Table of Contents

- Introduction

- What Are the Crypto Scams?

- Types of Crypto Scams You Should Know About

- Common Characteristics and Warning Signs of Crypto Scams You Should Be Aware Of

- Recent Trends and Statistics in Crypto Scams You Need to Know About

- How to Protect Yourself from Crypto Scams?

- The Impact Of Being A Victim Of A Crypto Scam

- Conclusion And Call To Action Against Crypto Scams

- FAQs (Frequently Asked Questions)

Introduction

Have you ever wondered why your social media feed is filled with stories about people losing their life savings to crypto scams? You’re not alone. Cryptocurrency fraud has become a widespread issue, leaving many victims behind.

Crypto scams are deceptive schemes where fraudsters exploit the complex nature of digital currencies to steal money or sensitive information from unsuspecting individuals. It’s like a modern-day version of the classic “snake oil” salesman, but with potentially devastating consequences.

Why should you care?

Here’s what’s at stake:

- Your hard-earned money

- Personal and financial information

- Mental well-being and peace of mind

The crypto world has seen some shocking scams. Remember the notorious BitConnect scandal that disappeared with $2.4 billion? Or the OneCoin scheme that tricked investors out of $4 billion? These aren’t just one-off cases – they’re part of a growing trend that’s becoming more sophisticated by the day.

The variety of crypto frauds

From fake investment opportunities to romance scams, and phishing attacks to impersonation schemes – the range of crypto frauds is staggering.

Are you ready to explore these scams further and discover how to protect yourself? Let’s delve into the darker aspects of cryptocurrency and equip ourselves with knowledge to defend against these digital criminals.

What Are the Crypto Scams?

A crypto scam is a deceptive scheme where fraudsters exploit people’s interest in digital currencies to steal their money or personal information. These scams often disguise themselves as legitimate cryptocurrency opportunities.

Key Elements of Crypto Scams:

- False Promises: Scammers create elaborate stories about guaranteed returns and instant wealth

- Psychological Manipulation: They prey on people’s fear of missing out (FOMO) and desire for quick profits

- Technological Deception: Using sophisticated fake websites, apps, and social media profiles

- Identity Theft: Stealing personal information to access victims’ crypto wallets or financial accounts

These fraudulent schemes have become increasingly sophisticated as cryptocurrencies gain mainstream attention. Just like counterfeit money in the traditional financial world, crypto scams attempt to exploit the decentralized nature of digital currencies.

How Scammers Exploit Cryptocurrency Popularity:

- Creating fake exchanges that look identical to legitimate platforms

- Launching worthless tokens with convincing marketing campaigns

- Setting up pyramid schemes disguised as “innovative” crypto projects

- Using social media bots to create artificial hype

The impact of these scams extends far beyond individual victims. When major crypto scams are uncovered, they can trigger market-wide panic, causing cryptocurrency prices to plummet. This ripple effect damages legitimate projects and erodes trust in the entire cryptocurrency ecosystem.

Real Market Impact:

- Price volatility in major cryptocurrencies

- Decreased investor confidence

- Stricter regulatory scrutiny

- Damaged reputation of legitimate crypto projects

For individual victims, the consequences can be devastating. Unlike traditional bank transactions, cryptocurrency transfers are typically irreversible. Once digital assets are sent to a scammer’s wallet, they’re nearly impossible to recover. Many victims lose their life savings, retirement funds, or borrowed money they can’t repay.

Types of Crypto Scams You Should Know About

Let’s dive into the dark world of cryptocurrency scams. You’d be surprised how creative fraudsters can get when it comes to separating you from your hard-earned crypto.

1. Investment Scams

Picture this: You’re scrolling through social media and spot a too-good-to-be-true investment opportunity promising 1000% returns in just a few days. That’s your first red flag right there.

Investment scams in the crypto world take several sneaky forms:

- Fake ICOs (Initial Coin Offerings): These scams involve non-existent blockchain projects, copied white papers from legitimate projects, and empty promises of revolutionary technology.

- Ponzi and Pyramid Schemes: In these schemes, early investors are paid with new investors’ money, there is a heavy focus on recruitment, and complex reward structures are used.

Common Tactics Used by Investment Fraudsters:

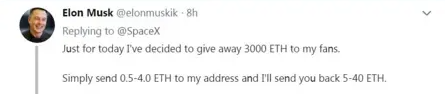

- Celebrity Impersonation: Scammers may use fake endorsements from well-known figures like Elon Musk or Bill Gates, doctored videos and images, and manipulated interviews to gain credibility.

- Professional-Looking Websites: Fraudsters often create websites that closely resemble legitimate exchanges, displaying fake trading volumes and prices, as well as sophisticated graphics and charts.

- Social Proof Manipulation: This tactic involves using fake user reviews, inflated follower counts on social media platforms, and manufactured success stories to create an illusion of popularity and trustworthiness.

- Pressure Tactics: Scammers employ techniques such as limited-time offers, claims of only a certain number of spots remaining, and exclusive membership claims to create a sense of urgency and push individuals into making impulsive decisions.

Have you noticed how these scammers always create a sense of urgency? They’ll use phrases like “Don’t miss out!” or “Last chance to invest!” to push you into making quick, emotional decisions.

A real-world example? The BitConnect scandal rocked the crypto world by promising 1% daily returns through a “trading bot.” Spoiler alert: It was a $2.4 billion Ponzi scheme that collapsed in 2018, leaving thousands of investors empty-handed.

Remember this: Any investment promising guaranteed returns in the crypto space is likely a scam. The volatile nature of cryptocurrencies means no one can guarantee profits – not even the most seasoned investors. For more detailed insights on various Bitcoin scams you should be aware of, continue reading.

2. Impersonation Scams

Have you ever received a message from Elon Musk asking you to send Bitcoin? Spoiler alert: it wasn’t really him. Impersonation scams have become a billion-dollar problem in the crypto world.

These crafty fraudsters create perfect replicas of:

- Social media profiles of crypto influencers

- Customer support accounts of major exchanges

- Government agency representatives

- Cryptocurrency project team members

Let’s take a look at their strategy. They’ll send you direct messages with urgent notifications about:

“Your account has been compromised – click here to secure your funds!”

“Send 1 BTC, get 2 BTC back – limited time offer from [insert celebrity name]!”

The most sinister twist? Legal impersonation scams. Picture this: You receive an official-looking email claiming you’re under investigation for crypto tax evasion. The scammer demands immediate payment in cryptocurrency to “resolve” the issue.

These impersonators use sophisticated tactics:

- Blue check marks bought on social media

- Identical logos and branding stolen from legitimate companies

- Professional-looking emails with convincing legal terminology

- Pressure tactics creating artificial urgency

They’re dangerous because they exploit our trust in authority figures and well-known personalities. A single successful impersonation scam can drain entire crypto wallets in minutes.

Remember that time when Twitter saw multiple high-profile accounts hacked to promote crypto scams? That’s just the tip of the iceberg. These scammers are constantly evolving their tactics, making it crucial to verify every interaction in the crypto space.

Their methods are part of a broader trend of social media crypto scams, which have become increasingly prevalent. The 2024 TOC Convergence Report provides an in-depth analysis of this concerning trend.

Moreover, it’s essential to understand that these scammers often create fake emergencies as a tactic to steal your money. This is a common strategy used by many fraudsters across various platforms, including popular ones like Amazon, as highlighted in recent Amazon scam trends.

As we navigate this complex landscape, we must stay informed and vigilant against these evolving threats.

3. Romance Scams

Picture this: You’re browsing a dating app when someone catches your eye. They’re charming, successful, and surprisingly knowledgeable about cryptocurrencies. What could go wrong? A lot, actually.

Romance scams in the crypto world are a heart-wrenching blend of emotional manipulation and financial fraud. These scammers, often called “pig butchers,” follow a calculated playbook:

1. The Setup

- Create attractive profiles on dating apps or social media

- Target individuals actively seeking relationships

- Present themselves as successful crypto investors

2. The Trust-Building Phase

- Share personal stories and photos (usually stolen)

- Show genuine interest in the victim’s life

- Maintain regular communication for weeks or months

- Demonstrate apparent wealth through fake screenshots

3. The Investment Hook

- Casually mention their crypto success

- Offer to “help” victims achieve similar results

- Share links to legitimate-looking investment platforms

- Start with small investments to build confidence

🚩 Common Red Flags:

- Refusing video calls or in-person meetings

- Pushing crypto discussions early in the relationship

- Claiming exclusive investment opportunities

- Directing victims to specific trading platforms

These scams are particularly devastating because they exploit both emotional vulnerability and financial aspirations. In 2022 alone, romance crypto scams cost victims over $1 billion, with average losses reaching $10,000 per person.

Remember: A genuine romantic interest won’t pressure you into cryptocurrency investments or share “exclusive” trading tips. If your new love interest seems more interested in your wallet than your heart, it’s time to swipe left.

4. Phishing Scams

Picture this: You receive an urgent email claiming your crypto wallet needs immediate verification. It looks legitimate, complete with familiar logos and professional design. But here’s the catch – it’s a phishing scam waiting to drain your digital assets.

Crypto phishing scams are digital deception at its finest. These attacks mimic legitimate cryptocurrency platforms, exchanges, or wallet services to steal your private keys and login credentials.

Common Phishing Tactics in the Crypto Space:

- Fake Wallet Apps: Scammers create counterfeit wallet applications that look identical to legitimate ones. Once installed, these apps steal your credentials and cryptocurrency

- Clone Websites: Perfect replicas of popular crypto exchanges trick users into entering their login details

- Email Spoofing: Messages appearing to be from trusted crypto services request “account verification” or “security updates”

- Social Media Impersonation: Fake support accounts on platforms like Twitter or Telegram offer to help with wallet issues

🚩 Red Flags to Watch For:

- Unusual URLs with slight misspellings

- Requests for private keys or seed phrases

- Pressure to act quickly

- Poor grammar or spelling errors

- Unsolicited contact from “support staff”

A real-world example? In 2022, hackers created a fake MetaMask wallet website, successfully stealing over $650,000 in cryptocurrency from unsuspecting users. The site looked identical to the original, but the subtle URL difference (.io instead of .com) was enough to fool many visitors.

Remember: No legitimate crypto service will ever ask for your private keys or seed phrases through email, social media, or direct messages.

5. Blackmail and Extortion Scams

Imagine this: You check your email and find a menacing message saying hackers have compromising photos or sensitive information about you. They demand payment in Bitcoin within 24 hours – or else.

This is the grim reality of crypto blackmail scams, where criminals use fear and shame to extort money from unsuspecting victims. These scams usually follow two main patterns:

Common Blackmail Tactics:

- Fake evidence of compromising activities

- Threats to expose personal data or browsing history

- Claims of device infection through malware

- Allegations of illegal content downloads

- Threats to reveal sensitive business information

The psychological manipulation runs deep. Scammers often include personal details like passwords from old data breaches to make their threats seem credible. They create a sense of urgency through countdown timers and escalating threats.

Real-World Impact:

- Victims report average losses of $8,000 per incident

- Psychological trauma can last long after financial losses

- Many victims face shame and isolation

- Some experience anxiety and depression

- Business owners risk reputation damage

A rising trend involves scammers targeting business executives with threats to release sensitive company information. They often demand payments in privacy-focused cryptocurrencies like Monero to avoid detection.

Remember: Legitimate organizations never demand cryptocurrency payments under threats. These scammers rely on creating panic to cloud your judgment and force quick, irrational decisions.

Common Characteristics and Warning Signs of Crypto Scams You Should Be Aware Of

Let’s dive into the telltale signs that can help you spot a crypto scam before it’s too late. Think of these warning signs as your personal crypto fraud detector – they’ll help you separate legitimate opportunities from dangerous schemes.

Red Flag #1: Too Good to Be True Returns

Be cautious if you come across any investment opportunity that makes the following claims:

- “guaranteed” profits

- Specific percentage returns (like “100% in 30 days”)

- Risk-free investment opportunities

- Pressure to “act now” or miss out

Red Flag #2: Suspicious Documentation

When evaluating a crypto project, pay close attention to its whitepaper and other official documents. Red flags to watch out for include:

- White papers filled with technical jargon but lacking substance

- Missing or vague information about the team

- Copied content from other projects

- No clear explanation of how returns are generated

Red Flag #3: Marketing Tactics

Scammers often rely heavily on aggressive marketing tactics to promote their schemes. Here are some signs that a project may be using such tactics:

- Heavy reliance on social media influencers

- Aggressive promotional campaigns

- Unsolicited investment opportunities in your DMs

- Celebrity endorsements (often fake or manipulated)

Red Flag #4: Project Structure

A legitimate crypto project should have a clear use case for its token and transparent tokenomics. Be wary if you notice any of the following red flags:

- No clear use case for the token

- Lack of transparent tokenomics

- Inability to withdraw funds

- Hidden fees or unusual payment requirements

Red Flag #5: Communication Patterns

Pay attention to how a project communicates with its community. Red flags in communication patterns include:

- Poor grammar and spelling in official communications

- Unprofessional email addresses

- Limited or non-existent customer support

- Communication only through messaging apps

Have you noticed how legitimate crypto projects focus on technology and development? Scams, on the other hand, put most of their effort into marketing and promises. A genuine project will never guarantee returns – they’ll discuss potential benefits and risks openly.

Remember that scammers often create a false sense of urgency. They’ll push you to invest quickly, claiming limited-time offers or exclusive deals. This pressure tactic aims to bypass your natural skepticism and critical thinking.

The crypto world moves fast, but legitimate opportunities don’t disappear in hours. Take your time to research, verify, and trust your instincts when something feels off.

Recent Trends and Statistics in Crypto Scams You Need to Know About

The world of cryptocurrency scams has reached alarming levels in 2023, with staggering losses that paint a concerning picture for investors and users alike.

1. Romance Scams Take the Lead

- $185 million lost to crypto romance scams in Q1 2023

- 70% increase from the previous year

- The average victim loses $45,000

- Dating apps remain the primary hunting ground

2. Impersonation Scams Hit New Records

- $542 million stolen through fake identities

- 40% surge in celebrity impersonation cases

- Social media platforms targeted heavily

- Verified badge scams increased by 90%

3. DeFi Vulnerabilities Exposed

- $200 million lost in DeFi protocol exploits

- Smart contract vulnerabilities account for 65% of attacks

- Flash loan attacks increased by 125%

- Cross-chain bridge attacks resulted in $80 million in losses

4. ICO Fraud Evolution

- New ICO scams dropped by 30%

- Replaced by more sophisticated “IDO” scams

- $150 million lost in fake token launches

- 80% of victims aged 25-40

5. Emerging Trends

- AI-powered deepfake scams on the rise

- Metaverse-related fraud increasing

- Gaming tokens targeted more frequently

- Mobile wallet attacks up by 55%

6. Geographic Distribution

- Asia Pacific: 45% of total losses

- North America: 30% of reported cases

- Europe: 20% of victim count

- Africa: Fastest growing region for crypto scams

These numbers highlight the sophisticated evolution of crypto scams. Fraudsters now employ advanced technologies and psychological manipulation tactics to target victims. The rise in DeFi-related incidents signals a shift toward more complex technical exploits, while traditional scam methods continue to adapt and evolve.

How to Protect Yourself from Crypto Scams?

Here are some proven strategies that’ll help you shield your investments from crypto fraudsters:

Do Your Own Research (DYOR)

- Check the project’s whitepaper for clear, well-defined goals

- Research the development team’s background and credentials

- Look for code audits by reputable security firms

- Examine the token’s use case and technical specifications

Verify Platform Legitimacy

- Check for proper licensing and registration

- Look up user reviews on independent platforms

- Verify the platform’s security measures

- Test customer support responsiveness

Red Flags to Watch For

- Pressure to act quickly

- Guaranteed returns or profits

- Unsolicited investment advice

- Requests for upfront fees

- Limited or no withdrawal options

Smart Investment Practices

- Start with small amounts to test platforms

- Use strong, unique passwords for each platform

- Enable two-factor authentication (2FA)

- Keep your private keys offline

- Never share your seed phrase

Stay Updated

- Follow crypto news from reliable sources

- Join legitimate crypto communities

- Subscribe to security alerts

- Monitor regulatory changes

Think of protecting your crypto investments like building a fortress – each security measure adds another layer of defense. Your crypto wallet is your castle, and these protective steps are your walls, moats, and guards.

Remember: legitimate crypto projects won’t rush you into decisions or promise unrealistic returns. They’ll provide transparent information about their technology, team, and tokenomics. When in doubt, take a step back and ask questions. The crypto space rewards patient informed investors who prioritize security over quick gains.

The Impact Of Being A Victim Of A Crypto Scam

Falling victim to a crypto scam creates deep wounds that go beyond empty wallets. The psychological aftermath can be devastating:

1. Shame and Self-Blame

- “I should have known better”

- Reluctance to share experiences with others

- Feelings of embarrassment and foolishness

2. Mental Health Challenges

- Anxiety about future financial decisions

- Depression from lost savings

- Sleep disturbances and stress-related symptoms

3. Relationship Strain

- Trust issues with new business opportunities

- Difficulty opening up to potential partners

- Damaged family relationships due to lost shared funds

The ripple effects of crypto scams often lead to social isolation. Victims might withdraw from financial discussions, avoid investment opportunities, or become overly suspicious of legitimate platforms. Many report feeling “stuck” – unable to move forward with their financial goals.

“The hardest part isn’t losing the money – it’s losing faith in your own judgment.” – Anonymous crypto scam victim

This trauma can persist long after the financial loss, creating a lasting impact on decision-making abilities and risk assessment. Some victims develop hypervigilance, questioning every transaction and opportunity, while others swing to the opposite extreme, becoming completely risk-averse in all financial matters.

Conclusion And Call To Action Against Crypto Scams

The fight against crypto scams demands our collective vigilance. Each of us plays a crucial role in creating a safer crypto ecosystem by staying informed and sharing knowledge with others.

Ready to protect yourself and others? Here’s what you can do:

- Join crypto safety communities and forums to stay updated on the latest scam tactics

- Report suspicious activities to law enforcement and crypto exchanges

- Share your experiences to help others learn from them

- Follow reputable crypto news sources for real-time updates on emerging threats

Need help? These resources have got your back:

- Cryptocurrency Crime and Anti-Money Laundering Report – Latest insights on crypto crime trends

- FBI’s IC3 Complaint Center – Report crypto-related crimes

- Global Anti-Scam Organization – Support network for scam victims

- Crypto Safety First – Educational resources about crypto security

Remember: Your awareness is your strongest defense against crypto scams. By staying alert and informed, you’re not just protecting yourself—you’re helping build a more secure future for cryptocurrency. Let’s work together to make crypto safer for everyone.

Have you spotted a potential scam? Don’t keep it to yourself. Report it, share it, stop it.

FAQs (Frequently Asked Questions)

- What is a crypto scam?

A crypto scam refers to fraudulent schemes that exploit the popularity of cryptocurrencies to deceive individuals. These scams can take various forms, including investment frauds, impersonation scams, romance scams, and phishing attacks, often leading to significant financial losses for victims.

- What are the common types of crypto scams?

Common types of crypto scams include investment scams that promise guaranteed returns, impersonation scams where scammers pose as legitimate entities, romance scams that build trust before soliciting investments, phishing scams aimed at stealing private keys or login credentials, and blackmail/extortion scams that exploit victims’ vulnerabilities.

- How can I identify a potential crypto scam?

You can identify potential crypto scams by being aware of red flags such as promises of guaranteed returns, poorly written white papers, excessive marketing tactics, and unsolicited requests for personal information or funds. Always conduct thorough research before investing.

- What should I do if I become a victim of a crypto scam?

If you become a victim of a crypto scam, it’s essential to report the incident to relevant authorities and seek support from resources available for victims. Additionally, consider sharing your experience to help raise awareness and prevent others from falling victim.

- What are the recent trends in crypto scams?

Recent trends in crypto scams have shown significant losses reported in areas such as romance and impersonation scams. Additionally, there has been an uptick in fraudulent activities related to decentralized finance (DeFi) and Initial Coin Offerings (ICOs) in 2023.

- How can I protect myself from crypto scams?

To protect yourself from crypto scams, ensure you conduct thorough research before investing in any cryptocurrency or platform. Verify the legitimacy of projects and platforms by checking their track record and user reviews. Stay informed about common scam tactics to recognize potential threats.