Table of Contents

- Amidst The Soaring Price of MKR Tokens, The Venture Capital Firm a16z Sells $7 Million Worth of MKR Tokens

- Dogecoin Experiences a 10% Surge Amid Speculation Surrounding X Payments, While DOGE Futures Traders Suffer a $10M Loss

- Bridge Protocol LayerZero Achieves a Milestone by Successfully Processing Over 50 Million Cross-Chain Messages

- ZkSync’s Main Lender Falls Victim to a $3.4M Exploit

Amidst The Soaring Price of MKR Tokens, The Venture Capital Firm a16z Sells $7 Million Worth of MKR Tokens

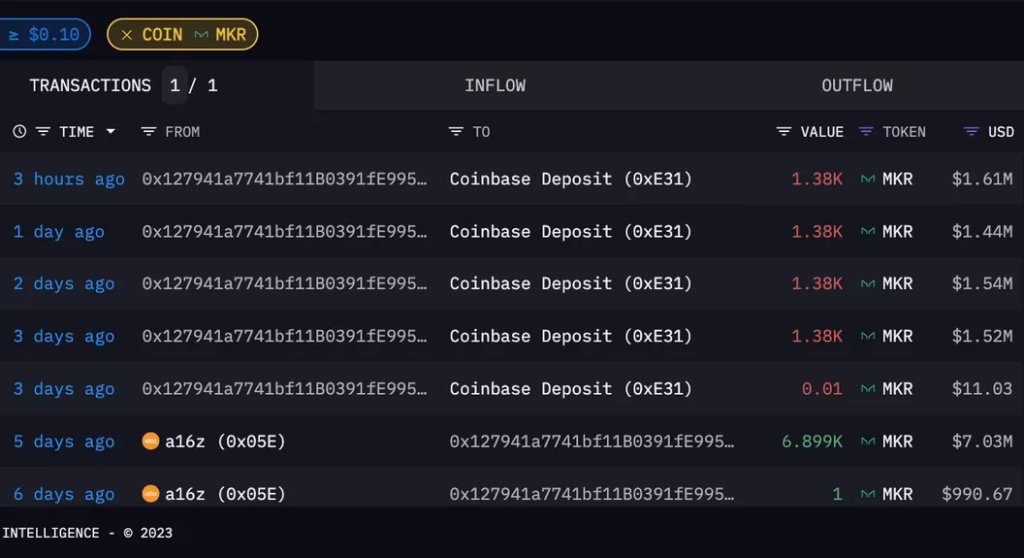

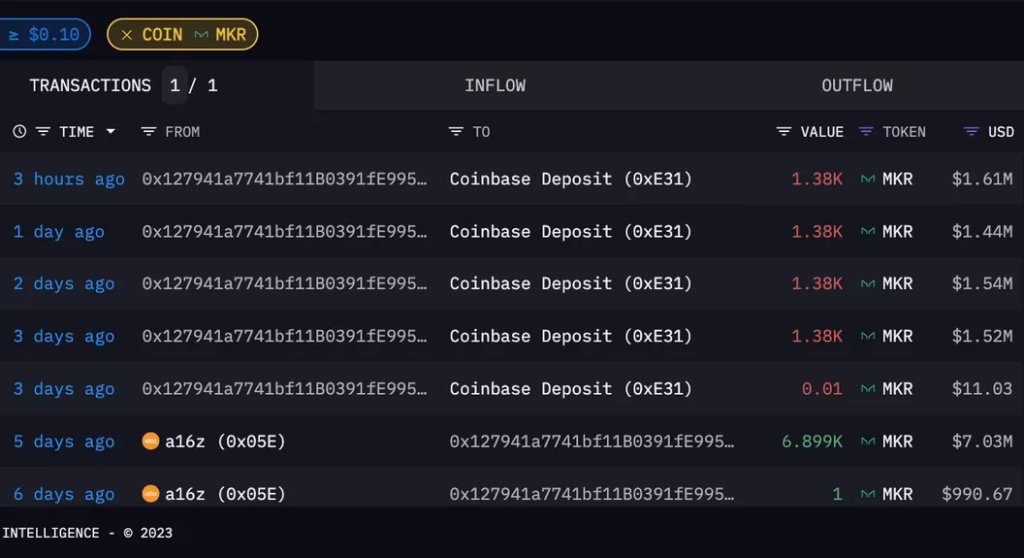

Blockchain data reveals that the prominent venture capital firm Andreessen Horowitz (a16z) is divesting a portion of its investment in MakerDAO’s MKR governance tokens due to a significant surge in the token’s value, reaching a nearly one-year high.

Approximately $7 million worth of MKR tokens were transferred from a16z’s crypto wallet to a new address late on Thursday, as reported by the Ethereum blockchain monitoring website Etherscan.

Subsequently, the new wallet deposited batches of 1,380 tokens daily, equivalent to approximately $1.5 million, into the cryptocurrency exchange Coinbase.

Typically, sending tokens to an exchange signifies an intention to sell.

As of Tuesday, deposits from this wallet to Coinbase totaled $6.1 million, with the most recent transaction occurring on at Tuesday 14:18 UTC.

Despite this development, a representative from a16z has not yet responded to inquiries for comment.

The transactions coincide with MKR’s remarkable surge on Friday, reaching its highest value in nearly a year, surpassing $1,200.

This surge occurred following the implementation of a new token buyback scheme designed to remove coins from circulation, effectively reducing their overall supply. Subsequently, the token’s value retreated somewhat, falling to as low as $1,040 on Monday, before rebounding by 10% to its current price of $1,140.

MakerDAO stands as one of the leading decentralized finance (DeFi) lending platforms and the issuer of the $4.6 billion stablecoin, DAI.

The platform is managed by a decentralized autonomous organization (DAO), allowing MKR token holders, including a16z, to partake in governance-related decision-making.

Notably, a16z was a significant investor in MakerDAO, purchasing 6% of MKR’s total supply for $15 million in September 2018.

The protocol is undergoing a substantial restructuring led by founder Rune Christensen, known as the “Endgame Plan.”

This plan includes the division of the protocol’s units into smaller, autonomous entities (SubDAOs) with the potential to issue their own tokens.

In October, a16z opposed the plan to create new units, arguing that the existing structure already achieved sufficient decentralization.

Nevertheless, the community members favored the proposed changes in a governance vote.

Following the recent transactions, a16z’s crypto wallets still retain 12,395 MKR tokens, representing 1.3% of the circulating supply and valued at $14 million, as per data from blockchain forensics platform Arkham Intelligence.

Dogecoin Experiences a 10% Surge Amid Speculation Surrounding X Payments, While DOGE Futures Traders Suffer a $10M Loss

On the second consecutive day, Dogecoin (DOGE) saw a surge in value, driven by speculation that the meme coin would have a more significant role on the newly rebranded X platform.

According to CoinGecko data, DOGE experienced a notable 10% increase, reaching over 7.7 cents in the past 24 hours, with a trading volume of $2.3 billion.

A substantial portion of these trades occurred on the South Korean exchange UpBit, which is known for attracting speculative plays, particularly against the Korean won trading pair. However, during this rally, futures traders suffered losses of nearly $10 million, as per data from Coinglass.

Industry analysts believe that Twitter, which recently rebranded to the “everything app” X, may soon accept DOGE tokens in the coming months.

This speculation is driven by owner Elon Musk’s apparent fascination with the meme coin. Kryptomon Chief Marketing Officer, Tomer Nuni, explained that there are expectations that advertisers could use DOGE for purchasing ads and for other purposes on Twitter, similar to how Tesla allowed DOGE payments for their products.

There is a possibility that Musk’s other businesses and holdings might also start accepting cryptocurrencies as Tesla does.

This speculation has some basis, as Musk had previously hinted at DOGE payments on Twitter.

He proposed dogecoin as one of the payment options for Twitter Blue, the platform’s subscription service with premium features.

Moreover, Tesla already accepts DOGE payments for merchandise purchases in their store. While Musk’s primary focus for Twitter payments is fiat currencies, there is an intention to add cryptocurrencies later, according to a January report, where Twitter was developing a payment system for its platform.

Bridge Protocol LayerZero Achieves a Milestone by Successfully Processing Over 50 Million Cross-Chain Messages

On Tuesday, the Bridge protocol LayerZero achieved a significant milestone by surpassing 50 million messages exchanged among various blockchains, marking a remarkable achievement for this interoperability platform.

This accomplishment follows LayerZero Labs, the development team behind LayerZero, raising $120 million from 33 backers, which included prominent names like Andreessen Horowitz, Christie’s auction house, Sequoia Capital, and Samsung Next.

LayerZero’s success highlights the growing demand among cryptocurrency users for seamless liquidity transfers between different chains and the ability to conduct cross-chain token swaps, despite potential vulnerabilities.

It’s worth noting that Bridge exploits resulted in the theft of over $2 billion in assets during the year 2022, as reported by blockchain analytics firm Chainalysis.

ZkSync’s Main Lender Falls Victim to a $3.4M Exploit

According to blockchain security firm CertiK, EraLend, the leading lending protocol on Ethereum’s zkSync blockchain, has fallen victim to a read-only reentrancy attack, resulting in a $3.4 million loss.

Following the exploit, the total locked capital on EraLend dropped from $18.5 million to $10.75 million, as reported by DefiLlama data.

In response to the incident, EraLend issued a tweet confirming the security breach and stating that they have contained the threat.

As a precautionary measure, they have suspended all borrowing operations and warned against depositing USDC.

The platform is actively collaborating with partners and cybersecurity firms to resolve the issue, with further updates to follow.

A read-only reentrancy bug is a type of vulnerability that allows attackers to manipulate asset prices by repeatedly flooding a smart contract with calls, ultimately resulting in asset theft.

Notably, Conic Finance, another decentralized finance (DeFi) protocol, was also targeted by a similar attack the previous week, causing a total loss of $3.6 million.