What is DeFi Lending?

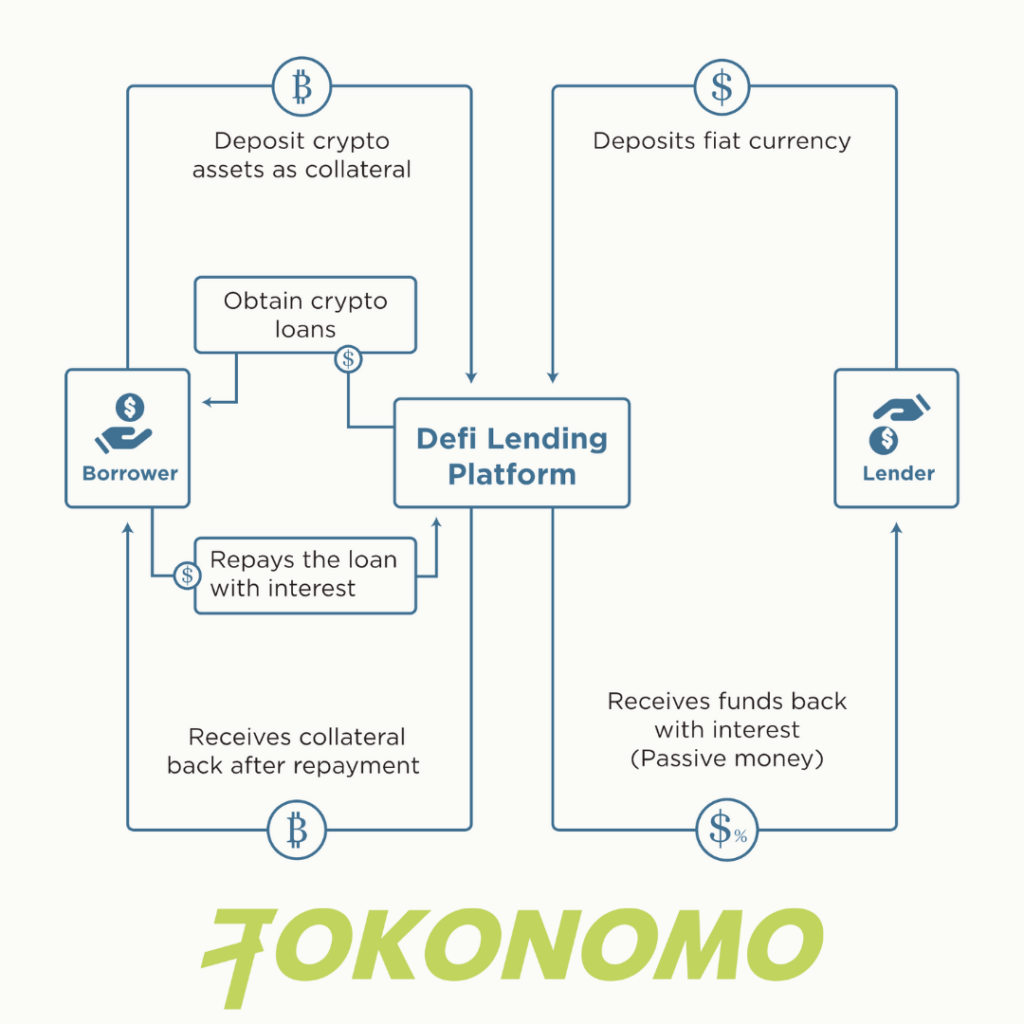

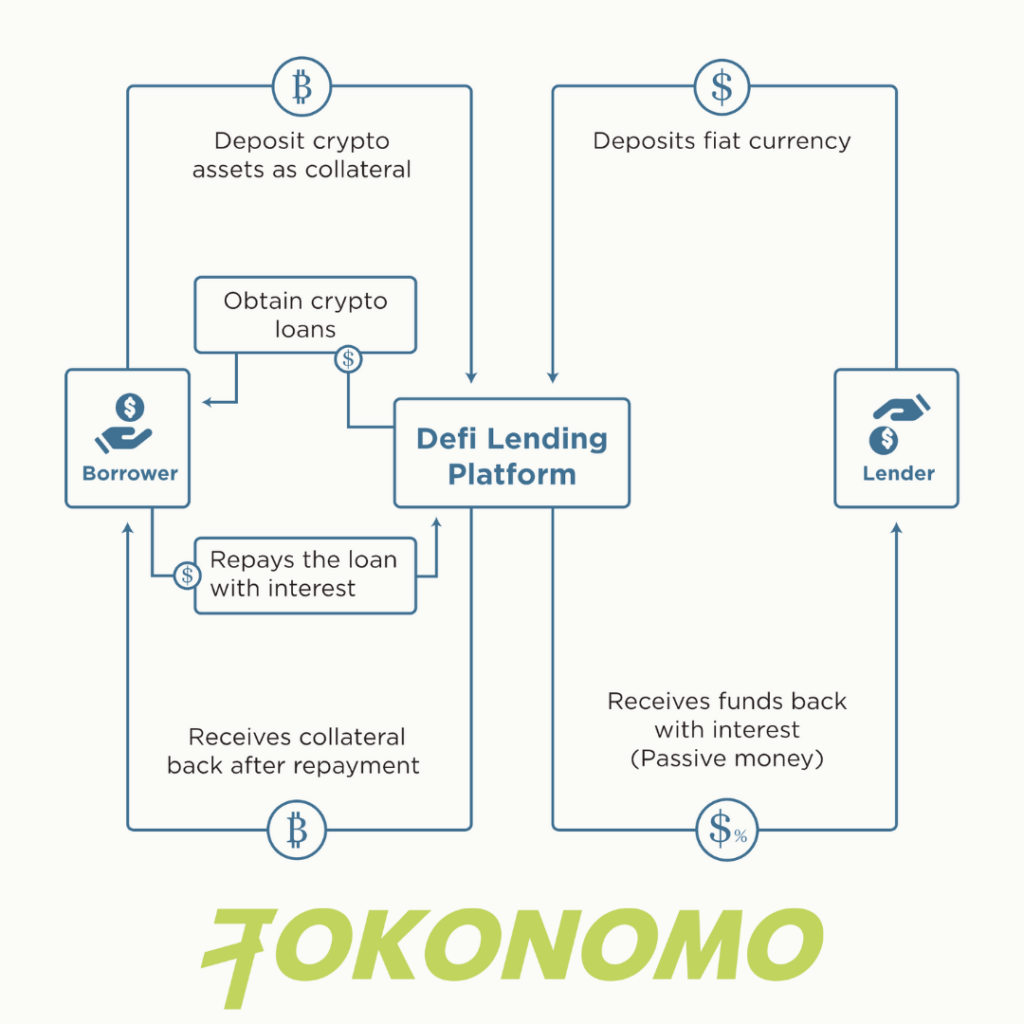

Decentralized finance (DeFi) lending is a method of lending and borrowing digital assets using blockchain technology. It allows individuals to lend and borrow money without the need for a central intermediary, such as a bank. Instead, transactions are recorded on a public blockchain, providing transparency and security.

How does DeFi Lending Work?

DeFi lending platforms, such as Aave and Compound, act as a marketplace connecting borrowers and lenders. Borrowers can use their digital assets as collateral to borrow other digital assets at a certain interest rate. As of today, Defi-Pulse reports that the Total Value Locked (TVL) in decentralized finance protocols has reached $20.46 billion, representing a significant increase from just under $1 billion in the same period last year. Lenders can supply digital assets to the platform, which are then lent out to borrowers at a higher interest rate. The platform typically uses smart contracts to automate the lending and borrowing process, ensuring that all terms of the loan are met.

How is DeFi Lending Different from Traditional Lending?

DeFi lending is different from traditional lending in several ways.

- Decentralization: One of the main differences between DeFi lending and traditional lending is that DeFi lending is completely decentralized. This means that there is no central intermediary controlling the transactions, such as a bank or other financial institution. Instead, transactions are recorded on a public blockchain, providing transparency and security.

- Range of assets: DeFi lending allows for the lending and borrowing of a wide range of digital assets, including cryptocurrencies and tokens. Traditional lending typically only allows for the lending and borrowing of fiat currencies, such as the US dollar or the Euro.

- Interest Rates: The interest rates on DeFi loans are determined by the market, rather than being set by a central authority. This means that interest rates can fluctuate depending on supply and demand for loans. In traditional lending, interest rates are typically set by the central bank or other financial institution and do not fluctuate as much.

- Credit Checks: DeFi lending does not require credit checks or minimum requirements, making it accessible to a wider range of borrowers. Traditional lending typically requires credit checks and minimum requirements, such as a minimum credit score or income level.

- Transparency and Security: DeFi lending offers a greater level of transparency and security due to the use of smart contracts and blockchain technology. Traditional lending often lacks transparency and relies on intermediaries to ensure security.

- Accessibility: DeFi lending allows for a wider range of borrowers and lenders to participate, as anyone with digital assets can supply them to the platform. Traditional lending is typically only accessible to those who meet certain credit and financial requirements.

Benefits of DeFi Lending

DeFi lending offers several benefits over traditional lending.

- Greater accessibility: DeFi lending allows for a wider range of borrowers and lenders to participate, as anyone with digital assets can supply them to the platform. This means that individuals who may not qualify for traditional loans can still access funds.

- Higher returns for lenders: DeFi lending platforms typically offer higher interest rates for lenders than traditional savings accounts or bonds. This can provide a higher return on investment for those looking to earn passive income.

- Automation: DeFi lending platforms use smart contracts to automate the lending and borrowing process. This ensures that all terms of the loan are met and reduces the risk of human error.

- Borderless transactions: DeFi lending is not limited by geographical boundaries, meaning that individuals from all over the world can participate. This allows for a more inclusive financial system.

- Non-custodial: DeFi lending platforms do not hold custody of users’ assets, meaning that users have full control over their own funds. This reduces the risk of hacking or other security breaches.

- Flexibility: DeFi lending platforms offer a wide range of loan options, such as flash loans, fixed-term loans and more, which gives more flexibility to the borrowers and lenders.

- No Middlemen: DeFi lending eliminates intermediaries, such as banks and other financial institutions, which reduces the costs and increases the speed of transactions.

- Transparency: DeFi lending platforms are built on blockchain technology, which provides transparency and immutability to the transactions. This makes it easier to track and verify transactions and reduces the risk of fraud.

Constraints in Decentralized Lending

While DeFi lending offers several benefits, there are also some constraints to consider.

- Regulation: One constraint of DeFi lending is the lack of regulation and oversight. This means that there is a higher risk of fraud or hacking, as there is no central authority to ensure security.

- Volatility: The value of digital assets is highly volatile, which can make it difficult for borrowers to repay their loans. If the value of the collateral drops, the borrower may not have enough assets to cover the loan, which could lead to a default.

- Liquidity: Some DeFi lending platforms may have limited liquidity, which means that there may not be enough lenders or borrowers to support the platform. This can make it difficult for users to access funds or earn interest on their assets.

- Smart contract risks: Decentralized lending platforms rely on smart contracts to automate the lending and borrowing process. However, if there is a bug or error in the contract, it could lead to a loss of funds or other issues.

- Complexity: DeFi lending can be complex and difficult to understand, especially for those new to the space. This can make it difficult for individuals to fully understand the risks and make informed decisions.

- Lack of Insurance: Traditional lending often comes with some kind of deposit insurance, which ensures that depositors’ funds are safe in case of bank failure. Decentralized lending platforms do not have such insurance, which means that lenders’ funds are at risk if the platform were to fail.

- Lack of transparency: Despite the transparency offered by blockchain technology, it can be difficult to know the real-world identities of the counter-parties and the real-world collateral securing the loans, which makes it difficult to understand the real-world risks involved in a loan. Limited options: DeFi lending is still a new and rapidly evolving space, and options are limited compared to traditional lending. This means that the terms and conditions of the loans may not be as favorable as traditional loans, and the borrowers may not have as many options to choose from.

Top DeFi Lending Platforms

There are several DeFi lending platforms currently available, including Aave, Compound, and MakerDAO.

Aave: Aave is a decentralized lending platform that allows borrowers to take out loans using their digital assets as collateral. It also allows for flash loans, which are short-term loans that do not require collateral and can be taken out and repaid within the same transaction. Aave’s unique feature is its “money market” where users can deposit and lend out assets and earn interest. Data provided by DeFi Llama, reveals that Aave v2 continues to dominate the public lending market, with a Total Value Locked of $5.29 billion. While Aave v3, a newer version, has a TVL of $1.47 billion, it is significantly smaller in comparison.

Compound: Compound is a decentralized lending and borrowing platform that allows users to earn interest on their digital assets by lending them to borrowers. The platform uses a unique cTokens system, which represent the assets deposited and borrowed on the platform. The cTokens can be traded, and their value is tied to the underlying assets.

MakerDAO: MakerDAO is a decentralized lending platform that uses a stablecoin called DAI to provide loans. DAI is pegged to the value of the US dollar, making it less volatile than other cryptocurrencies. Borrowers can take out loans in DAI and use Ether (ETH) as collateral. The platform uses a system of collateralized debt positions (CDPs) to ensure that the value of the collateral is always greater than the value of the loan.

These are just a few examples of the many DeFi lending platforms available. Each platform has its own unique features and advantages, so it’s important to research and compare them before deciding which one to use. It’s also worth noting that the space is evolving rapidly and new platform are emerging all the time.

Conclusion

DeFi lending is a new and exciting way of lending and borrowing digital assets using blockchain technology. It offers several benefits over traditional lending, such as a wider range of borrowers and lenders, and greater transparency and security. However, it is important to be aware of the constraints, such as the lack of regulation and the volatility of digital assets. With the right research and precautions, DeFi lending can be a valuable addition to your financial portfolio.