Table of Contents

- Coinbase Faces Lawsuit by SEC over Accusations of Operating an Unregistered Securities Exchange

- Coinbase’s Stock Plummets Following SEC’s Legal Action Against the Company

- Amidst SEC Lawsuits, Coinbase Traders Pull Out $600 Million In a Single Day

- Bitcoin Surges Past $27,000 While The Crypto Market Disregards SEC Lawsuits Targeting Binance and Coinbase

- SEC Pursues Temporary Restraining Order Request to Suspend Binance.US Assets

- Louis Vuitton Plans To Launch Physical-Backed NFTs With A Price Tag Of $42,000

Coinbase Faces Lawsuit by SEC over Accusations of Operating an Unregistered Securities Exchange

The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against Coinbase (COIN), a U.S.-based cryptocurrency exchange, accusing the company of violating federal securities laws.

This legal action comes just a day after the SEC filed a similar suit against Binance.

The SEC alleges that Coinbase has operated as an unregistered broker, exchange, and clearing agency simultaneously, combining functions that are typically separate in traditional securities markets.

According to the SEC, Coinbase solicited customers, processed orders, facilitated bids, and acted as an intermediary without registering with the SEC as a broker, national securities exchange, or clearing agency.

The lawsuit names Coinbase, Inc. and Coinbase Global, Inc. as defendants, but does not specifically mention founder and CEO Brian Armstrong or other executives.

The SEC claims that Coinbase’s failure to register deprives investors of important protections, such as anti-fraud measures, disclosure requirements, safeguards against conflicts of interest, and routine oversight by the SEC.

In response, Coinbase’s Chief Legal Officer, Paul Grewal, has called for the development of crypto-specific legislation, emphasizing the need for clear and transparent rules for the digital asset industry.

The SEC points to various aspects of Coinbase’s operations, including its Prime, Wallet, and staking products, as well as the tokens it lists, as areas where the company allegedly violated federal securities laws.

The SEC also accuses Coinbase of knowingly offering cryptocurrencies that could be classified as securities to U.S. customers, citing the company’s Crypto Ratings Council initiative as evidence.

The lawsuit alleges that Coinbase added these assets to its platform despite recognizing their security-like characteristics, in order to fuel its own trading profits and platform growth. The SEC identifies several tokens, including Solana (SOL), Cardano (ADA), Polygon (MATIC), and others, as securities according to its assessment.

The lawsuit references problematic statements made by issuers and highlights Coinbase’s public registration statement, which acknowledged the possibility of certain listed assets being securities.

The SEC had previously issued a Wells Notice to Coinbase, warning of potential legal action, to which Coinbase responded in April.

In this new lawsuit, the SEC accuses Coinbase of violating the Exchange Act and the Securities Act and seeks permanent injunctions, disgorgement, and civil penalties.

Unlike the Binance lawsuit, the SEC does not allege the commingling of customer funds or improper transfers by company executives in the case of Coinbase.

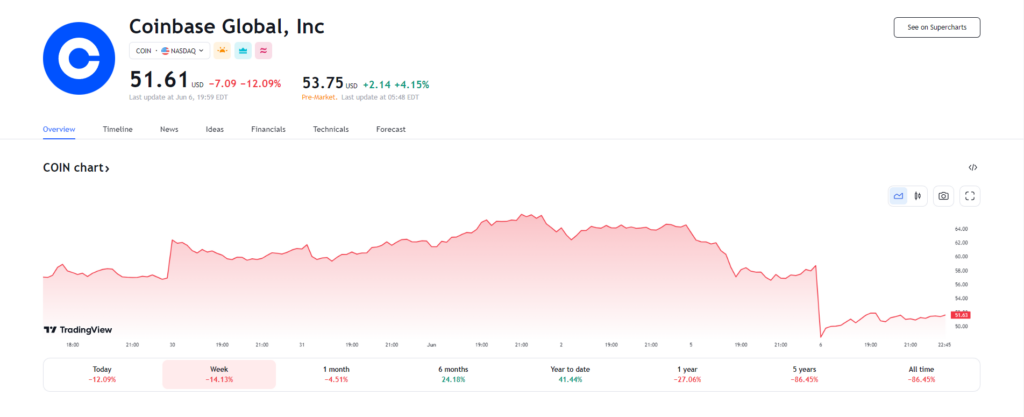

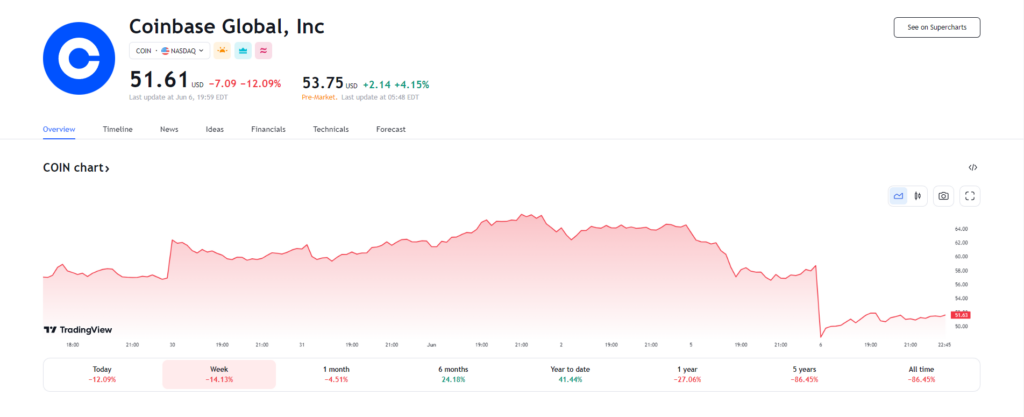

Coinbase’s Stock Plummets Following SEC’s Legal Action Against the Company

On Tuesday, the stock of Coinbase (COIN) experienced a decline after the company was hit with a lawsuit filed by the U.S. Securities and Exchange Commission (SEC) over allegations of violating federal securities law.

The shares initially dropped by as much as 20% at the market open but later recovered slightly, trading 15% lower at $47.10 as of 10:07 a.m. in New York (14:07 UTC), according to TradingView prices.

Notable shareholders of Coinbase include The Vanguard Group, Cathie Wood’s ARK Invest, Nikko Asset Management, Fidelity, and BlackRock.

In March, ARK Invest increased its holdings in Coinbase by adding an additional 301,437 shares to its ARK Innovation ETF (ARKK).

As of Monday, the funds held a total of approximately 11 million shares, according to data available on the ARK Invest website.

According to the SEC, Coinbase had been simultaneously operating as an unregistered broker, exchange, and clearing agency.

The allegations against the company involve soliciting customers, handling orders, facilitating bids, and acting as an intermediary all at once.

Edward Moya, a senior markets analyst at Oanda, stated that the legal battle ahead would be lengthy and expensive for Coinbase.

He added that it might be challenging for the company to argue and prove that it didn’t commingle and unlawfully offer exchange, broker-dealer, and clearinghouse functions.

This lawsuit against Coinbase comes just a day after the SEC filed a similar lawsuit against Binance, the largest cryptocurrency exchange globally.

On Monday, Coinbase shares had already experienced a 9% decline. Robinhood Markets (HOOD), a brokerage platform, also saw a 3% decrease in its stock value.

Robinhood reported $38 million in cryptocurrency trading revenue for the first quarter.

Both Binance and Coinbase had previously received warnings in the form of a Wells Notice earlier this year.

Coinbase responded to the notice in April, refuting the SEC’s allegations.

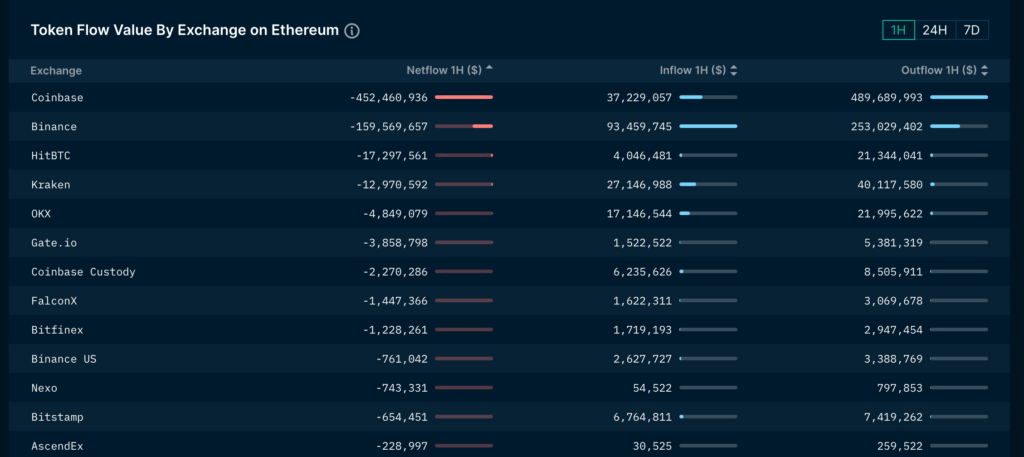

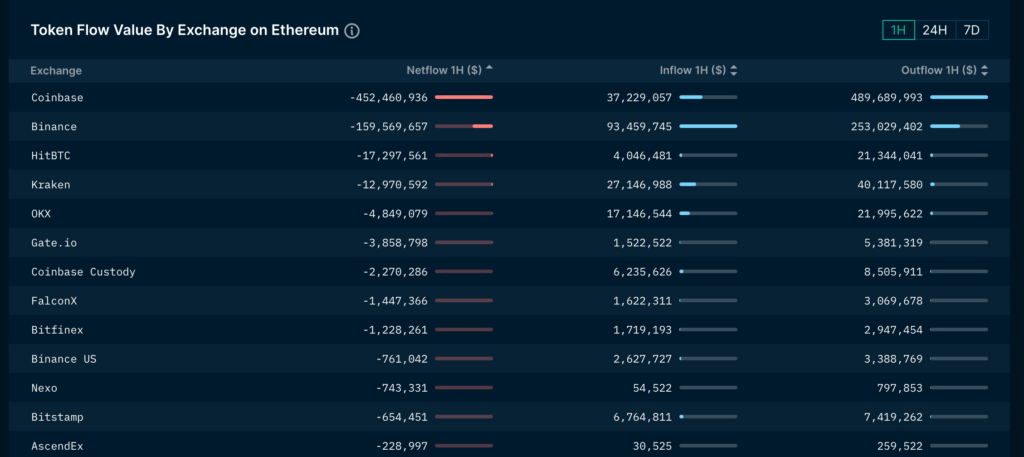

Amidst SEC Lawsuits, Coinbase Traders Pull Out $600 Million In a Single Day

On Monday and Tuesday, there was a significant increase in user withdrawals from Coinbase as the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against the crypto exchange, following a similar lawsuit against rival Binance.

According to data from Nansen, a crypto intelligence firm, over a 24-hour period, Coinbase experienced net outflows totaling $600 million.

During this time, traders withdrew $1.38 billion in cryptocurrencies, while deposits amounted to $771 million (excluding bitcoin transfers).

It is important to note that the SEC accused Coinbase of violating federal securities regulations, shortly after taking legal action against Binance and Binance.US.

Furthermore, various state regulators in the U.S. suspect that Coinbase may have violated the law by offering staking rewards to users through its “Earn” program.

The withdrawal activity from Coinbase occurred in two waves, as indicated by the data.

Following the lawsuit against Binance, there was a sudden surge of net outflows, reaching $450 million within an hour on Monday, before stabilizing.

Withdrawals then increased again on Tuesday after the lawsuit was filed against Coinbase, before eventually subsiding.

As of the time of publication, the net flows for the most recent hour turned positive, according to Nansen.

On the other hand, Binance experienced an even larger surge in withdrawals after facing regulatory actions.

On Monday, net outflows exceeded $700 million, marking the highest daily outflow since February when New York state regulators halted the issuance of the Binance-related stablecoin BUSD.

The trend continued on Tuesday, with net outflows surpassing $1.2 billion in the past 24 hours, based on Nansen data.

The magnitude of these outflows is comparable to previous significant events in the cryptocurrency industry, such as the crypto banking crisis in March and the collapse of the FTX exchange, which eroded investor confidence in centralized exchanges.

According to real-time blockchain data from Arkham Intelligence, both Coinbase and Binance process withdrawals sequentially.

Bitcoin Surges Past $27,000 While The Crypto Market Disregards SEC Lawsuits Targeting Binance and Coinbase

Cryptocurrency prices rebounded on Tuesday, led by bitcoin (BTC), following a significant sell-off triggered by the U.S. Securities and Exchange Commission (SEC) filing lawsuits against Binance.

Despite a separate lawsuit against Coinbase, bitcoin, the largest cryptocurrency by market capitalization, recently surged above $27,000, representing an almost 6% increase over the past 24 hours.

On Monday, BTC experienced a drop near $25,400 as investors, already wary due to previous issues in the digital asset space, abandoned crypto following the SEC’s accusations of securities law violations by Binance.

The wider cryptocurrency market also showed signs of recovery since Monday, although not to the same extent as BTC.

Ethereum (ETH), the second-largest cryptocurrency by market value, was trading slightly below $1,900, reflecting a 4.5% increase from Monday’s levels.

Cardano’s ADA and Solana’s SOL, tokens associated with smart contract platforms, saw modest recoveries after experiencing declines of over 8% and 10%, respectively.

Binance’s BNB native token exhibited positive movement, while Polygon’s MATIC declined by 1%.

The SEC included these tokens, along with nine others, in its lawsuits, alleging they were unregistered securities.

SEC Pursues Temporary Restraining Order Request to Suspend Binance.US Assets

The U.S. Securities and Exchange Commission (SEC) has requested a court to issue a temporary restraining order aimed at freezing assets associated with Binance.US.

The court filing, submitted to the D.C. District Court, seeks approval to freeze assets linked to BAM Management US Holdings and BAM Trading Services, the holding and operating companies for Binance.US.

The SEC’s lawsuit against Binance.US, Binance Global, and CEO Changpeng Zhao alleges various failures in compliance and control, including allegations that entities connected to Zhao were able to covertly access funds belonging to Binance.US customers.

In their filing, the SEC asserts the need for expedited relief to protect customer assets and prevent the dissipation of available assets due to the Defendants’ history of noncompliance, disregard for U.S. laws, evasion of regulatory oversight, and unanswered questions regarding financial transfers and the custody of customer assets.

The SEC’s filing also includes additional requests, such as an order to show cause for granting a preliminary injunction, an order directing defendants to repatriate assets held for BAM customers, and an order prohibiting the destruction of records.

If granted, the order would require Binance to ensure that only Binance.US has access to customer funds within five days, followed by the transfer of all customer assets to new wallets accessible exclusively by Binance.US within 30 days.

Binance.US, in a tweet, reassured its users that their assets remain safe and secure, and mentioned that their legal representatives have addressed the SEC’s concerns about fund safety.

In a memorandum of law submitted after the application for the temporary restraining order, the SEC restated its arguments from the initial lawsuit, including the claim that Binance had access to Binance.US funds and that Binance and CEO Zhao expressed intentions to evade U.S. regulators.

The SEC’s previous filing alluded to the request for a temporary restraining order, as it indicated the intention to seek preliminary injunctive relief, which could involve asset freezes and an accounting verification.

In the lawsuit, the SEC accused Binance of allowing two companies connected to CZ (Changpeng Zhao), Sigma Chain and Merit Peak, to access billions of dollars of customer funds held by BAM Trading.

Binance responded to the lawsuit by stating that user funds on Binance.US were never at risk and reaffirmed the safety and security of user assets across all Binance platforms, including Binance.US.

The statement also emphasized Binance’s commitment to vigorously defend against any allegations suggesting otherwise.

Louis Vuitton Plans To Launch Physical-Backed NFTs With A Price Tag Of $42,000

French luxury fashion brand Louis Vuitton is preparing to launch a new collection of physical-linked non-fungible tokens (NFTs) called Via Treasure Trunks.

This exclusive collection aims to provide members-only products and experiences.

Registration for the digital trunks will begin on June 8 for customers in the United States, Canada, France, the United Kingdom, Germany, Japan, and Australia.

Eligible customers will have the opportunity to purchase these NFTs on June 16 for approximately $42,000 (€39,000).

As part of the NFT’s utility, holders will receive a physical replica of their digital Treasure Trunk, granting them access to upcoming Louis Vuitton products and immersive events.

The brand plans to release limited products and experiences periodically throughout the year.

The collection is a component of Louis Vuitton’s larger initiative called “Via,” derived from the Latin word for “road.”

Treasure Trunk owners will be able to acquire digital keys enabling access to future Louis Vuitton NFT collections with physical links.

The NFTs will be sold as soulbound tokens, making them non-transferable once purchased.

While NFT holders cannot sell their Treasure Trunks, they will have the ability to sell individual items they mint in the future.

Louis Vuitton has been exploring blockchain projects for several years.

In 2019, the brand’s parent company, LVMH, announced the development of the Aura blockchain for tracking the provenance of luxury goods.

In 2021, Louis Vuitton joined forces with luxury retailers Cartier and Prada to establish the Aura Blockchain Consortium, aimed at combating counterfeit products.

Additionally, in August 2021, the brand launched “Louis The Game,” a gamified experience where players had the chance to win 30 NFTs in celebration of Louis Vuitton’s 200th anniversary.