Table of Contents

- Circle, the issuer of the USDC stablecoin, has moved $8.7 billion into repurchase agreements (repos) to protect its reserves from a potential U.S. government default

- The price of Axie Infinity’s native cryptocurrency, AXS, surged by 12% after the game was listed on the Apple App Store

- Tether, the issuer of the USDT stablecoin, announced that it will use a portion of its realized profits to purchase Bitcoin (BTC) for its reserves

- Dogecoin’s daily transaction volume reached an all-time high following the introduction of DRC-20 tokens

Circle, the issuer of the USDC stablecoin, has moved $8.7 billion into repurchase agreements (repos) to protect its reserves from a potential U.S. government default

Circle Internet Financial, the issuer of the USD Coin (USDC) stablecoin, is adjusting the reserves that back the USDC in anticipation of a possible U.S. government debt default.

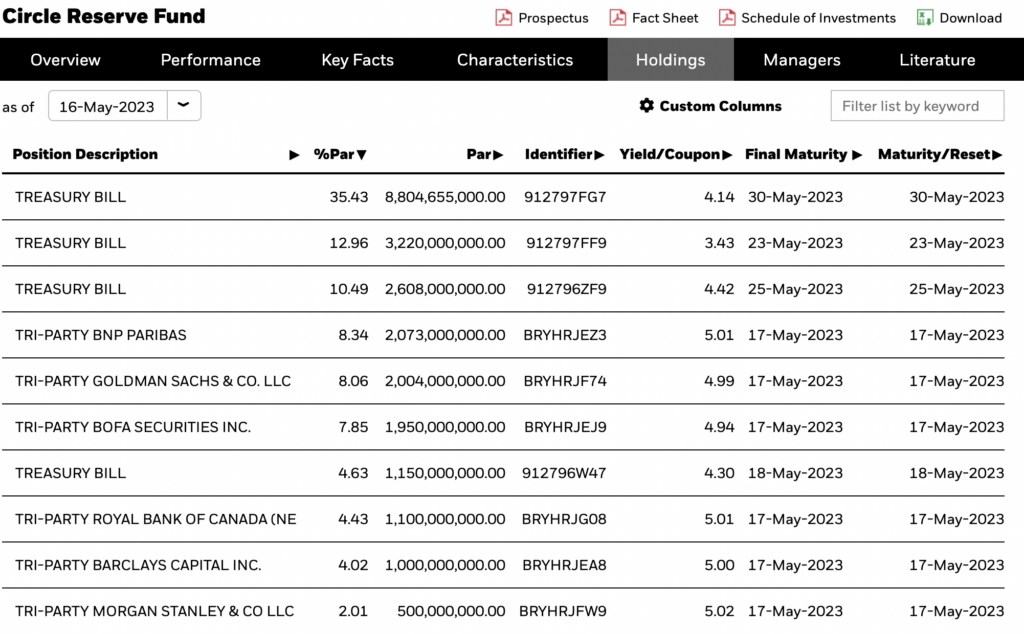

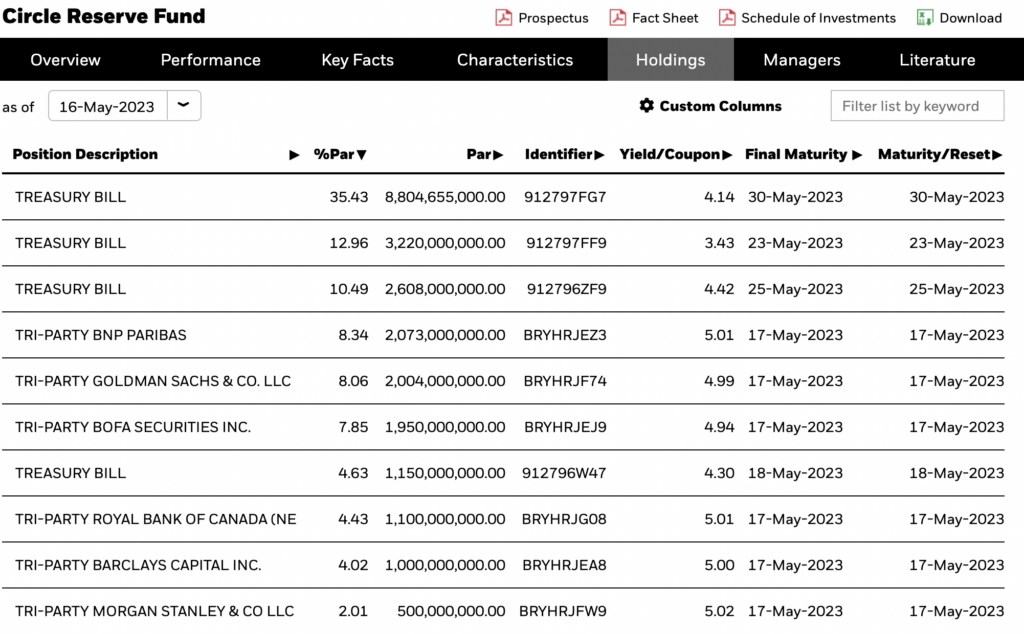

The Circle Reserve Fund, which is managed by global investment management giant BlackRock, added $8.7 billion in overnight repurchase (repo) agreements to its portfolio as of May 16, according to the fund’s website.

The so-called tri-party repo agreements involve banking giants such as BNP Paribas, Goldman Sachs, Barclays, and Royal Bank of Canada.

Overnight repo transactions are essentially short-term collateralized loans.

The borrower sells security—in this case, U.S. Treasurys—for cash and agrees to repurchase the collateral the next day for a slightly higher price.

However, what is actually happening is that large institutional investors with cash to spare are parking it with Wall Street dealers that need funding.

“While this plan has been in the works for many months, the inclusion of these highly liquid assets also provides additional protection for the USDC reserve in the unlikely event of a U.S. debt default,” a Circle spokesperson said in an email.

Circle is taking these steps as U.S. lawmakers are locked in discussions with President Joe Biden’s administration over raising the government’s ability to issue new debt, also known as the debt ceiling.

Treasury Secretary Janet Yellen said that the Treasury Department is set to run out of cash by early June unless the debt limit is raised.

As part of the preparations, Circle’s fund has sold Treasurys that mature beyond the end of this month as of May 10, rotating the assets into cash or government repo transactions instead, the Circle spokesperson said.

The collateral for any such repo transactions excludes securities maturing within three days, the spokesperson added.

“We don’t want to carry exposure through a potential breach of the ability of the U.S. government to pay its debts,” Jeremy Allaire, CEO of Circle, said last week in an interview with Politico.

The price of Axie Infinity’s native cryptocurrency, AXS, surged by 12% after the game was listed on the Apple App Store

The price of AXS, the native cryptocurrency of the blockchain-based play-to-earn project Axie Infinity, surged by more than 12% after CoinDesk reported that the game’s card-based strategy game debuted on the Apple App Store.

The price of AXS rose from $7.16 to $8.04 after the news.

At the time of writing, AXS was on track for its best single-day percentage gain since January 22.

The cryptocurrency fell by more than 3% in April, registering its third consecutive monthly decline amid the token unlock and risk aversion in the broader market.

Initially, users of the Apple Store in Latin America and Asia, including Argentina, Colombia, Peru, Mexico, Venezuela, Indonesia, Malaysia, and Vietnam, will have access to the card-based game called Axie Infinity.

The game already has 1.5 million installations across all platforms.

Sky Mavis, the creator of the play-to-earn project, plans to expand the game’s reach to Google and Apple mobile users.

AXS’s price rally was accompanied by a sharp increase in the notional futures open interest or the dollar value locked in open futures contracts.

This is a sign of an influx of new money into the market.

The notional open interest rose to over $75 million from nearly $40 million a day ago, reaching its highest level since February, according to Coinglass.

However, the leverage appeared to be skewed to the bearish side, as funding rates in the perpetual futures market remained negative. Negative rates indicate the dominance of bearish short positions in the market.

Investors may have shorted perpetual futures contracts to protect their long positions in the spot market from a sudden price drop, a reflection of a lack of confidence in the sustainability of the price rally.

Tether, the issuer of the USDT stablecoin, announced that it will use a portion of its realized profits to purchase Bitcoin (BTC) for its reserves

Tether, the company that issues the USDT stablecoin, announced that it will start buying Bitcoin (BTC) using a portion of its profits.

The company will purchase BTC on a regular basis and plans to have BTC make up a significant portion of its reserves.

Tether has been under scrutiny in recent months due to concerns about its reserves.

The company has said that its reserves are backed by a basket of assets, including cash and U.S. Treasury bills.

However, some have questioned the quality of these assets.

By purchasing Bitcoin, Tether is diversifying its reserves and reducing its reliance on fiat currencies.

Bitcoin is seen as a more stable asset than fiat currencies and has the potential to appreciate in value over time.

Tether’s move is a positive development for the cryptocurrency market. It shows that the company is committed to the long-term success of Bitcoin and the cryptocurrency industry.

Here are some additional details about Tether’s announcement:

- Tether will use up to 15% of its realized profits to purchase Bitcoin.

- Realized profits are profits that have been earned and are not just potential profits.

- Tether will purchase Bitcoin on a regular basis.

- Tether’s goal is to have Bitcoin make up a significant portion of its reserves.

Tether’s announcement is a sign of confidence in the future of Bitcoin. It is also a sign that Tether is committed to providing a stable and reliable stablecoin for its users.

Here are some additional details about Tether’s reserves:

- As of March 2023, Tether’s reserves consist of $1.5 billion of BTC, $3.4 billion of gold, and $85 billion of cash and cash-like assets.

- Tether’s reserves are audited by a third-party firm, Moore Cayman.

- Tether’s reserves are held in a variety of locations, including the United States, the United Kingdom, and Switzerland.

Tether’s announcement is a positive development for the cryptocurrency market.

It shows that the company is committed to the long-term success of Bitcoin and the cryptocurrency industry.

Dogecoin’s daily transaction volume reached an all-time high following the introduction of DRC-20 tokens

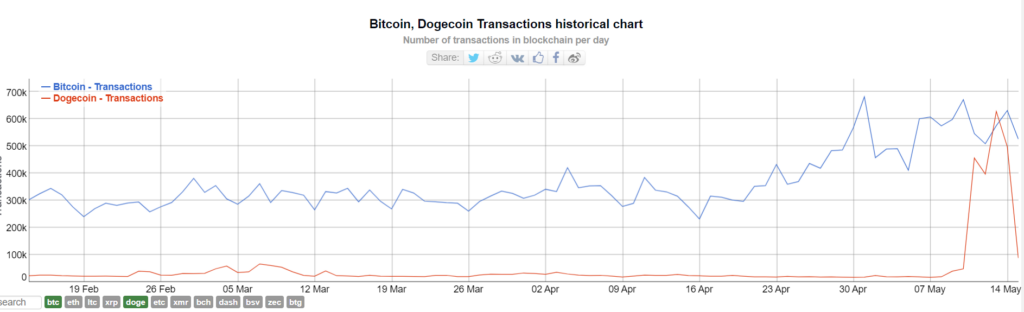

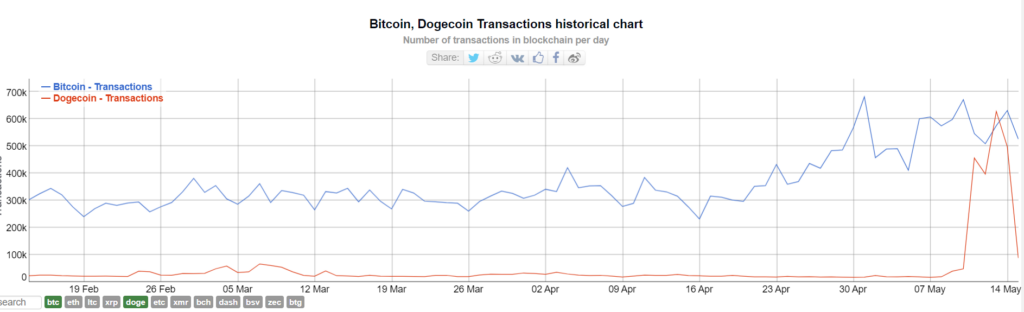

Dogecoin’s daily transaction volume increased tenfold from the average daily earlier this week to set a new all-time high.

This was due to the launch of a new mechanism that allows the issuance of tokens on the Dogecoin blockchain.

The network saw over 645,000 transactions on Sunday, data from BitInfoCharts shows.

This is a significant increase from the average daily transaction volume of around 20,000 transactions. The increase in transaction volume is due to the introduction of the DRC-20 token standard on May 9.

The DRC-20 token standard allows developers to issue tokens that take network fees in the form of dogecoin (DOGE). This adds to the value proposition for dogecoin and lays the path for potential decentralized finance (DeFi) services built on the blockchain.

However, not everyone is happy with the introduction of the DRC-20 token standard. Some critics have pointed out that it could lead to network congestion and that it moves away from dogecoin’s aim of being used as an everyday currency.

“The DRC-20 Dogecoin community should stop this shameless hype,” wrote one Dogecoin community member on Twitter.

“Everyone should probably focus on the transactional currency use case,” said another.

High fees and network congestion are valid concerns for any blockchain.

If the network becomes too expensive or slow, it could dampen adoption plans.

Bitcoin’s own ‘Bitcoin Request for Comment’ (BRC-20) standard went live in March last month, opening the floodgates to two-year high fees as a Bitcoin-based meme coin trading frenzy gained notoriety on the network.

It remains to be seen whether the introduction of the DRC-20 token standard will have a positive or negative impact on Dogecoin.

However, it is clear that the new standard has already had a significant impact on the network’s transaction volume.