Table of Contents

- What Does the Term ‘Wrapped Ether (WETH)’ Refer to?

- What is the Purpose of Wrapping ETH?

- What is the Process For Wrapping Ether (ETH)?

- What is the Process For Unwrapping Ether (WETH)?

- Is it Possible to Wrap ETH on Different Blockchain Networks?

- What Ensures That Wrapped ETH Maintains Its Price Parity With ETH?

- Which Decentralized Finance (DeFi) Applications Support the Use of Wrapped Ether (WETH)?

- Conclusion

In the world of cryptocurrency, the concept of wrapping has gained significant traction in recent years. One such popular wrapped token is Wrapped Ether, more commonly known as WETH. In this blog post, we will delve deep into understanding what WETH is and how the wrapping process works. To begin, let’s define what WETH actually is.

What Does the Term ‘Wrapped Ether (WETH)’ Refer to?

WETH, an ERC-20 token built on the Ethereum blockchain, is designed to be tethered to the value of Ethereum’s native cryptocurrency, Ether (ETH). Unlike ETH, which is primarily used for covering transaction fees (gas), WETH does not serve this purpose. Nevertheless, WETH boasts a broader spectrum of applications compared to ETH and enjoys significant prominence within the Decentralized Finance (DeFi) realm. Virtually all Ethereum network wallets, including popular options like MetaMask and TrustWallet, extend support for WETH. Let’s delve deeper into the diverse utility of WETH.

What is the Purpose of Wrapping ETH?

Initially, one might find it perplexing why a token like WETH exists, considering that Ethereum already features ETH. However, it’s essential to grasp that not all tokens within the Ethereum ecosystem are uniform in nature. The Ethereum network offers developers the flexibility to establish distinct regulations and standards for various cryptocurrencies.

A notable illustration of this is the ERC-721 format, which grants us Non-Fungible Tokens (NFTs). These NFTs operate distinctly compared to Ether or ERC-20 tokens, and developers enjoy a significant degree of freedom when crafting these digital assets. Consequently, while ETH serves as a means to cover gas fees on the Ethereum platform, it may not be suitable for every decentralized application (DApp).

Presently, most decentralized finance (DeFi) DApps readily accept ERC-20 tokens for investment and staking opportunities. When contemplating the addition of ETH to a liquidity pool or its use as collateral, it is far more convenient to have it available in the form of an ERC-20 token. This choice ensures optimal compatibility across the blockchain network and streamlines the development of new smart contracts, saving valuable time.

What is the Process For Wrapping Ether (ETH)?

If you possess ETH, you have the option to wrap it and acquire ETH by executing a straightforward trade of ETH for WETH.

Prior to that, you will be required to hold a certain amount of ETH in a wallet, such as MetaMask.

Subsequently, you will need to establish a connection between your wallet (in this instance, MetaMask) and a decentralized exchange (DEX) that operates on the Ethereum network, like Uniswap.

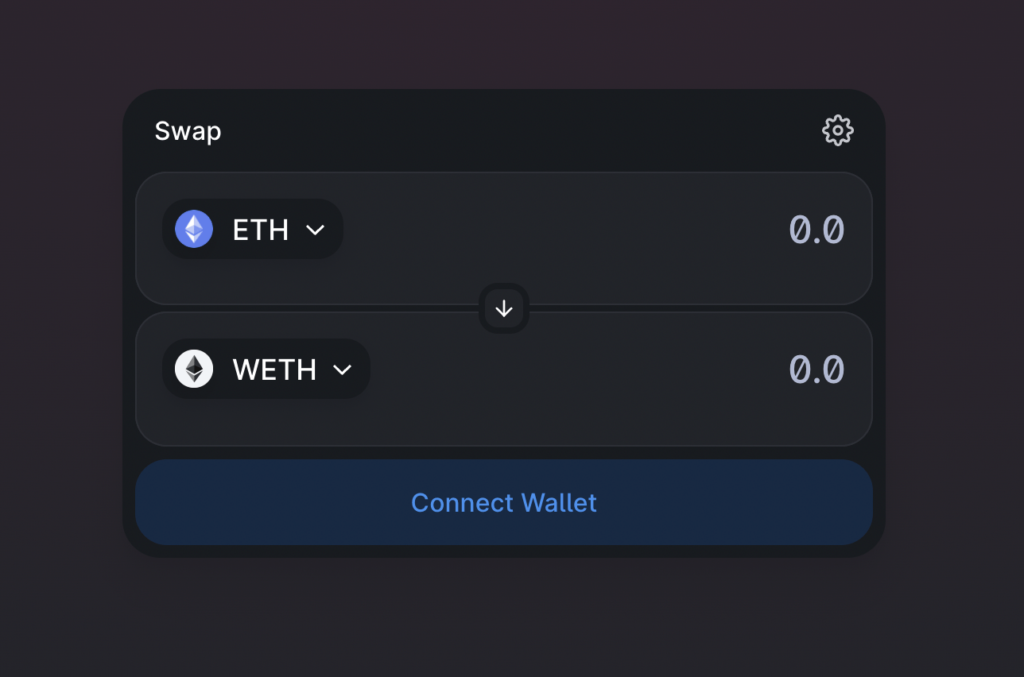

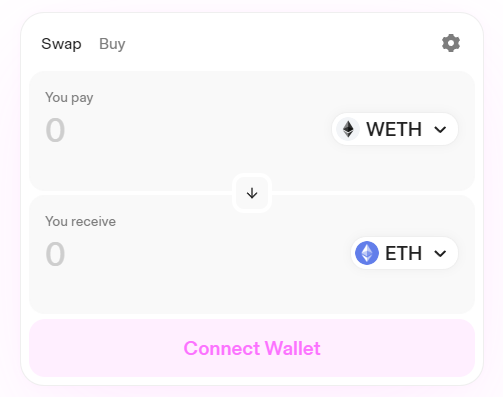

To effectuate the conversion of your ETH into WETH, please follow these steps:

- First, using your Chrome browser, log into your MetaMask account and proceed to install the browser extension.

- Then, navigate to https://app.uniswap.org/#/swap.

- Afterward, connect your wallet.

- Opt for ETH as the top asset and WETH as the bottom asset (as indicated in the image below).

- Indicate the specific quantity of ETH you wish to wrap.

- Subsequently, initiate the wrapping process by clicking the ‘Wrap’ button.

- Expect a pop-up notification from MetaMask, which will provide you with crucial information regarding estimated gas fees and the overall transaction amount.

- Once you’ve reviewed the details and are satisfied, go ahead and click ‘Confirm.’ In no time, you will find WETH safely deposited in your wallet.

What is the Process For Unwrapping Ether (WETH)?

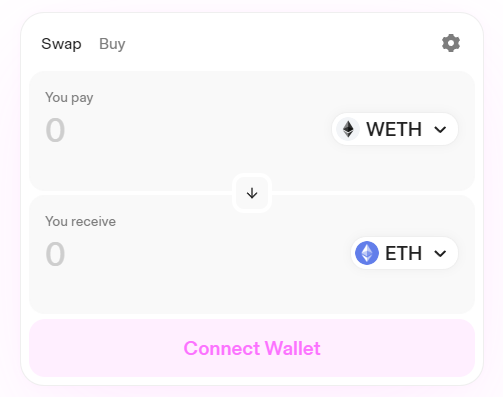

If you possess WETH, you have the opportunity to initiate the unwrapping process, which effectively converts WETH into ETH. By undertaking this unwrapping procedure, commonly referred to as ‘burning,’ you will receive the initial ETH amount in return. The WETH that has been ‘burned’ is subsequently transformed into ETH and deposited into the wallet belonging to the original holder of WETH.

Much like the process of wrapping ETH, you will require a digital wallet, such as a Metamask account. To execute the same steps outlined above, simply select WETH as the initial asset and ETH as the second asset in the conversion process.

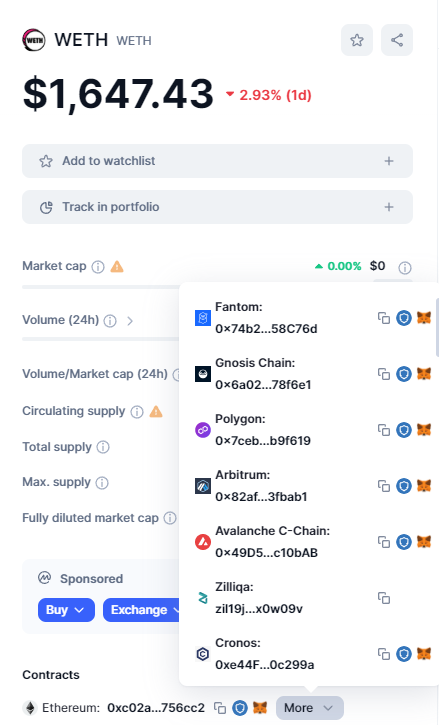

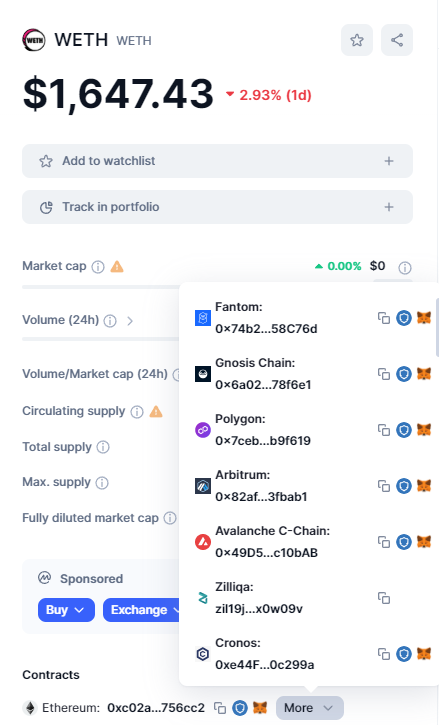

Is it Possible to Wrap ETH on Different Blockchain Networks?

Additional variations of ETH that have been wrapped can be found on various major blockchains, expanding the scope of ETH’s interoperability. For instance, utilizing wrapped ETH on the BNB Smart Chain (BSC) provides the opportunity to trade or utilize WETH within the BSC DeFi ecosystem. To achieve this, it is necessary to transfer ETH from Binance or another exchange to your BSC wallet. It is important to verify that your chosen exchange supports the conversion from ETH to WETH prior to initiating the withdrawal.

Alternatively, there is the option to utilize a bridging service. These bridging services, which are third-party DApps, take your cryptocurrency and store it on the original blockchain, subsequently creating wrapped tokens on the destination blockchain at a 1:1 ratio.

While bridging tokens generally function well, it is essential to be aware that transferring tokens between different blockchains may carry certain risks. In the past, there have been instances where some bridges had their smart contracts compromised. If you intend to bridge assets like wrapped Bitcoin, wrapped Ethereum, or any other tokens, it is advisable to conduct thorough research on the platform you intend to use for their bridging services.

What Ensures That Wrapped ETH Maintains Its Price Parity With ETH?

The fundamental factor that ensures WETH’s peg with ETH stays stable is its inherent 1:1 convertibility. When WETH is priced lower than ETH, individuals are incentivized to acquire WETH, convert it into the more valuable ETH, and thereby generate profits. This attractive opportunity amplifies the demand for WETH, subsequently driving up its price. Conversely, if WETH’s value surpasses that of ETH, individuals will opt to purchase ETH and convert it into WETH for selling, thereby bolstering the supply of WETH and causing its price to decrease. These fundamental principles of supply and demand work harmoniously to maintain the relative stability of the peg.

Which Decentralized Finance (DeFi) Applications Support the Use of Wrapped Ether (WETH)?

Ethereum offers a plethora of DeFi DApps for you to explore, and these platforms readily accept ERC-20 tokens. One interesting avenue to consider is the addition of WETH to a liquidity pool, which you can find on Decentralized Exchanges (DEX) such as Uniswap. By contributing to the liquidity pool, you open the door to earning fees from users who engage in token swaps through it. Nevertheless, it’s important to be aware that impermanent loss is an ever-present risk that could result in a reduction in the quantity of tokens you’ve deposited. Opting for a pool with a substantial liquidity pool size can mitigate this potential risk.

Alternatively, you may choose to initiate the lending of your WETH on a platform like Aave. Here, fellow users can borrow your tokens, but they must furnish collateral to secure their loan. In return for lending your assets, you’ll accrue interest until the point at which you decide to withdraw your deposit.

Conclusion

Ethereum boasts one of the most well-established and mature DApp ecosystems in existence. Given this extensive ecosystem, WETH becomes an essential component, as numerous ETH holders are eager to utilize their ETH in various DeFi projects. If you’re considering delving into the world of WETH, we strongly advise purchasing it using your ETH or other tokens, as this approach offers a more straightforward and user-friendly experience compared to engaging directly with the wrapping smart contracts.