zones (75%+): Signal prime opportunities for altcoin investments

- Red Zones (Below 25%): Suggest focusing on Bitcoin positions

- Yellow Zones (25-75%): Indicate balanced investment approaches

Historical Patterns and Cycles

By analyzing the historical data on the chart, you can identify patterns and cycles that may indicate potential market shifts. It’s common to see periods of alt season clustering together, creating waves of opportunity for strategic traders. For more insights into understanding these cycles, refer to this comprehensive guide on the crypto alt season.

Additional Features to Watch

In addition to the core functionality of the Altcoin Season Index, there are several other features worth keeping an eye on:

- Volume indicators: These show the level of trading activity for different altcoins and can provide insights into market interest.

- Price correlation metrics: By examining how various altcoins move in relation to one another, you can gain a better understanding of their interconnectedness.

- Market momentum measurements: Tracking the overall direction and strength of price movements can help you gauge market sentiment.

- Historical comparison tools: Looking at past performance data can give you context when evaluating current trends.

Combining with Other Analysis Tools

While the Altcoin Season Index is a powerful tool on its own, it becomes even more valuable when used alongside other technical analysis methods. Here are some additional factors to consider tracking:

- Market volatility metrics: Understanding how much prices fluctuate can give you insights into risk levels.

- Social sentiment indicators: Monitoring discussions and opinions about specific cryptocurrencies can help gauge public perception.

- Trading volume distributions: Analyzing where trades are occurring (e.g., exchanges) can provide clues about market behavior.

- Network activity data: Examining metrics like transaction counts or wallet addresses can reveal underlying demand.

By incorporating these elements into your analysis strategy, you’ll develop a more comprehensive understanding of market dynamics and improve your timing for entering or exiting positions.

Strategies for Successful Investing During Altcoin Seasons

Ready to dive into altcoin season? Let’s explore proven strategies that can help you make informed investment decisions during these exciting market phases.

Smart Portfolio Diversification

- Split investments across different altcoin categories (DeFi, NFTs, Layer-2 solutions)

- Allocate larger portions to established altcoins with proven track records

- Set aside a smaller percentage for emerging projects with high potential

- Maintain a balanced ratio between high-risk and stable investments

Research Framework for Altcoin Selection

Technology Assessment

- Review the project’s whitepaper

- Analyze the blockchain architecture

- Evaluate scalability solutions

- Check for security audits

Team Background Verification

- Research team members’ professional history

- Look for previous successful projects

- Check their social media presence

- Verify partnerships and advisors

Adoption Potential Indicators

- Active user base growth rate

- Developer activity on GitHub

- Social media engagement metrics

- Integration with existing platforms

- Real-world use cases and implementations

Project Evaluation Checklist

✓ Clear problem-solving approach ✓ Unique value proposition ✓ Strong community engagement ✓ Regular development updates ✓ Transparent roadmap ✓ Market competition analysis

Remember to track your investments through a portfolio management tool. Set clear entry and exit points for each position, and don’t chase pumps blindly. A methodical approach to altcoin selection, combined with proper risk management, creates a solid foundation for navigating altcoin seasons.

Consider setting up price alerts for your chosen altcoins. This practice helps you stay informed about significant price movements without constantly watching the markets. You’ll want to adjust your strategy based on market conditions and your investment goals.

Let’s explore the challenges of altcoin investing – it’s not always smooth sailing. The unpredictable nature of the crypto market becomes even more evident during alt season, bringing both exciting opportunities and nerve-wracking risks.

Volatility: A Double-Edged Sword

Price fluctuations of 20-30% in a single day aren’t uncommon during alt season. While these movements can lead to significant profits, they can also wipe out your investment faster than you can say “HODL.” A $1,000 investment could soar to $5,000 or plummet to $200 within hours.

Red Flags to Watch For:

- Pump and Dump Schemes – Groups artificially inflating prices before selling off

- Ghost Projects – Teams disappearing with investor funds

- Copy-Cat Tokens – Clones of successful projects with no real value

- Fake Trading Volume – Artificial activity to create FOMO

Market Manipulation Tactics

Small-cap altcoins are particularly vulnerable to whale manipulation. A single large holder can dramatically influence prices, leaving smaller investors at their mercy. Think of it as swimming in a pool with sharks – you might be fine, but you’re not the top predator.

Project Quality Assessment

Many altcoins launch with flashy websites and ambitious roadmaps but lack substance underneath. I’ve seen projects with copied code, non-existent development teams, and whitepaper plagiarism. Your best defense? Deep research and healthy skepticism.

💡 Pro Tip: Check GitHub activity, social media engagement, and community size. Dead repositories and inactive social channels often signal abandoned projects.

Risk Management Essentials

- Set strict stop-loss orders

- Never invest more than you can afford to lose

- Document red flags during your research

- Monitor project development milestones

- Track team member backgrounds

The altcoin market resembles the Wild West – lawless, unpredictable, and full of opportunities for both fortune and failure. Your success depends on your ability to navigate these treacherous waters while keeping your risk exposure in check.

The Impact of Timing and External Factors on Altcoin Seasons

Predicting the perfect moment for an altcoin season is like trying to catch lightning in a bottle. The crypto market’s dynamic nature creates an intricate dance of timing that shifts dramatically from year to year. Let’s break down the key factors that influence these unpredictable cycles:

1. Market Cyclical Patterns

- Bitcoin halving events often trigger market-wide movements

- Historical patterns show alt season frequencies varying between 2-4 times annually

- Peak periods can last anywhere from a few weeks to several months

2. Regulatory Landscape

The crypto market responds sharply to regulatory announcements:

- Positive regulations → market confidence rises → increased altcoin adoption

- Negative regulations → market uncertainty → potential altcoin sell-offs

- Regional differences → varying impacts across different jurisdictions

3. Macroeconomic Forces

The broader economic landscape plays a crucial role:

Interest rates, inflation, and global economic health directly influence investor behavior in the altcoin market

4. Real-World Examples

Several real-world events have shaped past altcoin seasons:

- 2021’s alt season gained momentum from Tesla’s Bitcoin investment

- China’s crypto mining ban in 2021 reshaped market dynamics

- SEC’s crypto regulations announcements frequently trigger market-wide reactions

5. Market Sentiment Indicators

Market sentiment can be gauged through various indicators:

- Social media trends

- News cycle intensity

- Institutional investor movements

Understanding these external factors helps create a more comprehensive investment strategy. While perfect timing remains elusive, recognizing these influences allows investors to make more informed decisions during altcoin seasons. The key lies in staying adaptable and maintaining awareness of these shifting market dynamics.

Conclusion: Embracing the Opportunities in Future Altcoin Seasons

The crypto market’s cyclical nature creates recurring opportunities for savvy investors during altcoin seasons. You’ve learned the essential elements of navigating these profitable periods:

- Market Analysis Skills – Understanding altcoin dominance patterns and trading volumes

- Strategic Portfolio Management – Diversifying investments across promising projects

- Risk Management – Balancing potential rewards against market volatility

- Timing Considerations – Adapting to market cycles and external influences

The future of altcoin seasons looks promising, with growing institutional adoption and technological advancement driving the crypto ecosystem forward. Are you ready to spot the next big opportunity?

Here’s your action plan for future altcoin seasons:

- Stay informed about market trends and regulatory developments

- Build a robust research framework for evaluating potential investments

- Set clear entry and exit strategies

- Keep emotions in check during high-volatility periods

- Maintain a long-term perspective while capitalizing on short-term opportunities

Remember: successful altcoin investing isn’t about catching every wave – it’s about riding the right ones. The crypto market rewards patient, educated investors who combine thorough research with disciplined execution. Your journey in the altcoin landscape starts with knowledge and grows with experience.

The next altcoin season might be just around the corner. Will you be prepared when it arrives?

FAQs (Frequently Asked Questions)

- What is altcoin season?

Altcoin season refers to a period in the cryptocurrency market when altcoins, or alternative cryptocurrencies to Bitcoin, experience significant price increases and trading volume. Understanding this phenomenon is crucial for investors looking to capitalize on potential gains.

- How can I identify an approaching altcoin season?

Identifying an approaching altcoin season can be done by monitoring rising altcoin dominance, analyzing trading volumes, and assessing market sentiment. A notable increase in altcoin dominance alongside positive trading trends often signals that an alt season may be near.

- What tools can I use to monitor altcoin seasons?

The Altcoin Season Index is a valuable tool for monitoring altcoin seasons. It provides insights into the performance of altcoins relative to Bitcoin. Investors can interpret the altseason index chart to make informed investment decisions based on current market conditions.

- What strategies should I consider when investing during altcoin seasons?

Successful investing during altcoin seasons involves portfolio diversification, thorough research on potential investments, and effective risk management. Evaluating technology, team background, and adoption potential are key factors in selecting promising altcoins.

- What risks should I be aware of when investing in altcoins?

Investing in altcoins carries risks such as high volatility, fraudulent projects, and overall market unpredictability. Investors must remain vigilant and conduct due diligence to avoid poorly managed investments during these periods.

- How do timing and external factors impact altcoin seasons?

Timing can vary significantly from year to year and is often unpredictable. Additionally, regulatory changes and macroeconomic factors can influence market dynamics and investor behavior, affecting the onset and duration of an altcoin season.