Tokenization emerges as a particularly intriguing aspect of the broader blockchain ecosystem, symbolizing the transformation of various assets or utilities into digital tokens. Real-world assets (RWA) refer to the process of tokenizing tangible assets that possess definitive monetary value, such as gold, real estate, and carbon credits, by converting them into tradable digital representations.

RWAs have gained significant traction and practical application within the decentralized finance (DeFi) sector. The fusion of RWAs with DeFi is frequently hailed as one of the most compelling illustrations of how traditional financial assets are converging with decentralized financial systems, offering new avenues for value exchange and financial innovation.

How Do Real-World Assets Function?

Before diving into the utility of RWAs in decentralized finance (DeFi), let’s first examine how they function. More specifically, how can we verify that RWAs are authentic representations of the real-world assets they claim to tokenize? This process can be divided into three key phases: off-chain formalization, the bridging of information, and the balance of demand and supply within RWA protocols.

Off-chain formalization

Before a real-world asset (RWA) can be incorporated into a digital ledger or blockchain, its value, ownership, and legal standing must first be clearly and indisputably established within the physical world. To estimate the value of an RWA, several key factors are considered, including its current market price, historical performance, and the physical condition of the asset. Furthermore, the asset must have documented and legally recognized ownership, supported by formal records such as deeds, titles, or invoices. Without these verifiable elements, the asset cannot be properly integrated into the digital ecosystem.

The bridging of information

During this phase, we undergo the comprehensive tokenization process, in which the asset’s details are converted into a digital token. Key information, such as the asset’s value and rightful ownership, is embedded within the token’s metadata. Thanks to the inherent transparency of blockchain technology, the authenticity of the token can be easily verified by anyone through its associated metadata.

When handling assets that fall under regulatory frameworks or are classified as securities, the use of regulatory technologies becomes essential. This includes engaging licensed security token issuers, ensuring compliance with crypto-specific KYC (Know Your Customer) and KYB (Know Your Business) protocols, and utilizing cleared security token exchanges to facilitate secure and compliant transactions.

Balance of demand and supply within RWA protocols

In the final phase, which revolves around the dynamics of demand and supply, DeFi protocols that specialize in real-world assets (RWAs) take center stage. These protocols serve two essential roles: first, they facilitate the creation of new RWAs, essentially increasing the availability of these digital assets within the ecosystem. At the same time, they actively work to attract investor interest, encouraging participation in the buying, selling, and trading of these assets.

By employing this three-step approach, RWAs are transformed from mere theoretical concepts into tangible, functional, and indispensable elements of the DeFi landscape. They carry the weight of real-world valuation, backed by legal frameworks, into the decentralized digital space, adding credibility and trust to the ecosystem.

How RWAs Have Revolutionized DeFi

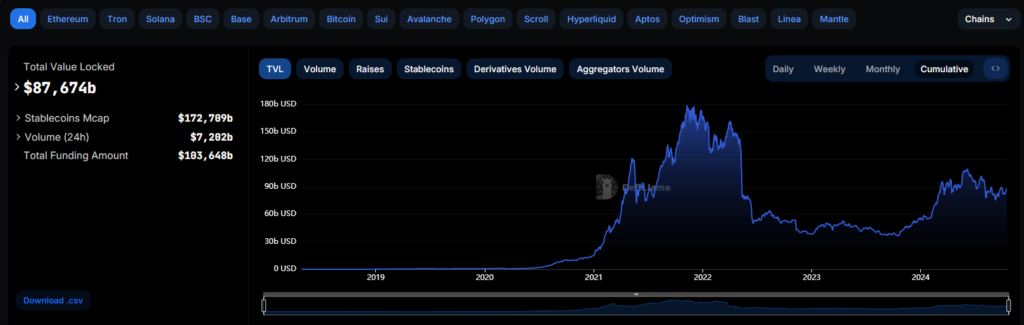

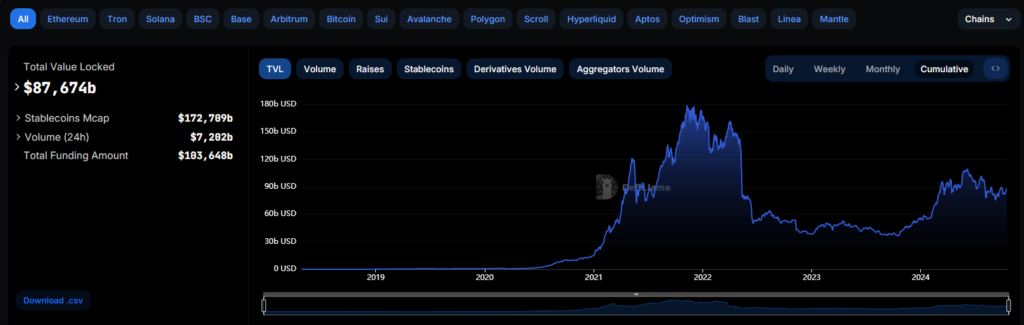

One of the most critical metrics in decentralized finance (DeFi) is “Total Value Locked” (TVL). This metric gauges the total amount of capital locked across various DeFi protocols. A higher TVL generally indicates greater utility within the ecosystem. In November 2021, the global TVL reached an all-time high of approximately $180 billion, driven by the bullish momentum of the so-called “DeFi Summer.”

However, as the market declined, DeFi’s TVL dropped sharply to $49.87 billion by June 2022, marking a staggering 72.3% reduction in just seven months. The lack of genuine utility and flawed tokenomics in some DeFi protocols only exacerbated the situation, leading to substantial liquidity loss across the market.

As a result, the typical DeFi investor’s mindset has shifted considerably. An increasing number of investors are now prioritizing stable, long-term investment strategies over the pursuit of quick gains. This shift has become especially noticeable in the post-2021 era, where there’s been a growing focus on more stable asset classes, such as Real World Assets (RWAs).

The following facts and figures highlight the rising interest in the RWA market:

- In 2023, the on-chain value of RWAs (excluding stablecoins) grew by $1.05 billion.

- Of this amount, $855.7 million (82%) came from yield-generating assets like treasuries, real estate, and private credit.

According to research conducted by analysts from January 1 to September 30, 2023:

- Active on-chain private credit loans increased by $210.5 million.

- Treasuries and other bonds saw growth of $557 million.

What Are Issuers of RWA?

Real-World Assets (RWAs) are brought to life on the blockchain through the dedicated efforts of issuers who undertake three fundamental activities:

- Acquisition of Tangible Assets: Issuers actively seek out and acquire physical assets from the real world, ensuring they have a solid foundation to work with.

- Tokenization Process: These tangible assets are then transformed into digital representations through the process of tokenization, which allows them to be integrated into the blockchain ecosystem seamlessly.

- Distribution of Tokens: Finally, the newly created tokens are distributed to users within the blockchain network, facilitating access and participation in the RWA marketplace.

Several key players are prominent in the RWA issuance landscape:

- Centrifuge: Recognized as one of the largest platforms for issuing on-chain credit loans, Centrifuge plays a crucial role in connecting real-world assets with decentralized finance (DeFi).

- Franklin Templeton: This TradFi behemoth, established in 1947, manages an impressive portfolio with over $1.5 trillion in assets under management (AUM). Recently, they have ventured into the issuance of tokenized treasury tokens, further bridging the gap between traditional finance and blockchain technology.

- WisdomTree: As a leading market player in exchange-traded products, WisdomTree boasts nearly $96 billion in AUM, making significant contributions to the growth and innovation of the RWA sector.

Benefits of Incorporating RWAs in DeFi

The tokenization of Real World Assets (RWAs) offers a multitude of compelling advantages that fundamentally transform investment strategies and the entire landscape of crypto finance.

- Liquidity Boost: By converting assets such as real estate into digital tokens, tokenization effectively transforms traditionally illiquid and slow-moving assets into highly liquid entities. This transformation allows a broader and more diverse pool of investors to engage with and invest in the underlying asset, significantly enhancing market participation.

- Fractional Ownership: One of the most intriguing applications of RWAs is the concept of fractional ownership. By dividing high-value assets like real estate into smaller, manageable tokens, the barriers to entry for everyday investors are significantly lowered. Consequently, groups of investors can pool their resources together, allowing them to collectively acquire and own a property, which is represented through these tokens.

- Transparency: The transparent ledger provided by blockchain technology ensures that every transaction, as well as ownership details related to an RWA, is meticulously recorded and can be openly verified by anyone. This transparency fosters trust among investors and enhances the credibility of the asset.

- Inclusivity: The movement of tokenized assets through decentralized finance (DeFi) channels not only creates new markets and financial instruments but also lays the groundwork for increased inclusivity in investing. This evolution brings fresh opportunities to existing investors while simultaneously attracting new participants, thereby enhancing the overall stability and growth potential of the financial ecosystem as a whole.

Challenges of Implementing RWAs in DeFi

RWA presents a revolutionary approach to seamlessly integrating physical assets with the realm of digital finance. Nevertheless, it is important to acknowledge the various limitations and challenges that accompany this innovation.

- Regulatory complexity: The landscape of RWAs and DeFi is fraught with intricate regulatory requirements. These regulations can vary significantly based on factors such as the type of asset involved, geographical location, jurisdiction, and even the specific blockchain platform utilized for the tokenization process.

- Security concerns: In the context of RWAs, it is imperative to preserve a strong and secure connection between the physical asset and its corresponding digital tokens. This linkage must be resilient enough to withstand potential fraud attempts and any legal disputes that may arise.

- Scalability: The platforms that facilitate RWA tokenization must possess the capability to manage a substantial volume of transactions and data effectively, ensuring smooth operation and efficiency as the ecosystem grows.

Conclusion

Real-world assets (RWAs) represent a thrilling advancement in the decentralized finance (DeFi) landscape, with the potential to significantly expand its functionalities and appeal to a wider audience. They offer the promise of a more interconnected financial ecosystem where traditional finance seamlessly integrates with decentralized finance. However, achieving this ambitious vision will necessitate navigating considerable challenges, such as adhering to stringent regulatory requirements and maintaining the integrity of the market.