Table of Contents

- Binance has halted withdrawals due to network congestion on the Bitcoin network

- The U.S. Department of Justice is conducting an investigation into Binance for potential violations related to sanctions imposed on Russia

- Voyager Digital intends to sell off its assets and gradually shut down its operations after its aspirations of a sale were shattered

Binance has halted withdrawals due to network congestion on the Bitcoin network

Binance, the world’s largest cryptocurrency exchange, temporarily halted bitcoin (BTC) withdrawals on Sunday due to high network congestion and fees.

Within two hours of announcing the pause on Twitter, the company resumed withdrawals.

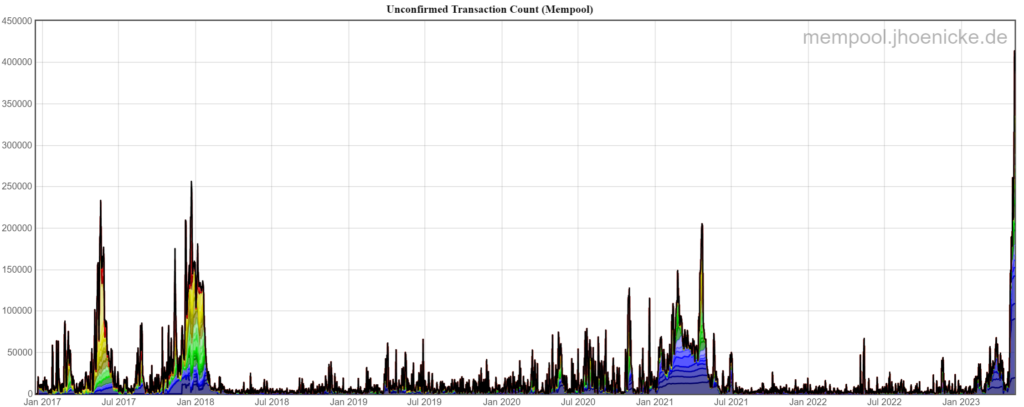

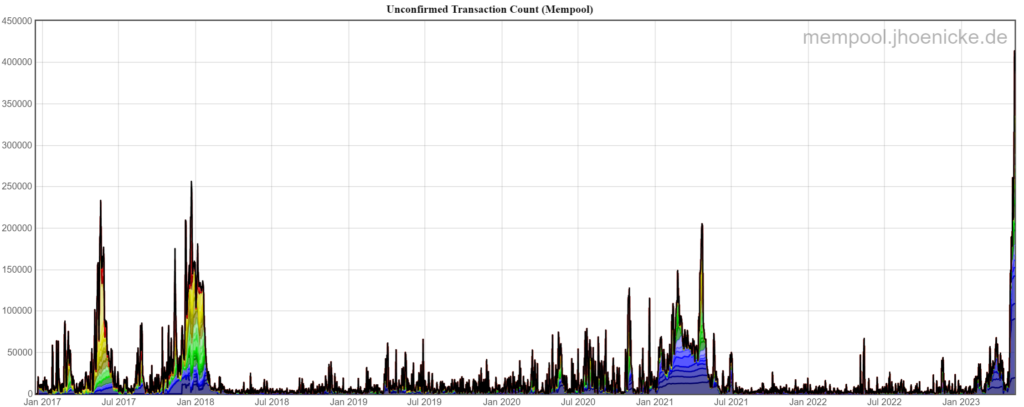

On-chain data reveals that there are almost 400,000 unconfirmed Bitcoin transactions, which is higher than the levels seen during the bull runs of 2018 and 2021.

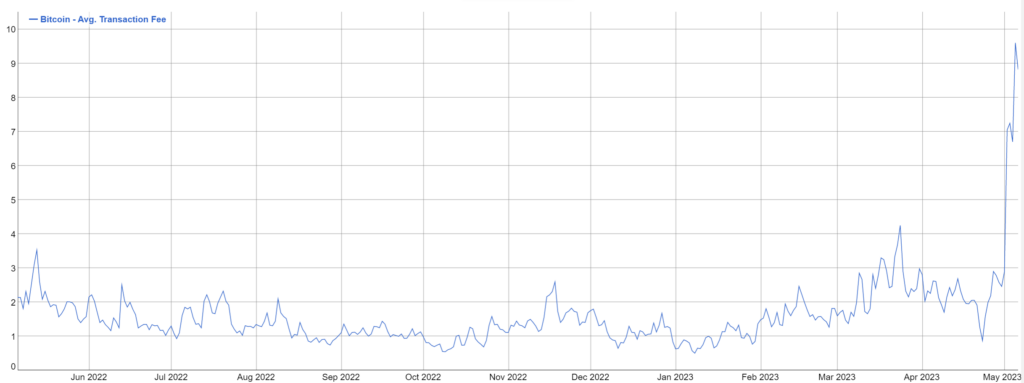

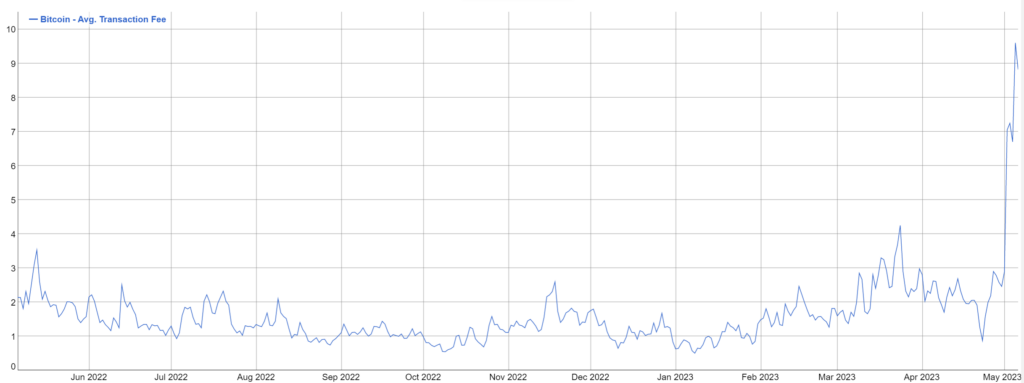

The average transaction fee has also doubled since March, reaching a two-year high of just over $8.

This represents a 309% increase from a year ago.

According to Colin Harper, head of content at Luxor Technologies, the current spike in fees is an anomaly caused by the adoption of the BRC-20 standard for inscription tokens, which has driven fees up.

There are currently 14,000 tokens with a total market cap of $482 million using this standard.

The U.S. Department of Justice is conducting an investigation into Binance for potential violations related to sanctions imposed on Russia

According to a report by Bloomberg, five people familiar with the matter have said that the U.S. Department of Justice’s national security division is investigating whether Binance allowed Russian customers to access its exchange in violation of U.S. sanctions related to Russia’s invasion of Ukraine.

This inquiry is another blow to Binance, which has already been investigated by the Internal Revenue Service and the U.S. Securities and Exchange Commission over other matters. Binance claims to comply fully with all financial sanctions, but the Justice Department has declined to comment on the investigation.

The exchange has also been sued by the U.S. Commodity Futures Trading Commission for allegedly offering unregistered crypto derivatives products in the U.S. Despite these allegations, Binance has boasted of having the world’s largest compliance team and claims to be able to handle a high volume of law enforcement requests.

Recently, Binance has also claimed to have kept North Koreans off its exchange and denied allegations that it cooperated with Israel in seizing accounts with alleged ties to terrorist groups.

Voyager Digital intends to sell off its assets and gradually shut down its operations after its aspirations of a sale were shattered

Voyager Digital’s attorneys have revealed that the bankrupt cryptocurrency lender will undergo a process of self-liquidation and gradual cessation of operations after failing to finalize a sale deal with either Binance.US or FTX US.

The announcement was made in a court filing on Friday, ten days after Binance.US pulled out of the $1 billion deal due to a U.S. government intervention.

Before the Binance.US deal, Voyager had an agreement to sell itself to FTX, but the transaction fell apart when FTX filed for bankruptcy protection in November.

According to the filing, Voyager’s customers will initially receive a recovery rate of only 36% of their cryptocurrency holdings, which is significantly lower than the estimated 72-73% recovery rate if either of the acquisition plans were successful, as well as the recovery rates for creditors of other bankrupt cryptocurrency platforms.

The recovery rate could potentially increase if Alameda Research’s attempt to recover $446 million from Voyager’s estate fails.

Voyager’s lawyers have reserved $446 million of the estate’s holdings for the Alameda suit and an additional $259.6 million for litigation costs, administrative claims, and other “holdback.”

Customers who have any of the 67 “supported” tokens, including bitcoin (BTC) and ether (ETH), stuck on the platform will be able to withdraw the allowable percentage of their cryptocurrency directly.

For those with any of the 38 “unsupported tokens,” including Solana’s SOL and Algorand’s ALGO, Voyager will liquidate everything and pay customers back with USD coin (USDC), a stablecoin.

Objections to the planned liquidation process must be submitted to the U.S. Bankruptcy Court of the Southern District of New York (SDNY) by May 15 at 4 p.m. ET (20:00 UTC).