Table of Contents

- Circle, the issuer of USDC, has removed all U.S. Treasuries from its $24 billion reserve fund in response to the ongoing debt ceiling confrontation

- CEO Zhaojun of the crypto bridging protocol Multichain remains unresponsive to attempts to establish contact

- Binance announces it is reconsidering its workforce structure following reports of layoffs

- Elizabeth Warren, a United States Senator, advocates for the cessation of cryptocurrency financing linked to fentanyl

- Jimbos Protocol collaborates with U.S. Homeland Security in efforts to retrieve $7.5 million following a Flash Loan Exploit

- NFT artist Fewocious unveils their forthcoming collection titled ‘Fewos’

- Sotheby’s upcoming auction features the second installment of 3AC NFT, showcasing a significant artwork by Dmitri Cherniak

Circle, the issuer of USDC, has removed all U.S. Treasuries from its $24 billion reserve fund in response to the ongoing debt ceiling confrontation

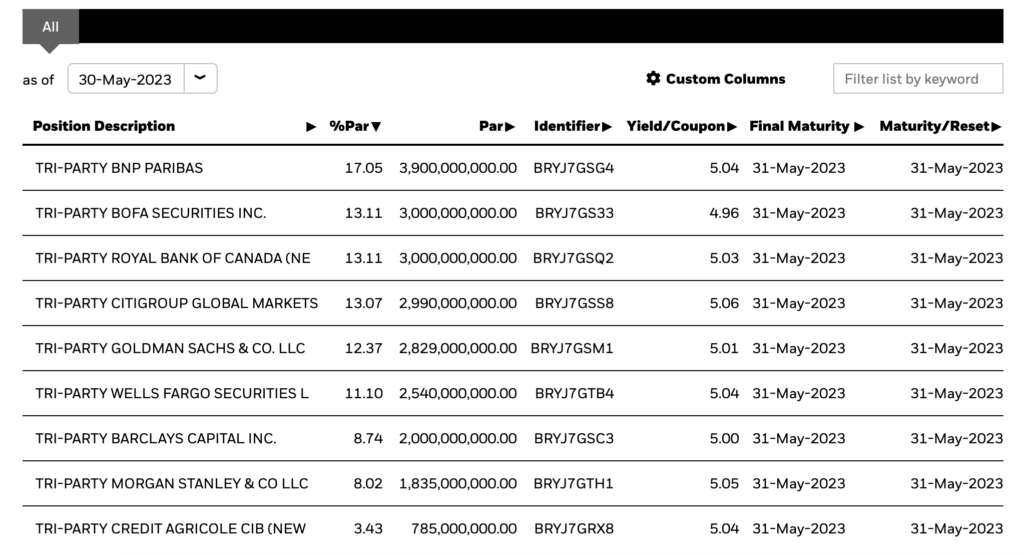

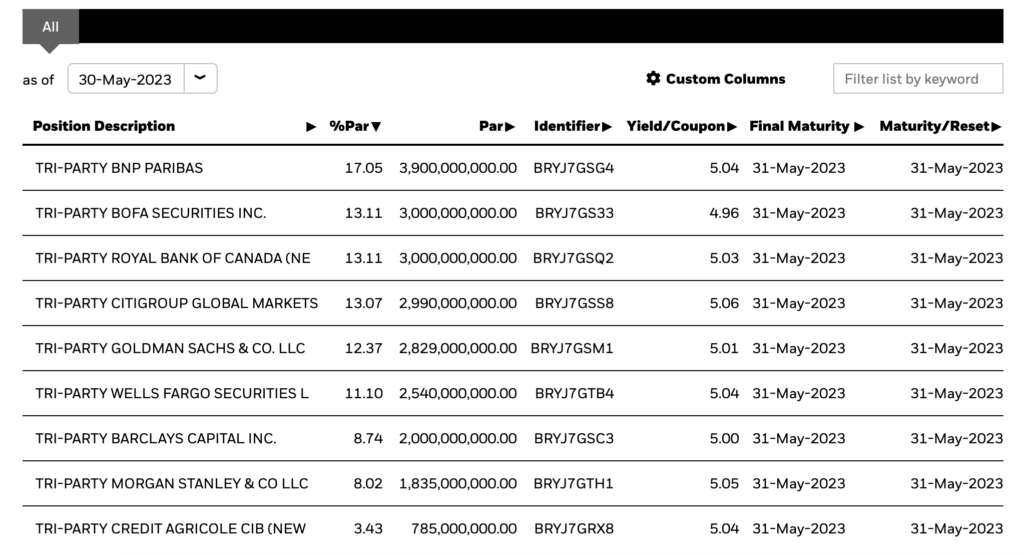

In an effort to safeguard against potential repercussions from the impending U.S. debt ceiling clash, Circle Internet Financial, the stablecoin issuer, has decided to eliminate all U.S. Treasury bonds from its backing reserves for USD Coin (USDC).

The Circle Reserve Fund, overseen by investment giant BlackRock, held approximately $24 billion in assets through overnight repurchase (repo) agreements as of May 30, as indicated on the fund’s website.

This marks a notable shift from the end of April when the fund possessed over $30 billion in U.S. Treasury bonds, according to Circle’s monthly attestation.

The final Treasury bond, valued at $4 billion, within the fund’s holdings, reached maturity on Tuesday, as indicated on the fund’s website.

This development is a direct outcome of Circle’s efforts to shield the $29 billion USDC stablecoin from potential turbulence in the bond market while U.S. lawmakers scramble to reach an agreement and avoid a government default.

Circle CEO Jeremy Allaire previously stated in early May that the company would not retain Treasury bonds maturing beyond the end of the month in the reserves supporting the value of USDC.

Concurrently, Circle’s reserve fund has been replacing maturing bonds with overnight repurchase agreements throughout the month.

The U.S. House of Representatives is poised to vote on a bill to raise the government’s borrowing capacity on Wednesday evening.

CEO Zhaojun of the crypto bridging protocol Multichain remains unresponsive to attempts to establish contact

On Wednesday, Multichain, one of the prominent bridging protocols in the cryptocurrency ecosystem, announced the suspension of its cross-chain routes due to unforeseen circumstances.

Additionally, the protocol revealed the inability to establish contact with CEO Zhaojun.

In a tweet, the Multichain account stated that despite the team’s efforts to keep the protocol operational, they were currently unable to reach CEO Zhaojun for necessary server access required for maintenance.

As a result of the server access issue, the remaining team members were unable to maintain the bridges online for several projects, including Kekchain, PublicMint, Dyno Chain, Red Light Chain, Dexit, Ekta, HPB, ONUS, Omax, Findora, and Planq.

The disclosure of Multichain’s server access problems confirmed the circulating rumors about the absence of a crucial team member.

At the time of the report, Multichain’s native token MULTI was trading at approximately $3.99, having experienced a nearly 50% decline in value over the past week.

Binance announces it is reconsidering its workforce structure following reports of layoffs

Binance, the leading cryptocurrency exchange globally in terms of trading volume, has stated its intention to focus on enhancing talent density within the organization in response to reports of job cuts.

The company clarified that it is not simply downsizing, but rather reevaluating the suitability of current talent and expertise in critical positions.

Binance’s spokesperson informed that the company will continue to fill numerous vacant positions and denied the claim that 20% of the staff had been laid off, as suggested by journalist Colin Wu’s report.

The spokesperson confirmed that Binance presently employs 8,000 individuals.

Binance’s Chief Communications Officer, Patrick Hillman, acknowledged the need for streamlining operations in a tweet but refuted the 20% staff reduction claim.

Hillman explained that the company routinely conducts talent density audits and resource allocation assessments every six months to determine areas where streamlining is required, without specifying an exact percentage of workforce reduction.

Elizabeth Warren, a United States Senator, advocates for the cessation of cryptocurrency financing linked to fentanyl

During a Senate hearing on Wednesday, U.S. Senator Elizabeth Warren (D-Mass.) raised concerns about the extensive use of cryptocurrency in the Chinese fentanyl trade.

She called for the implementation of legislation to disrupt this channel.

Warren, a prominent member of the Senate Banking Committee, referred to research data provided by Elliptic, a research firm, which revealed that over 90 Chinese businesses involved in shipping fentanyl precursors accepted cryptocurrency as payment.

Testifying before the panel, Elizabeth Rosenberg, the Assistant Secretary for Terrorist Financing and Financial Crimes at the U.S. Treasury Department, acknowledged the use of cryptocurrency wallets for receiving bitcoin payments by precursor manufacturers and illicit drug organizations.

She explained that these criminals are attracted to the pseudonymous nature of cryptocurrencies, which allows them to maintain a level of anonymity.

Fentanyl-related overdoses have become the leading cause of death among individuals aged 18-45 in the United States.

The precursor chemicals used in the production of this dangerous drug often originate from China and traverse multiple borders before reaching users of the synthetic opioid in the U.S. The Drug Enforcement Administration (DEA) has stated that fentanyl is approximately 100 times more potent than morphine.

To address the issue, Warren proposed the reintroduction of her Digital Asset Anti-Money Laundering Act in the current Congress, highlighting its potential to cut off cryptocurrency payments associated with the fentanyl trade.

She emphasized that cryptocurrencies are facilitating the funding of the fentanyl trade and stressed the need to take action to put an end to it.

Jimbos Protocol collaborates with U.S. Homeland Security in efforts to retrieve $7.5 million following a Flash Loan Exploit

The developers of Jimbos Protocol, an application built on Arbitrum, announced on Wednesday that they have initiated legal action with the New York branch of the Department of Homeland Security in order to apprehend the individual who exploited the protocol and obtained millions of dollars over the past weekend.

In a tweet directed at the attacker, the Jimbos team expressed their preference for the return of the stolen funds, offering them a bounty and a chance to rectify the situation before law enforcement intervention.

However, the team has now involved the Department of Homeland Security, indicating their intention to pursue legal measures.

This decision comes in response to a flash loan exploit that resulted in a $7.5 million loss, occurring approximately two weeks after the protocol’s official launch.

In addition to collaborating with U.S. law enforcement, the team is initiating similar actions in other jurisdictions.

They are also offering a 10% bounty, amounting to around $800,000, to individuals who provide information leading to the capture of the exploiter and the recovery of the funds.

A blockchain investigator involved in the recovery process, named Ogle, expressed confidence in identifying the attacker and speculated that they might choose to cooperate, keep a portion of the funds, and return the rest, as this would be the most sensible course of action.

The team is hopeful that the situation can be resolved in a manner that benefits all parties involved, emphasizing the risks and consequences the attacker would face if they choose to retain the stolen funds.

NFT artist Fewocious unveils their forthcoming collection titled ‘Fewos’

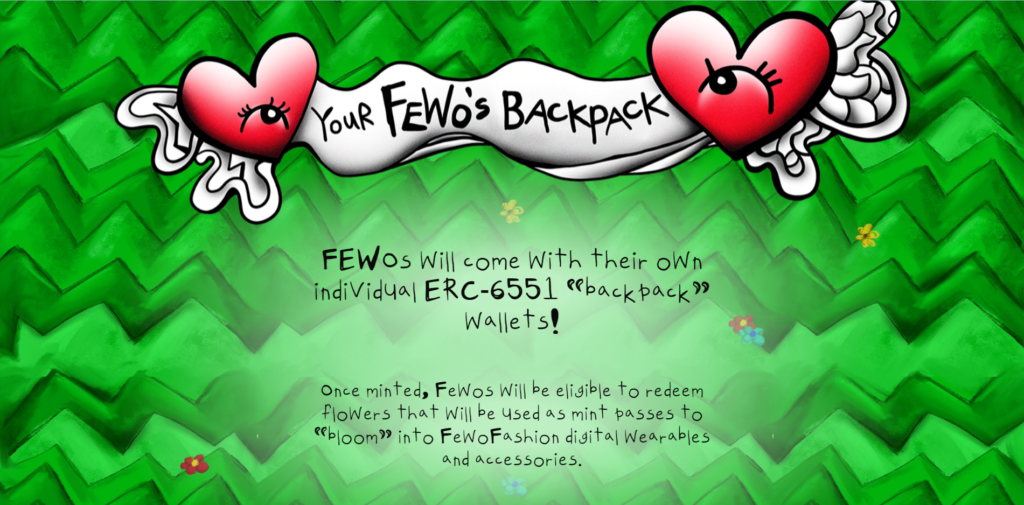

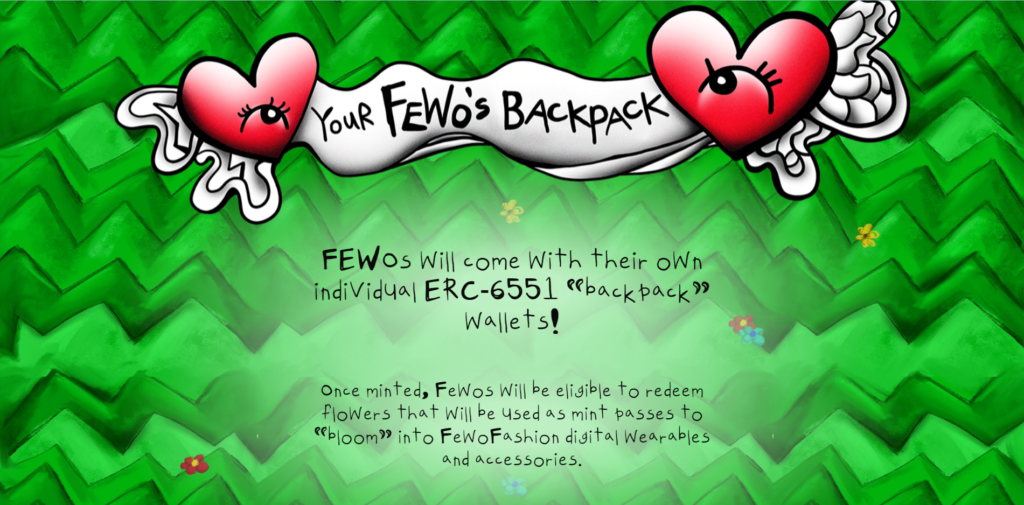

On Wednesday, Fewocious, an NFT artist, announced plans to launch their upcoming digital art collection called “Fewos.”

The 20-year-old artist shared a tweet introducing the collection and revealed that the series will consist of 20,000 profile-picture (PFP) NFTs, with minting set to begin in August.

According to the artist’s website, Fewos are characters within Fewocious’ Web3 universe of digital art.

The collection features three species of Fewo NFTs—Frankenstein, Misunderstood, and Humanoid—each possessing unique artistic attributes.

Pricing details for the NFTs have not yet been disclosed.

The website further explains that these creatures were conceptualized by Fewocious, with every characteristic meticulously hand-drawn and then transformed into stunning 3D artwork.

While the public sale will commence later in the summer, a presale will be available to holders of Fewocious’ previous Paint Drop collection and other digital art tokens associated with Fewocious.

Each Fewo NFT is equipped with an ERC-6551, allowing the token to transform into a wallet. This wallet will facilitate the claiming of a mint pass for FewoFashion, a collection comprising digital wearables and accessories.

Fewocious, whose real name is Victor Langlois, has become one of the most successful NFT artists to date.

In April 2022, the artist achieved $20 million in sales within 24 hours with the release of the Paint Drop collection.

Additionally, in October of the same year, a collaboration with the David Bowie estate resulted in the sale of an animated NFT paired with a seven-foot-tall physical sculpture for $127,000.

Sotheby’s upcoming auction features the second installment of 3AC NFT, showcasing a significant artwork by Dmitri Cherniak

Sotheby’s will conduct an auction featuring additional non-fungible tokens (NFTs) that were confiscated from the bankrupt crypto hedge fund Three Arrows Capital (3AC).

This auction will showcase valuable NFTs, including Dmitri Cherniak’s Ringers #879, also known as “The Goose,” which will be publicly available for the first time since 2021.

The second sale of 3AC collectibles from the “Grails” collection is scheduled for June 15 in New York and will present 37 artworks by generative artists such as Dmitri Cherniak, Tyler Hobbs, Jeff Davis, and others.

Sotheby’s stated in a press release that this auction will be the largest-ever live auction of digital art.

Micahel Bouhanna, Sotheby’s head of digital art and NFTs, explained that the focus of the live auction is to showcase generative art and the collection’s extensive holdings of renowned generative artists, while also highlighting the broader community of artists pushing the boundaries of algorithm-based art.

Notable pieces in this batch of NFTs include Cherniak’s Ringers #879, a significant generative artwork often referred to as “The Goose” due to its resemblance to the bird.

The artwork was originally purchased by 3AC co-founders Su Zhu and Kyle Davies in August 2021 for approximately 1,800 ETH (equivalent to around $5.8 million at the time).

Bouhanna described this piece as a major highlight of Cherniak’s portfolio and one of the most significant works from the generative art movement.

He emphasized the unique variation resulting from the randomness of its generation, which produces the goose-like image at the center, perfectly capturing the realm of possibilities inherent in algorithmic art.

Another notable NFT to be made available for purchase is Hobbs’ Fidenza #216, a vibrant and swirling artwork that previously sold for 320 ETH (approximately $1 million) in 2021.

This upcoming auction follows a successful initial NFT sale earlier this month, which generated over $2.4 million, including the sale of another Hobbs’ Fidenza NFT that fetched over $1 million, surpassing its estimated sale price.

Teneo, the liquidator for 3AC, announced in February its intention to sell a vast collection of NFTs estimated to be worth millions after the hedge fund filed for bankruptcy in July.

Additionally, a separate set of artworks from the Grails collection was recently sold privately for a combined total of over $3 million. In total, the Grails collection liquidation sales have yielded more than $6 million.