Decentralized Finance (DeFi) has become one of the hottest trends in the cryptocurrency and blockchain space. With its promise of revolutionizing traditional financial systems, more and more people are diving into the world of DeFi protocols. But have you ever wondered how these protocols actually generate revenue?

Definition of DeFi Protocols

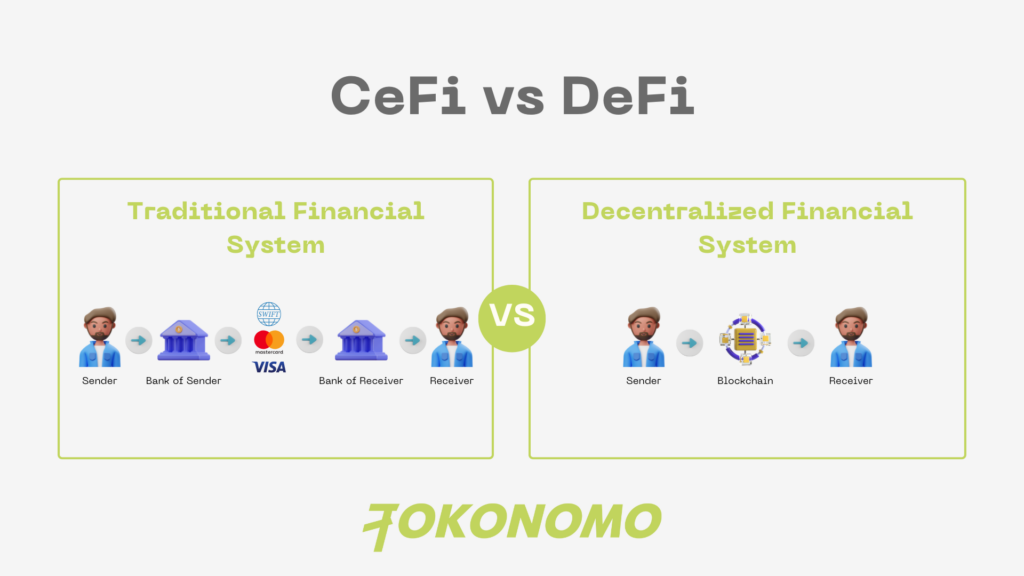

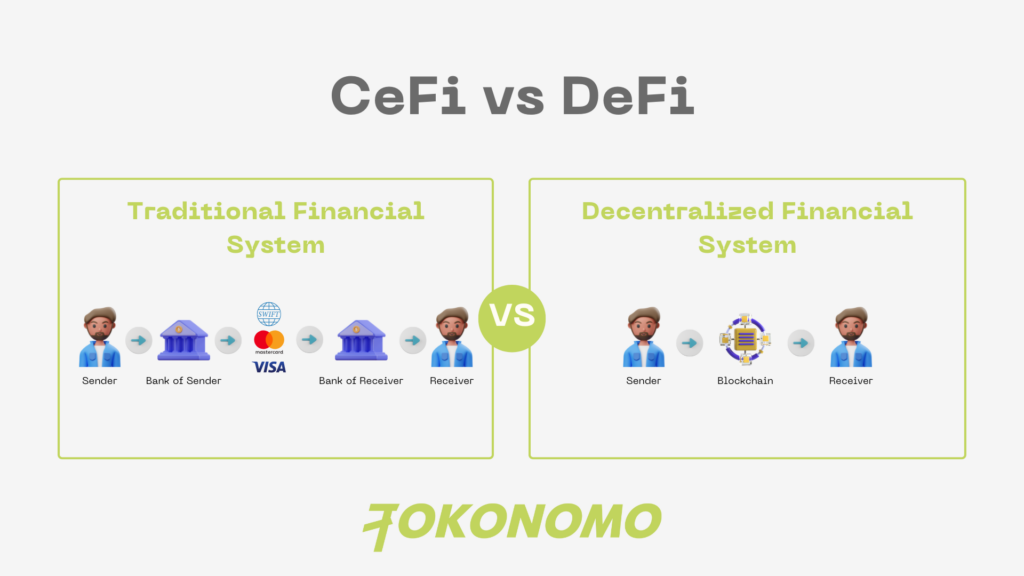

Decentralized Finance, commonly referred to as DeFi, represents a rapidly evolving ecosystem within the blockchain and cryptocurrency space. At its core, DeFi aims to recreate traditional financial services and products in a decentralized, permissionless, and programmable manner. DeFi protocols are the foundational building blocks that power this ecosystem, facilitating the creation, execution, and management of financial applications and services without the need for intermediaries like banks or traditional financial institutions.

DeFi protocols are software programs that are typically built on blockchain platforms like Ethereum, Binance Smart Chain, Solana, and others. These protocols are designed to automate and govern various financial functions, such as lending, borrowing, trading, asset management, yield farming, derivatives trading, and more. They utilize smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This code is immutable and is executed on the blockchain, ensuring transparency, security, and trustless execution.

Key Characteristics of DeFi Protocols:

- Decentralization: DeFi protocols are typically open-source and run on blockchain networks, making them decentralized and transparent. There is no central authority controlling these protocols, and decisions are made through consensus mechanisms and governance tokens held by participants.

- Permissionless Access: Anyone with an internet connection and a compatible cryptocurrency wallet can access and use DeFi protocols. This lowers the barrier to entry and provides financial services to a broader global audience.

- Interoperability: Many DeFi protocols are designed to be composable, meaning they can be combined to create more complex financial applications. This interoperability fosters innovation and the rapid development of new products.

- Programmability: DeFi protocols allow developers to program complex financial logic and automate processes. This programmability enables the creation of novel financial instruments and services that can be executed without human intervention.

- Liquidity Pools: Liquidity provision is a fundamental concept in DeFi. Users can lock up their assets in liquidity pools, providing liquidity for trading pairs or lending markets. In return, they receive rewards in the form of fees or tokens.

- Smart Contracts: Smart contracts underpin DeFi protocols, ensuring that the terms of financial agreements are automatically enforced and executed without intermediaries. This reduces counterparty risk and increases transparency.

- Yield Generation: DeFi protocols offer opportunities for users to earn interest, rewards, or yields on their crypto assets through activities like yield farming, liquidity provision, staking, and more.

- Risk Management: Some DeFi protocols include mechanisms for risk management, such as over-collateralization in lending markets or decentralized insurance to mitigate potential losses.

- Governance: Many DeFi protocols have decentralized governance mechanisms, allowing token holders to participate in decision-making processes, such as proposing and voting on protocol upgrades and changes.

Examples of DeFi Protocols:

- Compound: A lending protocol that enables users to borrow and lend various cryptocurrencies.

- Uniswap: A decentralized exchange (DEX) protocol that facilitates automated token swaps using liquidity pools.

- Aave: A lending and borrowing protocol that features variable and stable interest rates.

- MakerDAO: A protocol that facilitates the creation of stablecoins (like DAI) through collateralized debt positions.

- Synthetix: A platform for creating and trading synthetic assets, such as tokenized stocks and commodities.

- Curve Finance: A DEX optimized for stablecoin trading with low slippage.

Existing Revenue Generation Strategies

Existing revenue generation strategies of DeFi protocols encompass a diverse range of mechanisms that underpin the financial operations within the decentralized finance ecosystem. These strategies have enabled DeFi protocols to establish sustainable revenue streams while reshaping traditional notions of financial intermediation. By leveraging blockchain technology and smart contracts, these protocols have created novel ways to generate income, all while offering users a more open, accessible, and inclusive financial landscape.

Transaction Fees

Certain decentralized finance (DeFi) platforms implement transaction fees for particular operations. These operations encompass actions like token swapping, participation in liquidity pools with entry and exit, and the utilization of more advanced features. Much like conventional financial services, these transaction fees play a role in bolstering the platform’s revenue stream. Furthermore, with the escalating adoption of DeFi protocols, the platforms experience a surge in revenue due to the amplified transaction volume stemming from heightened platform usage.

Lending Fees

Furthermore, DeFi protocols play a pivotal role in enabling various borrowing and lending activities. This, in turn, enables users to not only securely deposit their assets but also to garner interest on these deposits or fulfill interest payments on acquired loans. Through the establishment of lending markets in a decentralized manner, these innovative protocols effectively remove intermediaries from the equation. As a result, borrowers gain access to enticingly competitive interest rates, simultaneously affording lenders the opportunity to enjoy appealing returns on their investments. It’s important to note that the considerable fees generated from these lending undertakings substantially contribute to the overall revenue generated by DeFi platforms.

Liquidity Mining

The fundamental core of numerous DeFi protocols is centered around the essential concept of liquidity provision. Within this framework, liquidity providers assume a crucial and central role by depositing their digital assets into designated liquidity pools. This strategic contribution effectively empowers users to readily engage in trading and various transactions within the given ecosystem. As a token of appreciation for their active involvement, liquidity providers become entitled to accrue fees that stem from the ongoing trades—frequently presented as a percentage proportional to the transaction volume. Particularly in markets exhibiting high levels of activity, these accrued fees possess the potential to become quite substantial. This underlying potential transforms liquidity provision into an exceptionally enticing avenue for participants to cultivate a rewarding stream of revenue.

Governance Tokens

Numerous DeFi protocols come equipped with their own native governance tokens, affording holders the privilege to actively engage in the various decision-making mechanisms within the ecosystem. These tokens frequently encompass a range of functionalities, encompassing the ability to cast votes regarding protocol enhancements, put forth alterations, and even receive a proportion of the platform’s earnings as a reward for holding the tokens. By virtue of these intricate mechanisms, individuals possessing these tokens are empowered to make meaningful contributions to the expansion of the platform, all the while reaping the rewards of its accomplishments.

Challenges of DeFi Protocols

The rapid rise of decentralized finance (DeFi) protocols has undoubtedly revolutionized the traditional financial landscape, introducing novel opportunities for users to engage in borderless lending, borrowing, trading, and yield farming. However, this disruptive transformation is not without its fair share of challenges.

Competition

Firstly, the DeFi space is witnessing an unprecedented influx of projects, resulting in cutthroat competition. With numerous platforms vying for user attention and liquidity, it becomes increasingly difficult for newer entrants to carve out a distinct market niche and gain widespread adoption. Moreover, the lack of standardization and interoperability among DeFi protocols exacerbates the competition, making it cumbersome for users to navigate across various platforms seamlessly.

Regulatory Uncertainty

Secondly, regulatory uncertainty looms large over the DeFi sector. As governments and regulatory bodies grapple with understanding the implications of these protocols, there is a palpable fear of potential crackdowns or restrictive policies. This uncertainty hampers investor confidence and can impede the growth of DeFi by discouraging participation from risk-averse individuals and institutions.

Security Risks

Finally, the issue of security risks poses a significant challenge to the DeFi ecosystem. While the technology powering these protocols is designed to be secure, the decentralized nature of these platforms can inadvertently expose vulnerabilities that malicious actors might exploit. High-profile hacks and exploits have already resulted in substantial financial losses, underscoring the need for robust security measures and thorough audits. Balancing innovation with security is an ongoing struggle, as the dynamic and fast-paced nature of DeFi can sometimes outpace the ability to identify and mitigate potential threats.

In sum, while DeFi protocols hold immense promise, their journey is fraught with the challenges of fierce competition, regulatory ambiguity, and the critical imperative of maintaining airtight security to ensure the long-term viability of this transformative financial landscape.

Conclusion

The emergence of DeFi has ushered in an entirely new era of financial innovation, opening up pathways for individuals to engage with a financial system that is both decentralized and inclusive. Within the realm of DeFi protocols, various mechanisms are employed to generate revenue. These include, but are not limited to, activities such as providing liquidity, engaging in yield farming, facilitating borrowing and lending transactions, adhering to governance models, covering transaction fees, and contributing to the overall utilization of the platform. Given the ongoing expansion of the cryptocurrency and blockchain sector, it is highly probable that the revenue derived from DeFi protocols will experience a notable uptick. This, in turn, will pave the way for captivating prospects for developers and users alike.

Through active participation in the DeFi ecosystem, individuals not only play a role in nurturing the growth of decentralized finance but also open themselves to the potential of unearthing fresh streams of income within this revolutionary domain. With such a promising horizon, it’s certainly worth considering an exploration of the vast realm of DeFi to become an integral part of the forthcoming landscape of financial evolution, isn’t it?