Table of Contents

- Blockchain data reveals that Justin Sun transferred MakerDAO’s tokens worth $4.3 million to Binance

- Ledger postpones its key-recovery service following a public outcry

- Ongoing legal expenses of FTX CEO suggest a potential ‘2.0 Reboot’ in the works

- Starting from June 1, the Hong Kong Securities Regulator will begin accepting license applications from crypto exchanges

Blockchain data reveals that Justin Sun transferred MakerDAO’s tokens worth $4.3 million to Binance

Earlier this week, Justin Sun, the founder of the Tron network and a prominent crypto investor, transferred approximately $4.3 million worth of MakerDAO’s maker (MKR) tokens to the cryptocurrency exchange Binance.

The transfer was revealed through blockchain data obtained from Arkham Intelligence, which indicated that a wallet associated with Justin Sun sent 6,802 MKR tokens to a Binance account.

It is important to note that the spot market for MKR is characterized by limited liquidity, meaning that significant sell orders can have a substantial impact on the token’s price.

According to data from Cryptowatch, placing a sell order of 525 MKR on the MKR/USDT pair on Binance, the most liquid market for the token, could potentially cause a 2% decline in its price.

MKR serves as the governance token for MakerDAO, a major decentralized finance (DeFi) protocol known for issuing the $4.7 billion DAI stablecoin.

As of now, MKR has been trading at around $621, according to CoinGecko data.

Sun’s token transfer coincides with MakerDAO’s ongoing overhaul of its governance structure, referred to as the “Endgame” process.

Spearheaded by protocol founder Rune Christensen, this restructuring involves the fragmentation of the decentralized autonomous organization (DAO) into smaller self-governing entities called SubDAOs.

These entities will issue their own tokens, while the DAI stablecoin and MKR governance tokens will be upgraded and renamed.

Additionally, MakerDAO aims to increase its investment in real-world assets using its substantial reserves.

Although the Endgame plan was approved through a governance vote, it faced criticism from community members and investors, leading to the resignation of several delegates and developers over the past few months.

In March, Arkham’s blockchain data revealed that Paradigm Capital, a significant investor in the protocol, sold approximately $20 million worth of MKR, with the tokens eventually ending up in a Coinbase deposit address.

Ledger postpones its key-recovery service following a public outcry

In response to strong criticism from the cryptocurrency community, hardware wallet provider Ledger has decided to postpone the release of its key recovery feature.

Ledger CEO Pascal Gauthier conveyed in a letter to users that the company will not introduce the feature until the code is released.

To address the issue, Ledger has also scheduled a Twitter Spaces session on Tuesday at 12:30 p.m. EST.

Last week, Ledger unveiled a service called Ledger Recover, which enables users to securely store encrypted backups of their seed phrases with three custodians.

This feature would allow Ledger owners to recover their private keys even if they misplaced or forgot their seed phrases.

However, the announcement drew immediate backlash from the cryptocurrency community, as sharing seed phrases with third parties was heavily criticized.

Numerous individuals expressed their discontent through social media platforms such as Twitter and Reddit, feeling betrayed by Ledger’s previous assurances that private keys would never leave the device.

Concerns were raised about potential risks, including custodian hacks, data leaks from KYC providers and law enforcement gaining control over Ledger users’ data.

Critics also pointed out the lack of open-source code for the Recover feature, making it impossible to verify the safety of the proposed custody mechanism.

Unlike some competitors, Ledger does not make all its code publicly available but instead subjects its product to testing by selected security researchers.

Gauthier acknowledged the company’s learning experience in his letter to users, stating that parts of the Ledger code had been open-sourced before, with more to follow soon.

Gauthier emphasized the importance of offering key recovery services to attract a new wave of cryptocurrency users who might find self-custody challenging.

He stated that a significant number of current crypto users either do not possess their private keys or expose them to risks by employing less secure methods of self-custody and storing their seed phrases in complex and inconvenient ways.

Ongoing legal expenses of FTX CEO suggest a potential ‘2.0 Reboot’ in the works

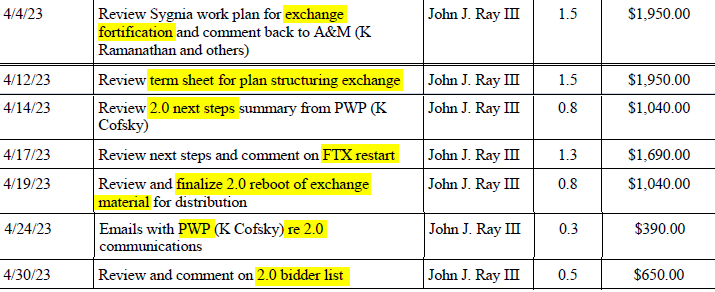

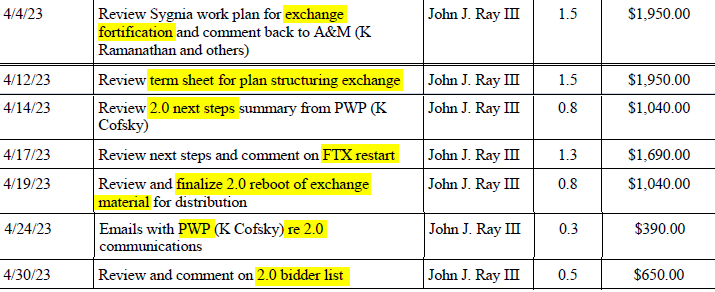

Indications of a potential revival of the troubled exchange, FTX, continue to emerge through the recent billing report of its newly appointed CEO, John Ray III.

In January, Ray hinted at the possibility of rebooting the exchange as he assumed responsibility for managing its bankruptcy process.

The latest billing report reveals that Ray dedicated 6.7 hours to tasks related to “2.0,” widely believed to refer to FTX 2.0, the anticipated reboot of the exchange.

While concrete plans for restarting the exchange have yet to materialize, apart from internal sketches and speculative statements, Ray has not completely ruled out the possibility.

He expressed a willingness to explore any viable path forward during an interview with the Journal in January, stating that “everything is on the table.”

In April, FTX’s lead attorney, Andy Dietderich, mentioned the potential resumption of operations for the cryptocurrency exchange.

Restarting the exchange would require substantial capital and might involve offering customers a stake in the future iteration.

However, Dietderich emphasized that this is one of many potential options, and decisions are still far from being finalized.

Tribe Capital, a venture capital firm, has reportedly shown interest in leading a funding round to revive FTX.

However, industry insiders have raised doubts about the feasibility of such a plan due to persistent technical issues, including high latency and software bugs, which plagued FTX since its inception and contributed to its financial collapse in 2022.

Considering the extensive efforts required to address the trading engine and other software flaws, some argue that building a new exchange from scratch, free from the associated baggage, might be a more viable option.

Notably, the former token of FTX, FTT, has experienced a 12% increase in value according to CoinGecko data.

However, if FTX were to be relaunched, it is unlikely that FTT would play a significant role, as the Securities and Exchange Commission considers it a security.

Starting from June 1, the Hong Kong Securities Regulator will begin accepting license applications from crypto exchanges

According to an announcement made on Tuesday, the Securities and Futures Commission (SFC) of Hong Kong will commence accepting applications for licenses for crypto trading platforms on June 1.

The SFC has agreed to permit licensed virtual asset providers to cater to retail investors, provided that operators assess their understanding of the associated risks.

A report on the SFC’s consultation on policy recommendations, released on Tuesday, outlined these developments.

The regulator also proposed that stablecoins, which are cryptocurrencies pegged to the value of other assets, should not be allowed for retail trading until the jurisdiction’s planned regulations for this asset class come into effect.

The rulebook explicitly prohibits the offering of crypto “gifts” designed to incentivize retail customers to invest, including airdrops.

The guidelines place the responsibility on platform operators to conduct due diligence, emphasizing that being included in two acceptable indices is the minimum requirement for being listed for trading.

As per the rules, crypto exchanges must maintain a minimum capital of 5,000,000 Hong Kong dollars ($640,000) at all times.

Additionally, they are required to submit monthly reports to the SFC, including information on available and required liquid capital, bank loans, advances, credit facilities, and a profit and loss analysis.

Tokens approved for trading on regulated exchanges must have a 12-month “track record.”

The document also provides detailed information on allowing retail investors to use trading platforms and conduct due diligence for token listing.

All tokens listed on exchanges must undergo due diligence procedures, even if they are already listed on another platform, and must go through smart contract audits conducted by independent assessors.

While the SFC allows platforms to segregate client and platform assets through an escrow arrangement or by setting funds aside, it responded to suggestions of engaging third-party custodians by stating that the lack of a regulatory regime for custodians of virtual assets would hinder their supervision and enforcement.

The SFC intends to consult a separate review on permitting derivatives, which it acknowledges are vital for institutional investors.

Regarding the implementation of the Financial Action Task Force’s travel rule for sharing information on crypto transactions between financial institutions, the SFC stated that it would accept the submission of the required information to the beneficiary institution as soon as practicable after the virtual asset transfer, until January 1, 2024, if it cannot be submitted immediately.

The guidelines also offer clarifications on anti-money laundering requirements and criteria for imposing fines on platforms that breach these requirements.

The revised guidelines will come into effect on June 1.