Table of Contents

- Societe Generale’s Crypto Division has launched a stablecoin backed by the euro on the Ethereum network

- Berachain, a Layer 1 blockchain platform with a focus on Decentralized Finance (DeFi), has secured $42 million in its Series A funding round with a valuation of $420.69 million

- Coinbase, a cryptocurrency exchange, has been granted a license to conduct operations in Bermuda

- Do Kwon, the Co-Founder of Terraform Labs, has been indicted in Montenegro

- The Dutch court has ruled that Pertsev, the developer of Tornado Cash, can be released on bail while awaiting trial

- The decentralized crypto exchange aggregator, 1inch, is set to launch on the Ethereum Rollup zkSync Era

- MoonPay will collaborate with Ethereum Name Service to develop a fiat on-ramp

- According to Dune Data, sales and user activity in NFT marketplaces have decreased to levels that were last observed in 2021

Societe Generale’s Crypto Division has launched a stablecoin backed by the euro on the Ethereum network

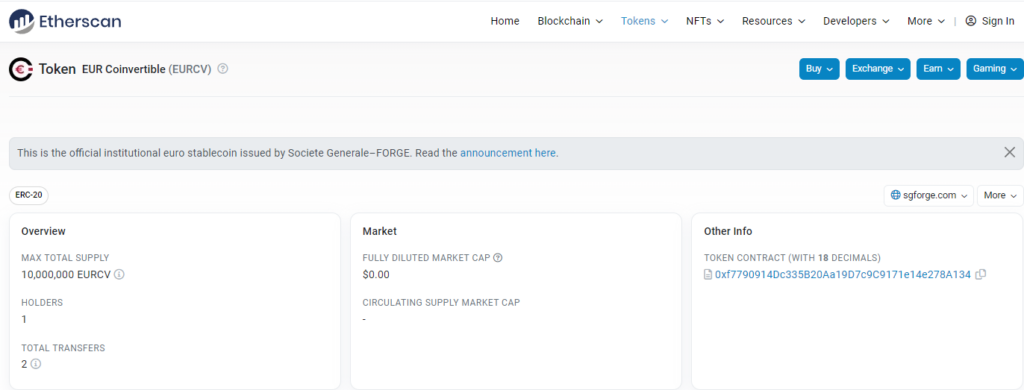

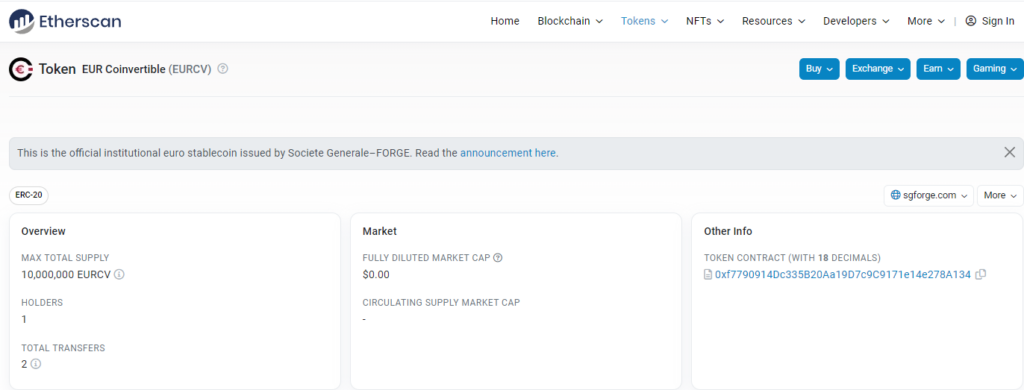

SG Forge, the crypto division of Societe Generale (GLE), has launched EUR CoinVertible (EURCV), a stablecoin pegged to the euro (EUR) on the Ethereum network.

This marks the first time such an asset has been deployed on a public blockchain.

The stablecoin will be offered to institutional clients as a way to bridge the gap between traditional capital markets and digital assets.

According to SG Forge, the launch is in response to growing client demand for a secure settlement asset for on-chain transactions and on-chain liquidity funding and refinancing. While JPMorgan’s in-house stablecoin has been in use since 2020 as a settlement token between financial institutions, it trades on the bank’s internal Onyx network and not a public blockchain.

SG Forge won registration from France’s Autorité des Marchés Financiers (AMF) last September to offer cryptocurrency trading and custody services, underscoring the growing institutional adoption of digital assets in France.

Berachain, a Layer 1 blockchain platform with a focus on Decentralized Finance (DeFi), has secured $42 million in its Series A funding round with a valuation of $420.69 million

On Thursday (4/20), Berachain, a layer 1 blockchain that focuses on DeFi, announced that it raised $42 million in its Series A funding round with a valuation of $420.69 million.

The funding round was finalized in December and was led by Polychain Capital.

Other investors included Hack VC, dao5, Tribe Capital, Shima Capital, CitizenX, and Robot Ventures, as well as several undisclosed centralized crypto exchanges.

Berachain claims that its technology will allow staked assets to be utilized in DeFi protocols, resulting in increased liquidity and capital efficiency on-chain.

Currently, staked assets, such as staked ether (ETH), are locked while being used to secure the underlying blockchain’s network.

Berachain claims that its “proof of liquidity” consensus will enable users to stake assets on Berachain and use them to trade, borrow, or lend on-chain simultaneously.

As per the press release, the Bera ecosystem has already committed over $250 million in capital to deploy, and a public incentivized testnet will launch in the coming weeks.

Berachain will also launch its native gas token, BERA, and its governance token, BGT. The ecosystem will also include a stablecoin, HONEY.

Coinbase, a cryptocurrency exchange, has been granted a license to conduct operations in Bermuda

As part of its efforts to expand internationally, Coinbase (COIN) announced in a blog post on Wednesday that it has been granted a license to operate in Bermuda.

The cryptocurrency exchange obtained a Class F license from the Bermuda Monetary Authority (BMA), allowing it to function as a digital asset exchange in the region.

This development follows Coinbase CEO Brian Armstrong’s recent comments that the company would consider relocating outside of the US if clear crypto regulations are not established.

Coinbase was reportedly in talks with institutional clients in March to create a crypto-trading platform overseas.

However, it remains unclear at this time which specific services Coinbase will offer in Bermuda.

Do Kwon, the Co-Founder of Terraform Labs, has been indicted in Montenegro

According to a report by Bloomberg Law citing Montenegrin newspaper Vijesti, prosecutors in Montenegro have proposed an indictment against Do Kwon, the Co-Founder of Terraform Labs.

Kwon and Terraform Labs’ Chief Financial Officer Han Chang-Joon were arrested in Montenegro last month and charged with forgery.

It is currently uncertain to which country Kwon will be extradited as a request has been made. Kwon is facing criminal charges in his home country of South Korea as well as in the United States.

Following the collapse of the Terra ecosystem last summer, Kwon had been evading authorities, which caused a stir in the cryptocurrency markets.

The Dutch court has ruled that Pertsev, the developer of Tornado Cash, can be released on bail while awaiting trial

A Dutch court has granted Alexey Pertsev, a Russian developer who contributed to the Tornado Cash privacy protocol, the opportunity to await trial from his home.

He was taken into custody in August at the request of the Dutch financial crime authority FIOD.

He will be released on the following Wednesday with the condition of having electronic monitoring devices installed at his home.

Though he will be required to wear an ankle bracelet, no financial security will be necessary.

The U.S. Treasury Department’s Office of Foreign Assets Control had previously sanctioned Tornado Cash just prior to Pertsev’s arrest, claiming that it had been used to raise money for the North Korean government.

The Dutch public prosecutor had originally expressed concerns that Pertsev could be a flight risk and conceal evidence if he was released, but more recently made specific allegations that he had laundered over 500,000 ether (ETH) of criminal origin, which Pertsev has denied.

The court will examine Pertsev’s residency status, which may expire in July, at the next hearing on May 24th.

The decentralized crypto exchange aggregator, 1inch, is set to launch on the Ethereum Rollup zkSync Era

1inch, a decentralized exchange (DEX) aggregator, is set to release its platform on zkSync Era, the recently launched Ethereum scaling network developed by Matter Labs.

By leveraging zero-knowledge cryptography, zkSync Era enables faster transaction speeds and lower fees on the Ethereum network.

It is part of a rapidly growing category of Ethereum scaling chains known as zkEVMs that claim to support any application currently based on Ethereum.

With this move, 1inch joins the ranks of major crypto applications that have launched on a zkEVM. Both zkSync Era and its primary competitor, Polygon zkEVM, are currently in beta mode but have opened their doors to developers.

1inch, which raised $175 million in a series B funding round in 2021, is best known for its decentralized finance (DeFi) protocol that includes an exchange aggregator, allowing traders to discover the best prices across various DEX platforms.

DEXs are blockchain-based trading platforms that use smart contracts to facilitate the swapping of cryptocurrencies, rather than relying on centralized intermediaries.

In addition to its DEX aggregator, 1inch is also launching its limit order protocol on zkSync Era.

At present, Era is the leading zkEVM in terms of total value locked, with around $250 million worth of cryptocurrency circulating in its DeFi ecosystem according to L2beat, a platform that tracks Ethereum’s layer 2 scaling chains.

In contrast, Polygon zkEVM has only $4 million, and other zkEVM builders such as ConsenSys and Scroll have yet to launch on Ethereum’s main chain.

MoonPay will collaborate with Ethereum Name Service to develop a fiat on-ramp

Ethereum Name Service (ENS), a digital identity protocol, has announced its partnership with MoonPay, a Web3 payments company, to create an on-ramp for users who want to buy an .eth domain name using fiat currency.

With this collaboration, users can purchase and register their .eth domain name directly using MoonPay’s payment service, eliminating the need to first acquire ether (ETH) and set up a cryptocurrency wallet, which can be complex for non-tech-savvy individuals.

ENS is a domain name protocol that operates on the Ethereum blockchain, providing users with a readable name such as “xyz.eth” instead of a lengthy or complicated alphanumeric address tied to a crypto wallet, making it easier to transfer and receive cryptocurrency to those abbreviated addresses.

Nick Johnson, the founder and lead developer at ENS, stated that the goal of this integration is to offer a payment solution that removes this barrier by allowing users to utilize payment options they are familiar with, such as Apple Pay and Google Pay.

By simplifying the process as much as possible, this partnership will not only promote mainstream adoption of decentralized financial applications but also Web3 as a whole.

According to Dune Data, sales and user activity in NFT marketplaces have decreased to levels that were last observed in 2021

Data collected from the Dune Analytics platform indicates that there has been a drop in both daily users and sales in non-fungible token (NFT) marketplaces over the past week.

This decline has led to new lows not seen since July 2021.

The number of unique users on top NFT marketplaces such as Blur, OpenSea, and LooksRare has been consistently decreasing over the last seven days, reaching 7,805 on April 19. Similarly, the number of sales has also declined, with only 16,149 sales recorded on April 19. This is the lowest number of sales since November 9, 2021.

The decline in users and sales appears to be affecting both OpenSea and Blur.

For instance, Blur’s sales and daily unique users decreased to 5,688 and 1,777, respectively, on April 19.

OpenSea’s daily traders count has also sharply dropped, reaching 10,640 on April 18, a level that hasn’t been observed since July 2021.

However, it’s worth noting that trading volume in ether (ETH) across NFT marketplaces has remained relatively stable over the last 30 days, according to Dune data.

Furthermore, compared to the number of daily active users across OpenSea and Blur, Uniswap has gained daily active users over the past two weeks, as per SeaLaunch.