Table of Contents

- Tribe Capital, a venture capital firm, shows interest in FTX’s reboot plan

- The popularity of meme coins featuring ‘Pepe the Frog’ is surging, as crypto enthusiasts on Twitter shift their attention from their previous obsession with Dogecoin

- Lido is contemplating utilizing its ARB airdrop as a means to increase engagement on Arbitrum

- The Safemoon developer team has reached an agreement with the hacker to return $7.1M in funds

- According to CEO Brian Armstrong, Coinbase may consider relocating from the United States if there is a lack of regulatory certainty

- The securities regulator in the UAE is set to commence receiving license applications from companies operating in the cryptocurrency industry

- Michael Saylor, the CEO of MicroStrategy, has integrated a Bitcoin Lightning address into the company’s email system

- The second set of digital trading card collection has been released by Trump

Tribe Capital, a venture capital firm, shows interest in FTX’s reboot plan

According to Bloomberg, venture capital firm Tribe Capital has shown interest in bankrupt cryptocurrency exchange FTX’s plan to restart operations.

Tribe Capital, which previously invested in FTX, is reportedly considering leading a $250 million fundraise, with $100 million committed from itself.

The firm’s co-founder, Arjun Sethi, met with FTX’s official committee of unsecured creditors in January to discuss an informal proposal.

FTX’s creditors’ committee stated on Twitter that they are evaluating all options to reboot or sell the exchange and create value for creditors.

FTX’s current chief, John J. Ray III, has expressed interest in restarting the exchange, but no formal process has been launched yet.

FTX’s exchange token, FTT, surged by as much as 23% following the news of Tribe Capital’s bid.

The popularity of meme coins featuring ‘Pepe the Frog’ is surging, as crypto enthusiasts on Twitter shift their attention from their previous obsession with Dogecoin

Traders on Crypto Twitter who are known for taking high risks are shifting their focus from Shiba Inu-themed tokens to those that feature the popular internet meme, Pepe the Frog.

The Pepe (PEPE) token, which was launched on Sunday, has experienced a remarkable surge of over 21,000% in value over the past three days.

This has resulted in trading volumes of $30 million on Uniswap and a market capitalization of as high as $33 million on Tuesday morning.

According to the Pepe website, this token is the most memeable memecoin in existence and it is time for Pepe to take over from the previously popular Dogecoin.

As of Tuesday, blockchain tracker Etherscan has recorded that Pepe has 10,000 individual holders, indicating that many investors have participated in the ongoing frenzy and are hoping to make a profit from the token.

Lido is contemplating utilizing its ARB airdrop as a means to increase engagement on Arbitrum

The Lido DAO community has the option to vote on whether or not to accept the Abitrum airdrop and use the received ARB tokens as emission rewards, which would serve as an incentive for utilizing wrapped staked ether (wstETH) in the Arbitrum ecosystem.

In March, Arbitrum distributed its governance token ARB to early adopters of its layer 2 scaling system, including decentralized autonomous organizations (DAOs) such as Lido, who contributed to the development and success of Arbitrum.

Lido’s head of decentralized finance (DeFi) business development and partnerships, Justin David Reyes, submitted a proposal on April 12 suggesting that the Lido community vote on operational and strategic matters concerning the claiming and efficient usage of the ARB tokens.

Reyes recommends distributing ARB tokens to users who provide liquidity for wstETH pools on Arbitrum.

Lido’s marketing lead, Kasper Rasmussen, explained that the incentive program would operate similarly to how liquidity pools currently earn additional LDO rewards on top of staking rewards.

Rasmussen mentioned that the proposal may go to a vote later this week.

The Safemoon developer team has reached an agreement with the hacker to return $7.1M in funds

On-chain data shared by SafeMoonSpidey, an anonymous Twitter user, reveals that a hacker who exploited Safemoon’s decentralized finance protocol has committed to returning 80% of the stolen funds, which amount to $7.1 million.

In the incident that took place last month, the hacker took advantage of a vulnerability in the smart contracts, draining Safemoon’s liquidity pool of SFM tokens worth almost $9 million.

The Safemoon development team kept the community informed of the situation via on-chain transactions available on the Binance Smart Chain block explorer.

The hacker and the Safemoon team reached an agreement where the hacker will receive a 20% bug bounty, and no legal action will be taken against them.

Safemoon’s SFM token has experienced a 2.8% increase in value in the past 24 hours.

According to CEO Brian Armstrong, Coinbase may consider relocating from the United States if there is a lack of regulatory certainty

At Fintech Week in London, Coinbase CEO Brian Armstrong suggested that the cryptocurrency exchange may contemplate leaving the United States if there is no greater regulatory clarity.

Armstrong stated that “anything is on the table” and that the company may need to relocate or take other measures.

He believes that the United States could be an essential market for cryptocurrency, but the lack of regulatory clarity is problematic. If the situation does not improve in the next few years, the company may need to invest more elsewhere in the world.

Armstrong compared the regulatory environment in the United Kingdom, which has a single regulator, the Financial Conduct Authority, with the United States, where the Commodity Futures Trading Commission and the Securities and Exchange Commission operate independently.

He emphasized the importance of having a clear regulatory framework to allow businesses to operate effectively.

Armstrong’s comments come on the heels of Bittrex’s decision to leave the United States due to the current regulatory and economic environment.

The SEC filed a lawsuit against Bittrex in March, citing evidence of legal violations.

The securities regulator in the UAE is set to commence receiving license applications from companies operating in the cryptocurrency industry

As per the announcement made on Monday, the federal securities regulator of the United Arab Emirates (UAE) is going to start accepting applications from companies that wish to provide cryptocurrency services in the country.

However, virtual-asset service providers that are already licensed in the UAE’s financial-free zones are exempted from this requirement.

The UAE Council of Ministers approved the licensing regime last year, and the Securities and Commodities Authority (SCA) was entrusted with regulating the sector earlier this year.

While Dubai and Abu Dhabi already have licensing frameworks for crypto companies, the SCA’s approval is mandatory for all virtual-asset service providers, except for the ones that operate in the financial-free zones.

To obtain authorization, firms will have to demonstrate “operational efficiency and flexibility,” and meet certain operational standards.

Additionally, companies seeking to operate in Dubai must obtain a license from its Virtual Assets Regulatory Authority in addition to the SCA’s approval.

The virtual-asset rule book has been amended, effective from 2022, to include financial activities such as brokerage and custody of virtual assets, as well as a new category of the virtual-asset service provider.

Michael Saylor, the CEO of MicroStrategy, has integrated a Bitcoin Lightning address into the company’s email system

Michael Saylor, the co-founder of MicroStrategy and a vocal supporter of Bitcoin, has incorporated the Lightning Network into his corporate email address, allowing anyone to send him Bitcoin by using the email address saylor@microstrategy.com.

The integration uses The Lightning Address protocol, which replaces a standard Lightning invoice with an internet identifier such as an email address.

The Lightning Network is a layer 2 scaling system on the Bitcoin blockchain that aims to make Bitcoin payments faster and cheaper.

Saylor, who is reportedly worth $1.2 billion and whose company holds approximately 140,000 BTC (worth around $4 billion), has received small Bitcoin donations from supporters after promoting the integration on Twitter.

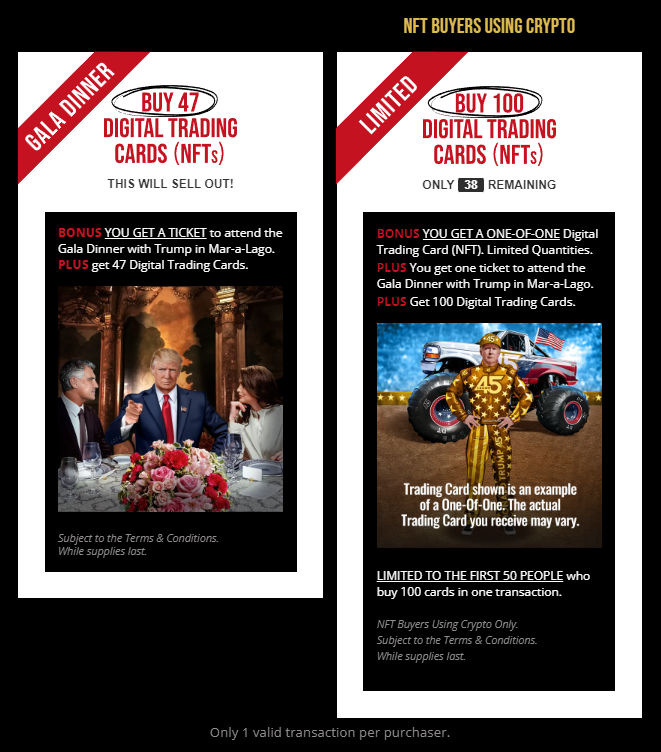

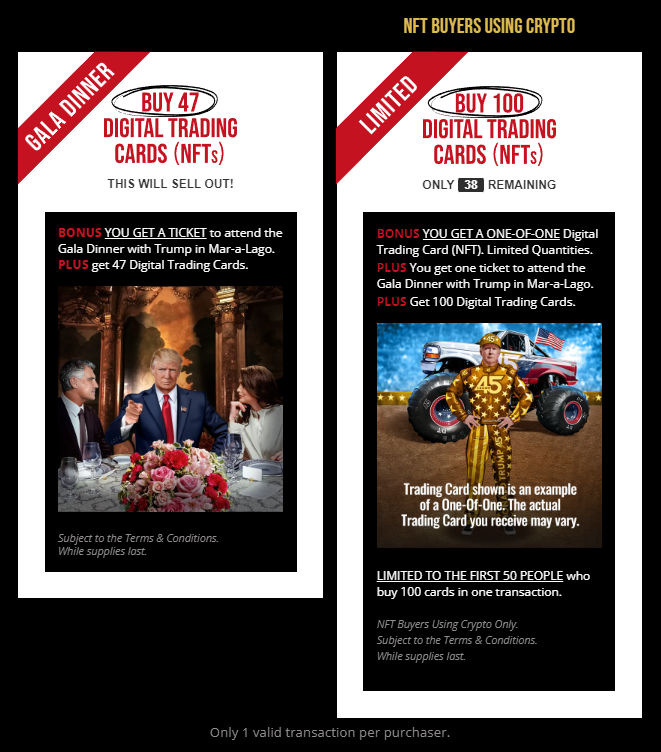

The second set of digital trading card collection has been released by Trump

Despite facing recent charges, Donald Trump has not slowed down in pursuing his Web3 aspirations.

The former US president recently announced the release of the “Series 2” of his NFT collection, Trump Digital Trading Cards.

Trump revealed the news on his social media platform, Truth Social, informing his followers that following the success of the first series, he has expanded the collection with a second release, which is now available to collectors.

The tokens will be minted on the Polygon blockchain and will retain their original price of $99, but with different art, rarity traits, and utility features.

Series 2 includes 47,000 non-fungible tokens, 2,000 more than the first series, which some speculate could be a reference to his ambition to become the 47th president once again.

The Trump Digital Trading Card website explains that no ten tokens will have the same features.

Instead of sweepstakes, collectors who purchase 47 tokens can claim a dinner with Trump at his Mar-a-Lago resort in Florida.

Collectors who purchase 100 tokens with cryptocurrency will earn the dinner and unique Trump-themed artwork.

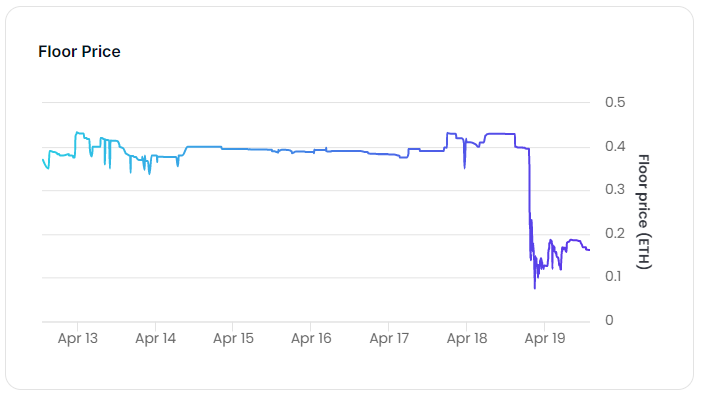

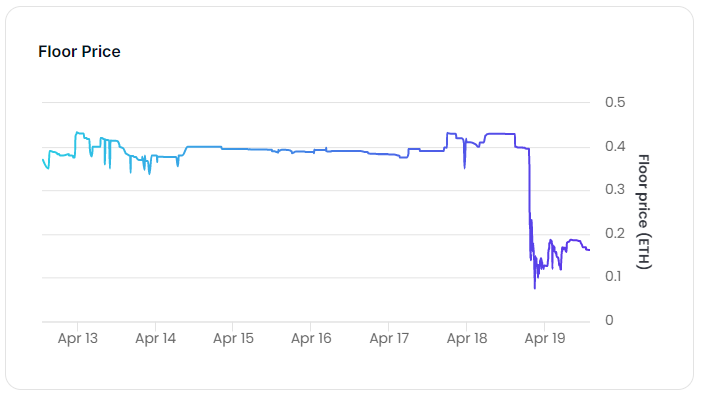

However, the news of the upcoming collection caused the original collection’s floor price on the secondary market OpenSea to plummet by half its value, dropping from almost 0.4 ETH ($840) to 0.2 ETH (around $420).