In the fast-paced world of cryptocurrency, new concepts and terms are constantly emerging. One such concept that has gained significant traction in recent years is that of wrapped tokens. These tokens have become an integral part of the decentralized finance (DeFi) ecosystem, allowing users to tokenize various assets and unlock their liquidity. So, what exactly are wrapped tokens?

What Are Wrapped Tokens?

A wrapped token functions as a representation of another cryptocurrency that has been tokenized. This tokenized version maintains a fixed connection to the value of the underlying asset it represents, and typically, it can be converted back into the original asset (unwrapped) whenever desired. Wrapped tokens are primarily utilized to depict assets that are not natively native to the blockchain on which they are issued.

You might consider a wrapped token akin to a stablecoin, as both derive their value from another asset. In the case of stablecoins, this typically involves a connection to a fiat currency, while with wrapped tokens, it usually pertain to an asset residing on a different blockchain.

Given that different blockchains operate as distinct systems, there exists a challenge in transferring information between them. Wrapped tokens play a pivotal role in enhancing interoperability across various blockchains; essentially, the underlying tokens have the capability to move seamlessly across different chains.

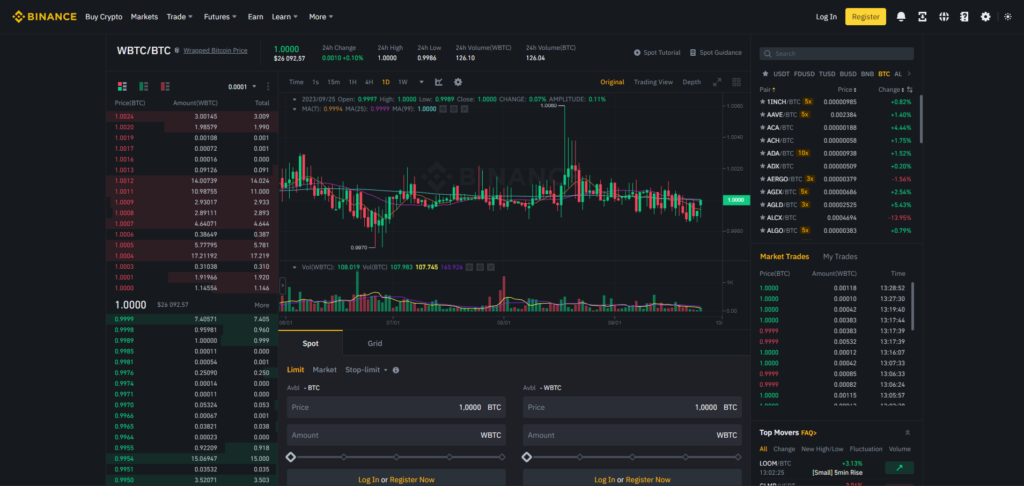

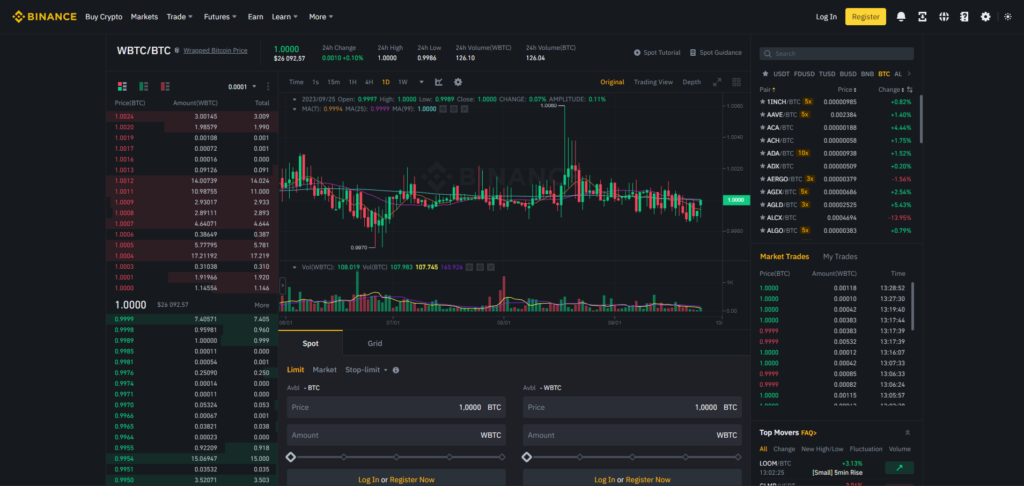

It is essential to highlight that for everyday users, there is no need to concern themselves with the intricacies of the wrapping and unwrapping procedures. They can engage in trading wrapped tokens just as they would with any other cryptocurrency. For instance, take the WBTC/BTC market on Binance as an example.

What Is the Mechanism Behind Wrapped Tokens?

Let’s consider Wrapped Bitcoin (WBTC) as our illustrative example, which represents a tokenized iteration of Bitcoin integrated into the Ethereum network. WBTC, designated as an ERC-20 token, is designed with the primary purpose of maintaining a strict one-to-one parity with the value of Bitcoin. This unique feature enables seamless utilization of BTC within the Ethereum ecosystem.

The issuance of wrapped tokens typically necessitates the involvement of a custodial entity, responsible for safeguarding an equivalent quantity of the underlying asset, corresponding to the total number of wrapped tokens in circulation. This custodial role can be assumed by various entities, including merchants, multi-signature wallets, decentralized autonomous organizations (DAOs), or even smart contracts. In the case of WBTC, the custodian must hold 1 BTC for every 1 WBTC token created, and this proof of reserve is verifiable on the blockchain.

But how does the process of wrapping and unwrapping assets unfold? Initially, a merchant transmits BTC to the custodian, who subsequently generates the equivalent amount of WBTC on the Ethereum network based on the BTC received. When a need arises to convert WBTC back into BTC, the merchant submits a request to the custodian for the burning of WBTC tokens, thereby releasing the corresponding BTC from the reserve. In essence, the custodian assumes the roles of both a wrapper and an unwrapper. In the case of WBTC, the addition and removal of custodians and merchants are executed through the governance of a DAO.

It is worth noting that some members of the community may colloquially refer to Tether (USDT) as a wrapped token, but this categorization requires a nuanced understanding. While USDT typically maintains a one-to-one value ratio with the United States Dollar (USD) in trading, it does not possess an exact 1:1 backing of physical USD for each USDT token in circulation within their reserves. Instead, the USDT reserve consists of a mixture of cash, real-world cash equivalents, various assets, and receivables from loans. Nevertheless, the overarching concept remains akin, as each USDT token functions as a virtual representation or “wrapped” version of the fiat USD.

Examples of Wrapped Tokens on Ethereum

Wrapped tokens on the Ethereum blockchain are specifically designed tokens sourced from other blockchains, tailored to conform with the ERC-20 standard. This crucial feature enables the utilization of assets originating from different blockchains on the Ethereum platform. Consequently, the process of wrapping and unwrapping tokens on Ethereum incurs gas fees.

A compelling illustration of a wrapped token within the Ethereum ecosystem is the concept of wrapped ether, abbreviated as WETH. In a nutshell, ETH (ether) serves as the primary currency for executing transactions on the Ethereum network, while ERC-20 stands as the established technical standard for generating tokens on Ethereum. Examples of ERC-20 tokens include the Basic Attention Token (BAT) and OmiseGO (OMG).

However, an inherent challenge arises due to the fact that ETH predates the introduction of the ERC-20 standard, rendering it non-compliant. This discrepancy poses an issue, particularly since many Decentralized Applications (DApps) necessitate the seamless conversion between ether and an ERC-20 token. This is precisely why wrapped ether (WETH) was conceived – to provide a compliant ERC-20 version of ether, essentially tokenizing ether on the Ethereum network!

Advantages of Employing Wrapped Tokens

Despite the presence of distinct token standards like ERC-20 for Ethereum or BEP-20 for BSC within various blockchains, it’s essential to acknowledge that these standards lack interoperability across multiple chains. This is where wrapped tokens come into play, facilitating the utilization of non-native tokens within a specific blockchain ecosystem.

Furthermore, the integration of wrapped tokens can significantly enhance liquidity and bolster capital efficiency, benefiting both centralized and decentralized exchanges. The ability to wrap dormant assets and leverage them on alternative chains fosters greater connectivity among liquidity sources that would otherwise remain isolated.

Lastly, an additional noteworthy advantage pertains to transaction times and associated fees. While Bitcoin boasts several remarkable attributes, its transaction speed and cost-effectiveness may not always meet expectations. Although this characteristic aligns with Bitcoin’s intended purpose, it can occasionally pose challenges. These challenges can be effectively addressed by opting for a wrapped version of Bitcoin on a blockchain with swifter transaction processing and reduced fees.

Constraints of Using Wrapped Tokens

Many of the existing implementations of wrapped tokens necessitate a level of trust in the custodial entity responsible for safeguarding the assets. Regarding the technology currently at our disposal, wrapped tokens often cannot facilitate authentic cross-chain transactions without reliance on a custodian as an intermediary.

Nevertheless, there are ongoing efforts to develop more decentralized alternatives, which might become accessible in the future, enabling completely trustless creation and redemption of wrapped tokens.

Moreover, it’s important to note that the minting process can be somewhat expensive due to the presence of elevated gas fees, potentially resulting in some slippage as well.

Conclusion

Utilizing wrapped tokens serves the purpose of establishing stronger connections between various blockchain networks. A wrapped token can be described as a tokenized representation of an asset originally residing on a separate blockchain.

This significantly contributes to enhancing interoperability within the cryptocurrency and Decentralized Finance (DeFi) landscape. Wrapped tokens pave the way for a scenario where capital becomes more streamlined, enabling applications to seamlessly exchange liquidity amongst themselves.