Decentralized Finance (DeFi) has emerged as one of the most promising sectors in the blockchain industry, offering innovative financial solutions that challenge traditional centralized systems. With the rapid growth and increasing popularity of DeFi investments, it is crucial for investors to have a comprehensive understanding of the key indicators that can help them make informed decisions.

Total Value Locked (TVL)

Total Value Locked (TVL) is the total amount of money held in a DeFi protocol. This includes all the money in a specific money marketplace. For example, Uniswap’s TVL is the total amount of money liquidity providers have deposited into the protocol. TVL is useful for investors because it gives them an idea of how much interest there is in DeFi and allows them to compare different DeFi protocols. This comparison is especially helpful for finding undervalued DeFi projects. TVL can be measured in different ways, such as ETH or USD, depending on the project.

The Price-to-Sales Ratio (P/S Ratio)

The Price-to-Sales Ratio (P/S Ratio) finds its roots in more conventional businesses, where it assesses a company’s stock price in relation to its generated revenues. In the context of DeFi, which frequently generates revenue, a similar metric can be applied. To compute it, you must divide the protocol’s market capitalization by its revenue. The core principle here is that a lower ratio implies a potentially undervalued protocol. However, it’s essential to recognize that this method isn’t a definitive valuation tool; rather, it provides a rough estimate of how the market may perceive a project’s value.

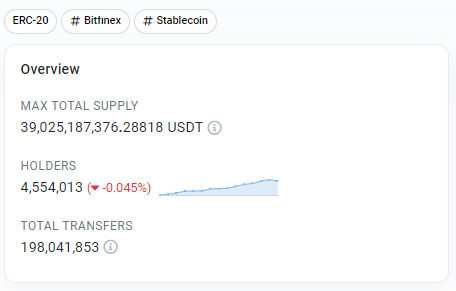

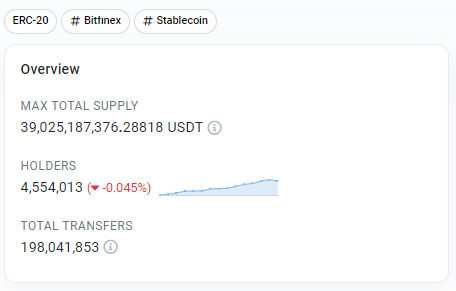

Token Supply on Exchanges

Monitoring the token supply on cryptocurrency exchanges is a strategic approach. When individuals wish to sell their tokens, they typically turn to centralized exchanges (CEXs). While decentralized exchanges (DEXs) are gaining popularity for their trustless nature, CEXs often boast superior liquidity. Therefore, keeping an eye on the token supply on CEXs is crucial. A common assumption is that a surplus of tokens on these exchanges may exert sell pressure, as holders and large holders may be preparing to offload their holdings. However, this isn’t always straightforward, as many traders employ their holdings as collateral for margin or futures trading.

Token Balance Changes on Exchanges

In addition to monitoring token supply, it’s valuable to examine recent changes in token balances on exchanges. Significant shifts in token balances can serve as indicators of increased volatility. For example, if substantial holdings are being withdrawn from CEXs, it could suggest that whales are accumulating the token, potentially signaling a long-term bullish sentiment. This underlines the importance of tracking token movements as a part of your analysis.

Unique Address Count

The unique address count, while having its limitations, offers insights into a coin or token’s adoption and usage trends. A consistently growing number of addresses holding a specific cryptocurrency often implies increased usage and user base expansion. However, it’s crucial to exercise caution, as this metric can be manipulated by creating multiple addresses and distributing funds among them to artificially inflate the appearance of widespread use. Therefore, it’s advisable to complement the unique address count with other relevant factors in your fundamental analysis.

Non-Speculative Usage

Evaluating non-speculative usage is pivotal when considering the value of a token. Tokens designed solely for price appreciation may lack sustainability. Assessing non-speculative usage can be challenging but can begin by examining transactions that do not occur on decentralized or centralized exchanges. The objective here is to confirm that the token is actively employed for practical purposes rather than solely for speculative trading.

Inflation Rate

The inflation rate is another crucial metric to track, even when a token has a limited initial supply. A small supply today doesn’t guarantee perpetual scarcity, particularly if the system continuously mints new tokens. An example contrasting this is Bitcoin, known for its decreasing inflation rate, designed to prevent future debasement of existing units. While there is no universally accepted “good” or “bad” percentage for inflation, it’s essential to consider this figure alongside other metrics in your assessment, as excessive inflation can dilute the value of your holdings.

Conclusion

In conclusion, these key metrics offer valuable insights for anyone navigating the dynamic world of cryptocurrencies and decentralized finance. From assessing the overall interest in DeFi through Total Value Locked (TVL) to gauging the practical utility of tokens through non-speculative usage, these metrics provide a multifaceted view of the crypto landscape. The Price-to-Sales Ratio (P/S Ratio) guides investors in determining whether a DeFi protocol is undervalued or overvalued while monitoring token supply and balance changes on exchanges unravels market sentiments and potential price volatility. Furthermore, keeping a vigilant eye on the inflation rate is essential for understanding a token’s long-term viability. In a space characterized by innovation and rapid change, employing these metrics as part of a comprehensive analysis toolkit can help investors and enthusiasts make informed decisions while navigating the complex cryptocurrency ecosystem.