In the fast-paced world of cryptocurrency, one term that often pops up is “whitepaper.” But what exactly is a cryptocurrency whitepaper, and why is it so important? In this blog post, we aim to demystify the foundation of digital currencies by explaining the concept of a whitepaper.

What Does the Term ‘Whitepaper’ Mean?

In general, a whitepaper serves as a comprehensive report or guide that aims to educate its readers on a specific subject or matter. As an illustration, developers have the option to craft a whitepaper detailing their software, to enlighten users about their project’s purpose and the reasoning behind its creation.

Within the realm of blockchain technology, a whitepaper serves as a vital document that serves the purpose of delineating the core attributes and intricate technical specifications of a particular cryptocurrency or blockchain initiative. While many whitepapers primarily focus on coins or tokens, they can also be centered around diverse project types, such as decentralized finance (DeFi) platforms or play-to-earn gaming concepts.

A whitepaper can include vital information presented in the form of statistics and visual diagrams, in addition to elucidating the governing structure of the project, the individuals involved in its development, and the current as well as prospective plans for progress, often referred to as the project’s roadmap.

However, it’s important to note that there is no universally prescribed format for creating a whitepaper. Instead, each project tailors its whitepaper to align with its specific circumstances. Ideally, a whitepaper should strive for a tone of impartiality and strive to be informative, ensuring a clear portrayal of the project and its objectives. Caution is advisable for users when encountering whitepapers that employ persuasive language or projects that make grand promises while providing insufficient details.

In the realm of cryptocurrencies, whitepapers are frequently likened to business plans for crypto ventures, given that they offer investors a comprehensive overview of the project. However, unlike traditional business plans, whitepapers are typically unveiled before the launch of the cryptocurrency. Consequently, a whitepaper often represents the initial stage in which a crypto project outlines the direction and purpose of its concept.

What Kind of Information Can be Discovered Within a Whitepaper?

Founders typically compose whitepapers to furnish a comprehensive insight into the overarching objectives of their project. To illustrate, consider Bitcoin’s whitepaper, which articulates its mission as follows: “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.” Ethereum’s whitepaper, in a similar vein, delineates its mission as: “The intent of Ethereum is to create an alternative protocol for building decentralized applications.”

Whitepapers, in many instances, serve as a vehicle for elucidating the practical real-world applicability of a cryptocurrency project. For instance, they may expound upon how the project addresses specific challenges or enhances facets of our daily lives.

Nonetheless, it is incumbent upon us to exercise prudence when assessing these proclamations. Creating a whitepaper is not an arduous endeavor. The Initial Coin Offering (ICO) fervor of 2017 bears witness to this fact, spawning a multitude of tokens with purportedly “innovative” concepts, yet a substantial majority of these initiatives failed to materialize. As a general guideline, it is imperative to remember that merely attaching a cryptocurrency to a use case does not guarantee its adoption or utilization.

In addition to delineating goals and commitments, whitepapers also serve as a platform for elucidating the practical functioning of the cryptocurrency. For instance, they may elucidate the consensus mechanisms employed to enable network participants to coordinate in a decentralized manner.

Furthermore, a whitepaper may provide a comprehensive overview of tokenomics components, encompassing aspects such as token burns, token allocations, and incentive structures. Ultimately, a whitepaper may incorporate a roadmap that furnishes users with insights into the project’s timeline, enabling them to anticipate product releases.

Whitepapers are deliberately crafted to be accessible, enabling individuals from diverse backgrounds to grasp the fundamental tenets of the cryptocurrency or blockchain project. Nevertheless, a robust whitepaper should also offer technical insights to substantiate the project’s technical competence.

Why do whitepapers hold significance? Whitepapers occupy a pivotal role within the cryptocurrency ecosystem. Although there are no universally mandated standards governing their composition, whitepapers have emerged as a foundational framework for scrutinizing cryptocurrency projects.

It is generally advisable to commence one’s exploration of a cryptocurrency project by perusing its whitepaper. Whitepapers empower users to discern potential warning signs or promising prospects. Furthermore, they facilitate the ongoing monitoring of whether a project remains faithful to its initial plans and objectives.

Whitepapers foster transparency and equity by disseminating key project information to the public. A multitude of stakeholders stand to gain from whitepapers. For instance, investors can make more informed investment decisions, developers can contemplate their potential involvement in the protocol, and individuals intrigued by the project’s concept can make more confident decisions regarding their participation in a particular community, all through the insights gleaned from these documents.

Instances of Whitepapers

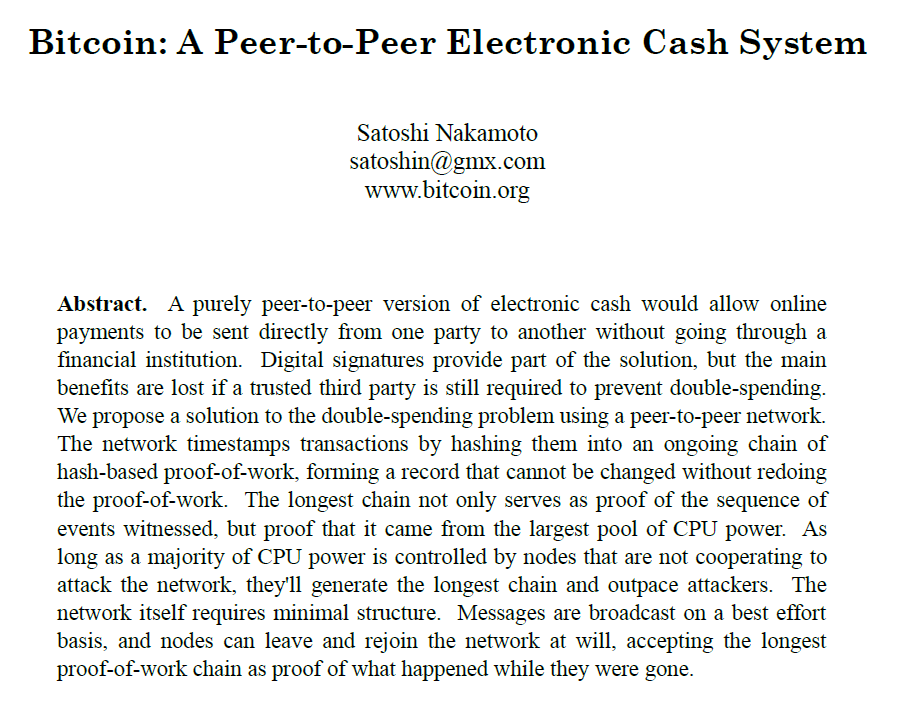

Bitcoin Whitepaper

The Bitcoin whitepaper, authored and released in 2008 by an enigmatic entity or collective known as Satoshi Nakamoto, is titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” Within its pages, this whitepaper meticulously delineates the potential of Bitcoin as a more efficient medium of exchange, emancipated from the confines of the conventional banking framework. It furnishes readers with intricate technical insights into how the Bitcoin network empowers users to transmit digital currency directly on a decentralized peer-to-peer network, eliminating the need for intermediaries. Moreover, the whitepaper expounds upon the robust safeguards incorporated within the Bitcoin network to thwart censorship and defend against the perils of double-spending attacks.

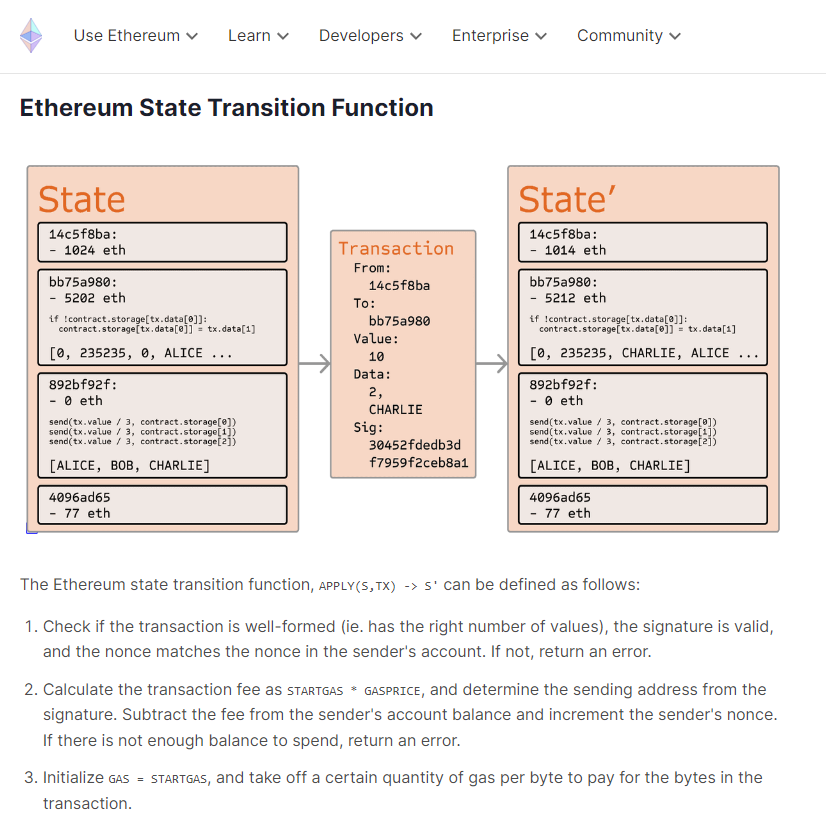

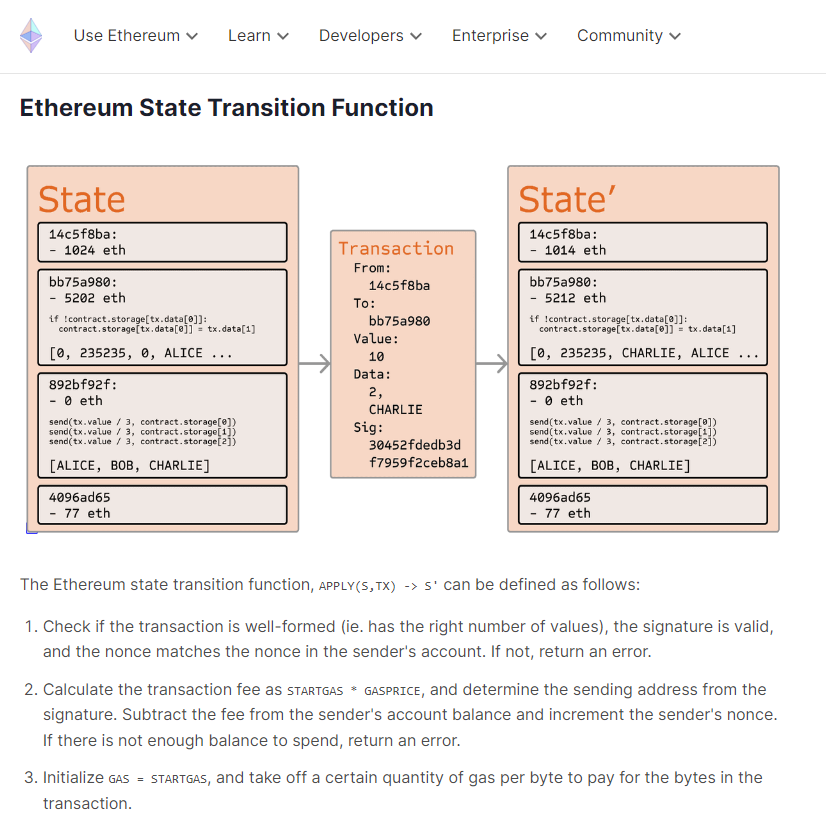

Ethereum Whitepaper

In contrast, the Ethereum whitepaper, introduced to the world by the budding programmer Vitalik Buterin in 2014, finds its roots in a 2013 blog post entitled “Ethereum: The Ultimate Smart Contract and Decentralized Application Platform” by Vitalik himself. This preliminary exposition laid the groundwork for the Ethereum whitepaper, which articulates a groundbreaking vision of a Turing-complete blockchain—a decentralized computing entity capable of executing a wide spectrum of applications given ample time and resources.

The Ethereum whitepaper elucidates its distinctive purpose in comparison to Bitcoin. While Bitcoin primarily serves as a digital peer-to-peer payment system, Ethereum’s whitepaper envisions a versatile platform that empowers developers to conceive and deploy a myriad of decentralized applications (DApps). These applications span a wide gamut, encompassing other cryptocurrencies, decentralized lending platforms, and more. Additionally, the whitepaper provides an in-depth exploration of the technological innovations underpinning Ethereum’s existence, including smart contracts and the Ethereum Virtual Machine.

Conclusion

Ideally, a whitepaper should furnish you with a comprehensive understanding of the cryptocurrency project’s intentions and the means by which they intend to achieve them. Nonetheless, it’s important to note that whitepapers lack regulatory oversight, making them accessible to virtually anyone for composition. Therefore, should your interest be piqued by a particular project, it is crucial to meticulously scrutinize their whitepaper, taking into account any possible warning signs and associated risks.