Decentralized Finance is an unregulated zone. DeFi protocols are a well-known way for scammers to make fast money.

In the wild west of decentralized finance (DeFi), scams are just about everywhere. In this article, you will learn how to check a smart contract and avoid scams.

So what exactly are scams?

Scammers want to take all of your cash to make a profit.

Many of the new protocols being launched have code vulnerabilities that they can use. In 2021 losses from crypto scams jumped 82% to $7.8 billion.

One method to reduce how many of crypto scams within the crypto space is to become familiar with scam schemes and grow your knowledge in crypto security. Check out this guide, and you will be safe.

What are the biggest crypto scam schemes in DeFi?

1. The rug pull

Imagine that most of the token supply is owned by a few investors or developers.

They get to be effective in promoting the coin and creating the hype. One minute your $100 investment is worth $1,500 and right after, it is worth $2. You just got rug-pulled.

What to analyze to steer clear of the rug pull:

- Liquidity (how much liquidity is locked in a smart contract)

- Top holders (the proportion of tokens held by the largest holders)

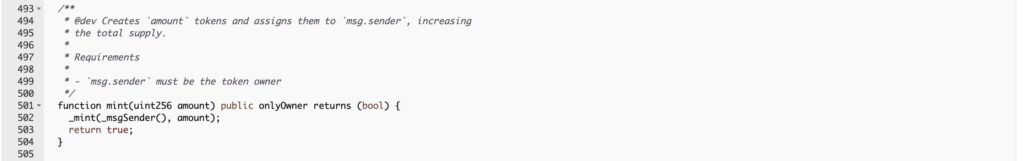

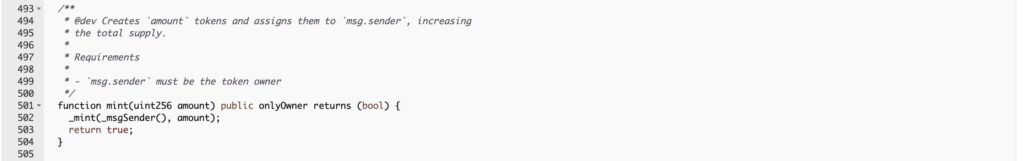

- Mint (if minting functions exist, token developer can create an infinite amount of new tokens anytime)

You may minimize the danger of becoming rug pulled following this quick research in the liquidity pool and token.

2. Honeypot

Oh, what? Honeypot lets funds come in during DEX trades but will never allow them to out. Imagine if you just found a great token and opt to invest some funds in it. A honeypot is a scam method where an attacker uses the smart contract function to lock your ETH or BNB in a liquidity pool after the decentralized exchange trade. How to identify a honeypot?

- Ownership (the current owner of a smart contract).

- Blacklist (if there is a function that will exclude your wallet address from making a transaction)

- Modify Max Tx (this function can lock your maximum transaction amount at 0 so your funds will be locked)

- Modify Fees (if the transaction fees are set at 100% it’s impossible to sell tokens)

- Disable trading (disable token trading)

To identify the honeypot scam, you must first analyze the smart contract code to see if there is a malicious function, then simulate the transaction on the decentralized exchange to check whether or not your funds may be locked in a liquidity pool.

Audited smart contracts

Examining a token’s smart contract audit is an effective way to define its safeness. Today several major companies perform an audit to check the legitimacy of the crypto project. Audited smart contract reduces the chance of attack.

What is the best way to be safe in DeFi?

Ask the right questions and use the correct tools. In this section, we will show how to make a quick analysis of the DeFi token smart contract.

How to analyze the smart contract

In conclusion, a smart (crypto) contract is similar to a legal contract. By reading any type of contract, you should understand the terms and conditions.

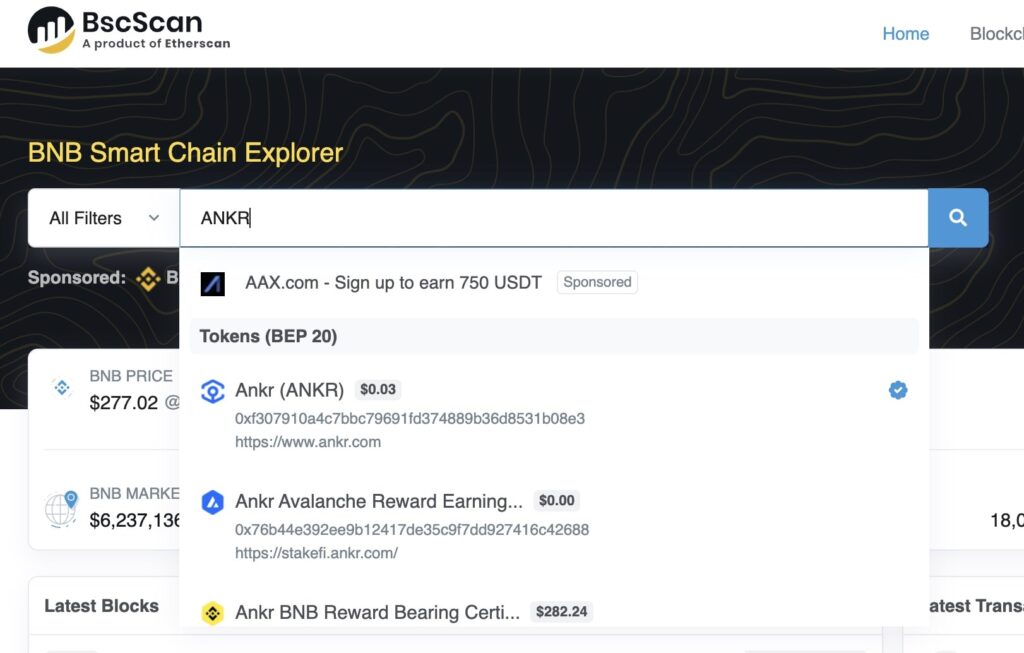

Etherscan (for ERC-20/Ethereum tokens) or BSCscan (for BEP-20/Binance Smart Chain tokens) are the most effective explorers to read the smart contract.

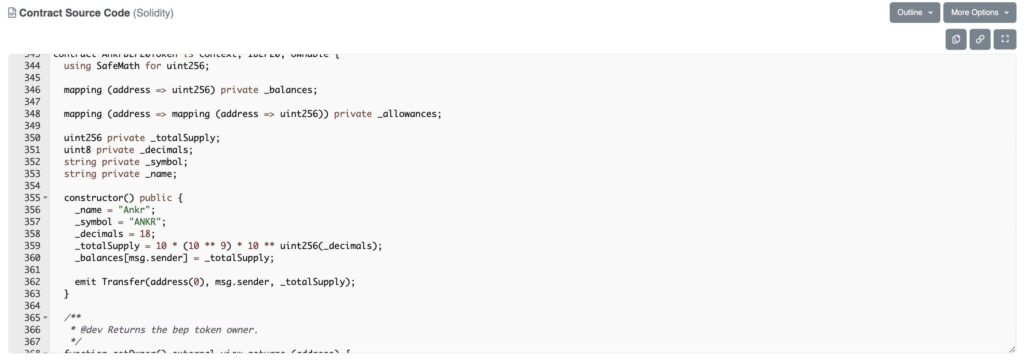

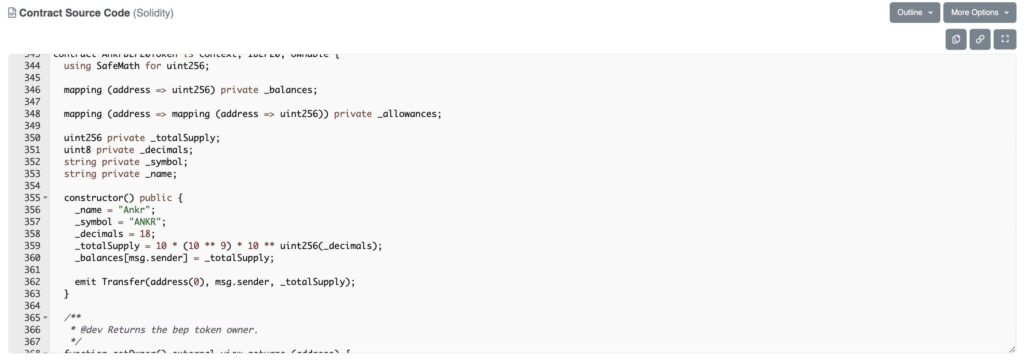

Let’s use the Ankr smart-contract as an example.

By typing ANKR into the search bar, we found the verified Bscscan page.

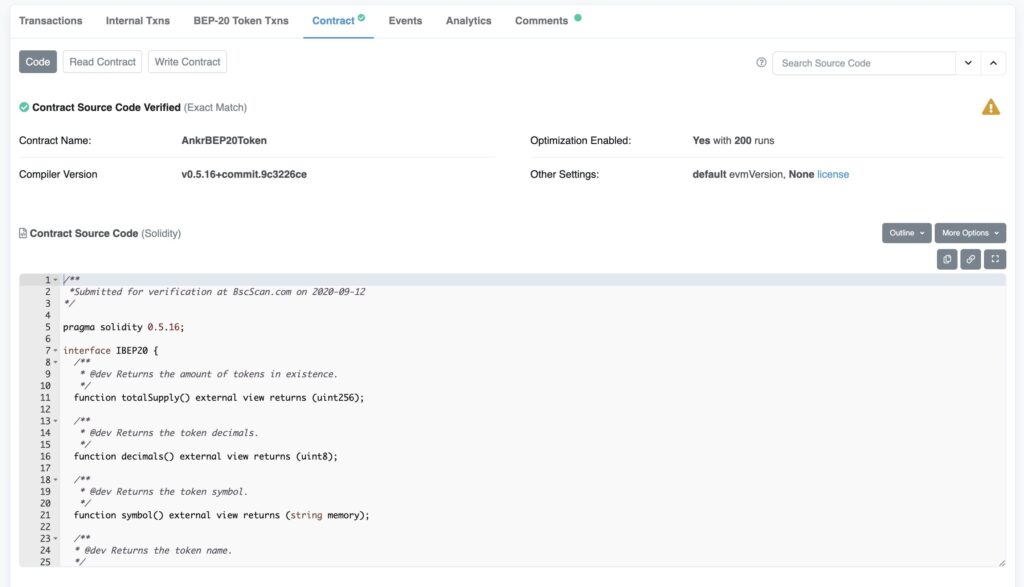

There is a list of tabs on the page, one of which is labeled «Contract».

The ANKR token’s contract can be read here, and it contains a set of functions you can expand and check.

The sections for decimals and totalSupply reveal the following information:

- ANKR is a token with 18 decimals.

- ANKR has a maximum total supply of 10,000,000,000 tokens.

Note: contract owner can create any amount of new tokens, increasing the total supply therefore, you should check the project team in detail before investing.

Another situation, which occurs frequently, is when we compare several smart contracts. A clone, which occurs when users create a new decentralized application or token by copying an already successful project, could be a red flag.

Conclusion

This is obviously just the tip of the iceberg. Checking smart contracts enables us to get answers to our questions about the project’s legitimacy. Remember always to improve your decentralized finance knowledge, and you will be safe!