Decentralized Finance (DeFi) is a hotbed of innovation, constantly witnessing the emergence of fresh DeFi projects with remarkable frequency, making it increasingly challenging to stay informed, let alone engage in thorough due diligence (DYOR).

We frequently discuss the permissionless nature of blockchains, which essentially means they are open to the public. No one requires authorization to engage with them, create applications for them, or introduce new ventures to them. While this characteristic is fundamental to cryptocurrencies like Bitcoin, it also carries certain drawbacks.

The lack of barriers means that anyone can introduce dubious or deceptive projects without hindrance. Well, to be technically precise, there is not a complete absence of safeguards – as a community, we can collaborate to identify common patterns that distinguish genuine innovations from deceptive ventures.

So, what should you be vigilant about?

What Is the Project’s Objective?

This may appear to be a rather straightforward inquiry, particularly if you are just entering the DeFi realm. Nevertheless, it’s worth noting that a significant portion of cryptocurrency assets fail to introduce any novel elements. While there is undoubtedly a wealth of exciting innovation occurring – which is the primary reason we are all here, after all – numerous fresh projects seem content to merely ride the coattails of DeFi’s spotlight, without making any genuine efforts to pioneer.

Consequently, one pertinent query you might consider is whether this particular project is striving to usher in something genuinely novel and inventive. Are they making an effort to contribute meaningfully to the emerging digital economy through their project? In what ways does it differentiate itself from its rivals? Is there a distinctive value proposition that sets it apart?

These may seem like fundamental, common-sense inquiries. Nevertheless, by posing them, you can already sift out a substantial portion of potential scams.

Development Endeavors

Another aspect worth considering is the developer activity aspect. DeFi is intricately connected with the open-source philosophy. So, if you possess some coding knowledge, you can certainly delve into the codebase yourself. The advantageous aspect of open-source projects, however, is that when there is substantial interest in a project, others are likely to contribute as well. This can potentially aid in the detection of any malicious intentions harbored by the project.

Furthermore, you also have the option of examining the development activity. Are the developers consistently releasing new code? While it’s true that this metric can be manipulated, it can still serve as a valuable indicator for determining the authenticity of the developers’ intentions, distinguishing between those genuinely committed to the project and those solely interested in a quick profit.

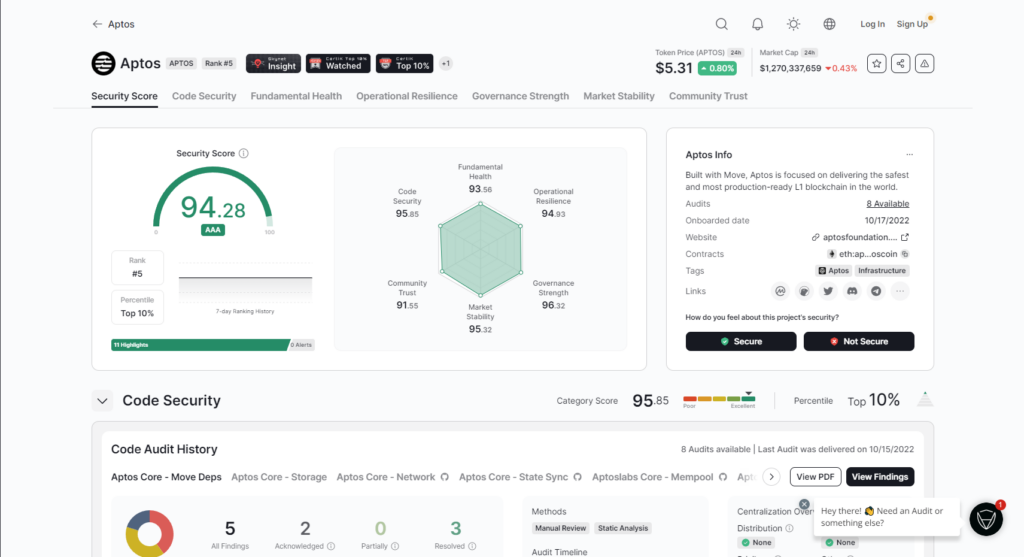

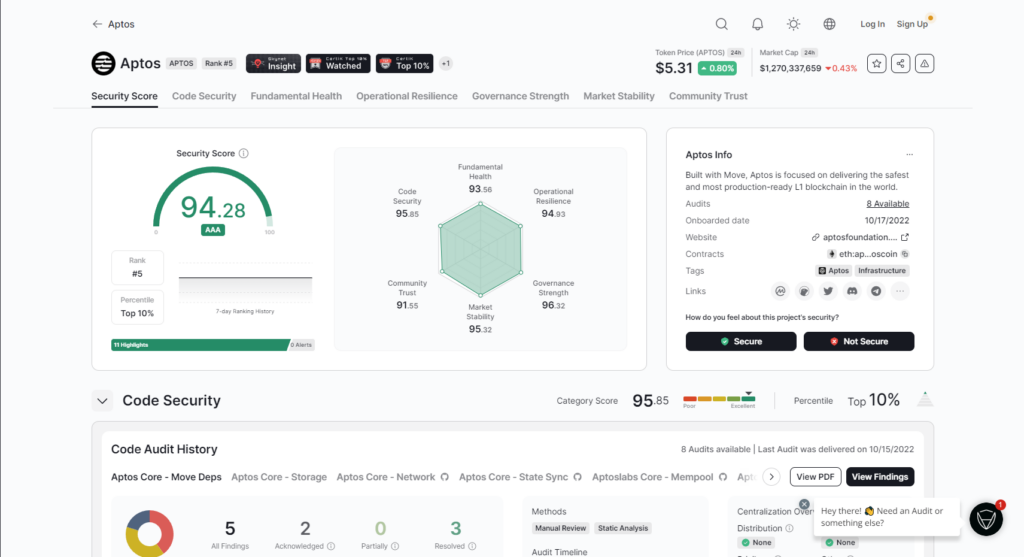

Audits of Smart Contracts

In the realm of smart contracts and DeFi, a recurring topic of discussion revolves around the practice of auditing. These audits serve the crucial purpose of ensuring the security of the underlying code. Despite their critical role in the development of smart contracts, a significant number of developers opt to deploy their code without subjecting it to any form of auditing, a decision that significantly elevates the risk associated with using such contracts.

It is worth highlighting that audits come with a substantial cost. Typically, legitimate projects can afford to allocate resources for these audits, whereas fraudulent endeavors often neglect this crucial step.

However, it’s essential to understand that having undergone an audit does not guarantee absolute safety. While audits are indispensable, they do not offer an impenetrable shield against all potential risks. It is paramount to maintain vigilance and awareness of the inherent risks associated with depositing your assets into a smart contract.

Do the Founders Remain Undisclosed?

The crypto space thrives on the profound sense of anonymity (and pseudonymity) that the Internet can offer. It’s worth noting that Satoshi Nakamoto, the enigmatic individual or collective behind the inception of the first cryptocurrency, will likely forever remain an unidentified entity.

Nevertheless, projects led by anonymous founders introduce an additional layer of risk that demands careful consideration. In the unfortunate event that these founders turn out to be fraudulent actors, the likelihood of holding them accountable becomes significantly diminished. While on-chain analysis tools continue to evolve in sophistication, the scenario differs when the reputation of project founders is intertwined with their real-world identities.

It’s important to emphasize that not all ventures guided by anonymous teams are fraudulent endeavors. Legitimate projects with anonymous leadership exist and flourish in the crypto landscape. However, it’s imperative to weigh the implications of founder anonymity when assessing the merits of such projects.

To sum it up, are projects featuring anonymous founders inherently bad? No. Yet, it is undeniable that projects led by anonymous figures pose greater challenges in terms of accountability for potentially malicious conduct.

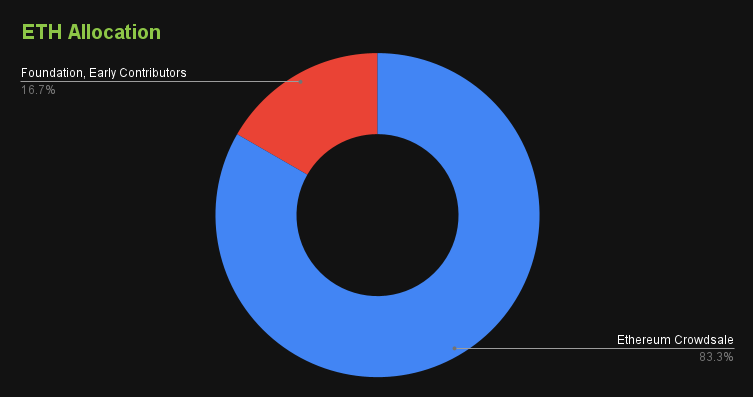

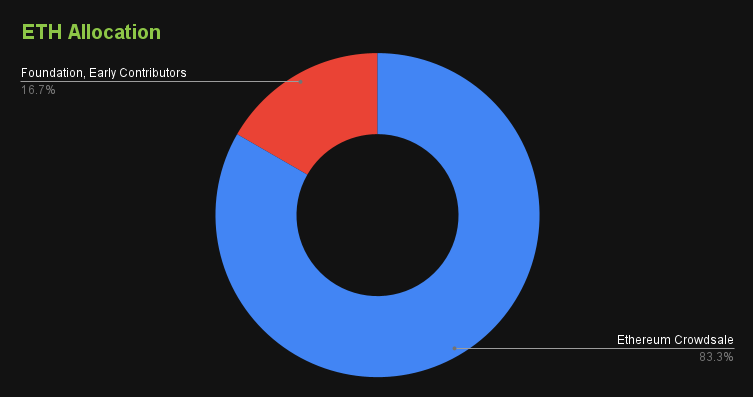

What Is the Distribution of Tokens Like?

Tokenonomics holds immense significance in the evaluation of a DeFi project. One of the strategies that bad actors may employ involves artificially inflating the token’s price while maintaining a substantial holding and subsequently offloading it onto the open market.

What transpires if, for instance, a substantial portion, perhaps 40-50-60%, of the circulating supply is liquidated on the open market? Such a scenario would result in a sharp decline in the token’s value, virtually erasing its worth. Although a considerable founder allocation isn’t universally regarded as a warning sign, it can potentially give rise to future complications.

In addition to examining allocations, it is essential to scrutinize the methods used for token distribution. Is it executed via an exclusive pre-sale, limited to privileged insiders who acquire tokens at an advantageous rate and subsequently generate hype about the project on social media? Is it structured as an Initial Coin Offering (ICO)? Are they opting for an Initial Exchange Offering (IEO), in which a cryptocurrency exchange places its reputation on the line? Or are they dispersing tokens through an airdrop, potentially exerting substantial selling pressure?

Token distribution models encompass a myriad of intricacies that necessitate consideration. In numerous instances, obtaining this information can prove challenging, and this alone can serve as a warning sign. However, for those seeking a comprehensive understanding of the project, such details are undeniably indispensable.

What Is the Probability of Encountering an Exit Scam?

Yield farming, also known as liquidity mining, has emerged as an innovative approach to introducing DeFi tokens to the market. This method is favored by numerous new DeFi ventures due to its potential to generate favorable distribution statistics for the project. The core concept revolves around users locking their assets within smart contracts, thereby receiving a share of the freshly minted tokens in exchange.

It’s worth noting that the potential pitfalls of this approach are apparent. Some projects may opt for a straightforward appropriation of the liquidity pool funds, while others may employ more intricate strategies or execute a substantial pre-mining process.

Furthermore, it is common practice for newly minted altcoins to initially find their listing on automated market makers (AMMs) like Uniswap or Sushiswap. If the project team is actively supplying a significant portion of liquidity for the AMM’s market pair, they have the capability to withdraw it and release their tokens into the market. This often leads to a dramatic decrease in the token’s value, effectively causing it to plummet to near-zero levels. This unfortunate scenario is frequently referred to as a “rug pull,” as it leaves virtually no viable market for token sales.

Conclusion

Whether you’re eager to engage in the exciting realm of yield farming in the wild west of decentralized finance or merely intend to utilize decentralized protocols for exchanging and trading, it’s crucial to be aware that the DeFi space is rife with scams. With that in mind, these overarching guidelines aim to empower you in recognizing malicious projects and identifying unscrupulous individuals more effectively.