What is the DEX?

Decentralized exchange (also known as DEX) is a peer-to-peer exchange where crypto traders can conduct trades without entrusting the administration of their money to a middleman or custodian. These transactions are possible because of smart contracts.

Decentralized platforms aren’t custodial like centralized exchanges (CEXs), therefore users that transact on a DEX platform have possession of their private keys.

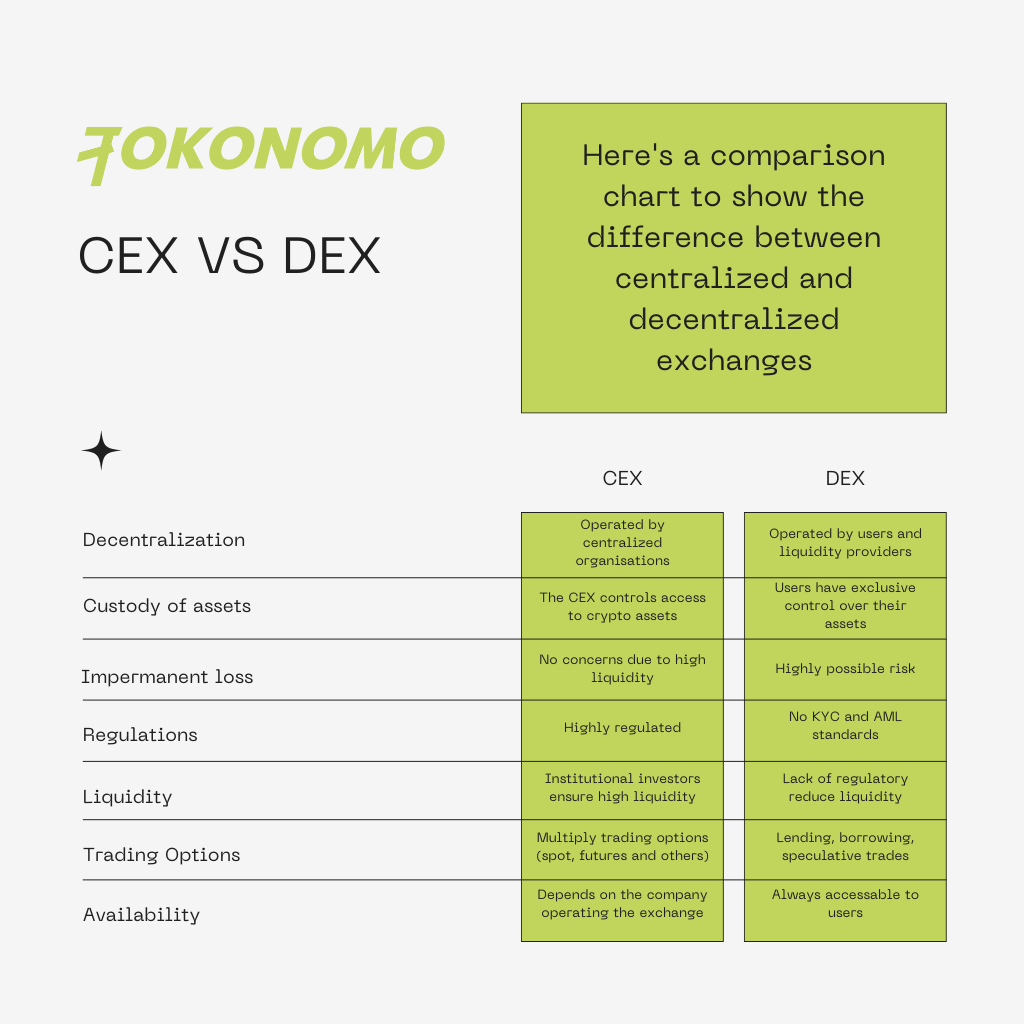

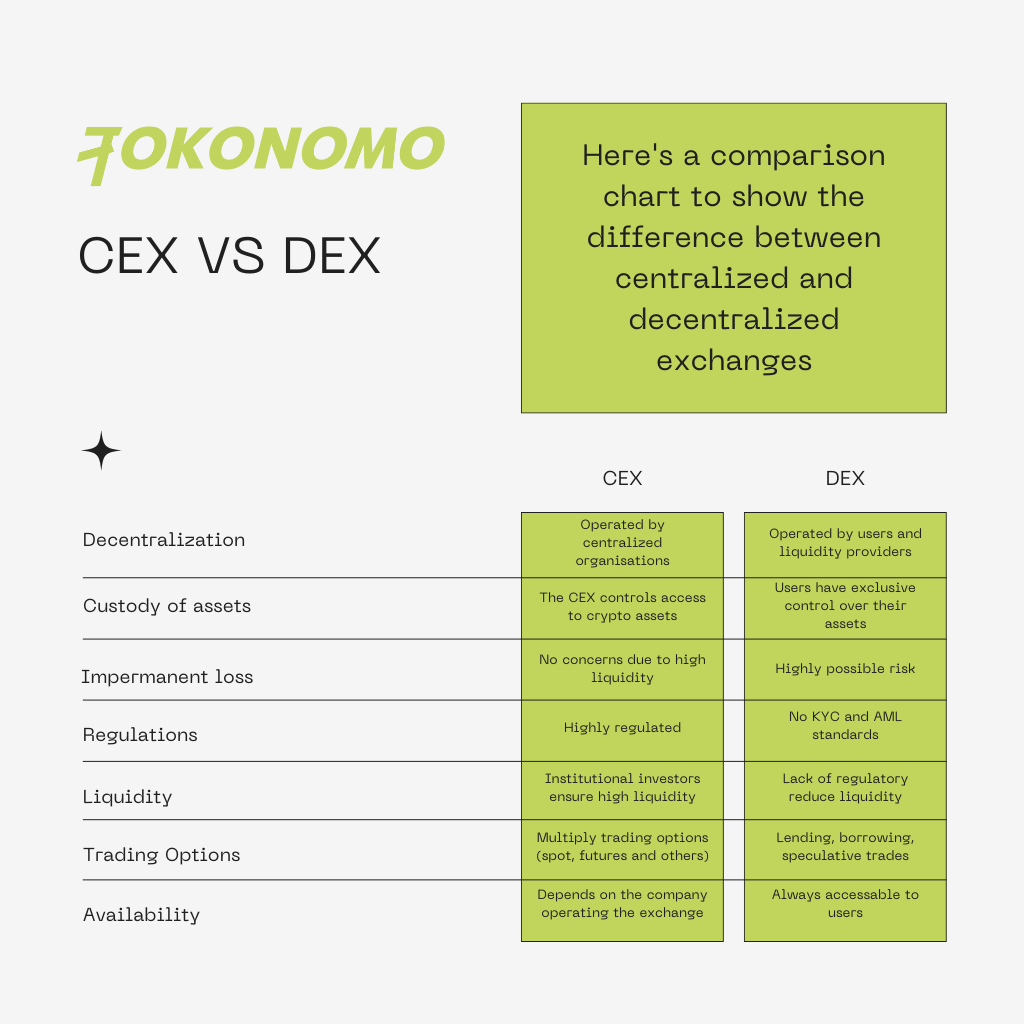

What are the differences between DEXs (decentralized exchanges) and CEXs (centralized exchanges)?

Leading centralized crypto exchanges make trading in digital assets easier in every way, including with regard to security, fair market pricing, regulatory compliance, consumer protection, and access to the newest digital assets. On the majority of CEXs, making trades requires a deposit of fiat currency or cryptocurrency into an exchange-held cryptocurrency wallet. You can send money to a third-party cryptocurrency wallet directly from your exchange wallet. Additionally, you can convert cryptocurrencies into currency and withdraw money to your bank account.

DEX systems employ a distinctive strategy to make it easier to purchase and sell digital assets. DEXs make use of the self-executing smart contract functionality to execute transactions rather than via a middleman company. DEXs adopt a non-custodial architecture in the absence of intermediaries, allowing you to maintain control over your private keys and crypto funds. The majority of DEXs do not adhere to Know Your Customer (KYC) or Anti-Money Laundering (AML) regulations and have no counterparty risk, which means they do not run the danger of experiencing a credit default.

How do decentralized exchanges work?

To calculate asset pricing, decentralized exchanges frequently use liquidity pool protocols. These peer-to-peer exchanges instantaneously carry out trades between users’ wallets, a procedure some regard as a swap.

Since decentralized exchanges are built on top of blockchain networks that support smart contracts, every transaction takes a trading fee and a transaction fee. Basically, in order to use DEXs, traders interact with smart contracts on the blockchain.

Tokonomo’s contribution to the DEX segment of DeFi

At Tokonomo, we are building a multi-chain aggregator that will allow users to make cross-chain swaps at the lowest prices available on the market. We believe, that this type of DEX will open a lot of possibilities to users and save them millions of $ annually.

Conclusion

With the growth of DeFi sector, DEXs have seen an increase in use over the past few years due to their ability to enable quick liquidity for freshly issued tokens, their easy onboarding process, and the democratized access to trade. It is unclear whether the majority of trading activity will move to DEXs and whether the present DEX designs will sustain institutional acceptance and long-term growth. However, the self-executing smart contracts on which these platforms are based may lead to the development of more use cases in the future.