Yield farming stands out as a widely embraced method for generating yields within the expansive realm of global DeFi markets. It empowers participants to potentially secure yields that surpass the average by engaging in the act of depositing cryptocurrency into specialized yield farming protocols.

Delve deeper into the intricacies of yield farming and gain a comprehensive understanding of its operational dynamics by continuing to read further.

What is Yield Farming?

Yield farming, also recognized as liquidity mining, encompasses the practice of lending or staking cryptocurrencies within decentralized finance (DeFi) protocols to gain additional tokens as rewards. This strategy has gained popularity due to its potential to yield higher returns in comparison to conventional saving methods.

Consider an investor who possesses cryptocurrencies like ether (ETH) or stablecoins such as DAI. Instead of allowing these assets to remain dormant in their crypto wallet, they can actively engage by lending or depositing them on diverse DeFi platforms. These platforms might include decentralized exchanges (DEX), lending and borrowing platforms, yield aggregators, liquidity protocols, as well as options and derivatives protocols.

Investors may receive the platform’s native tokens, governance tokens, or even a share of the platform’s revenue in prominent coins like ether as a reward for providing liquidity and taking on the role of a liquidity provider (LP).

Yield farmers often utilize a liquidity pool to generate yield, subsequently depositing the earned yield into other liquidity pools to acquire additional rewards, creating a chain of interconnected actions. The intricacy of strategies can evolve rapidly, but fundamentally, a liquidity provider deposits funds into a liquidity pool and receives rewards in return.

The rewards one can obtain are contingent on various factors, including the type and quantity of assets lent, the duration of participation, and the overall demand for the services provided by the platform.

What is the Mechanism Behind Yield Farming?

Yield farming is intricately linked to a model known as an automated market maker (AMM), wherein the active participants are usually liquidity providers (LPs) contributing to liquidity pools.

The initiation of liquidity mining involves liquidity providers depositing their funds into a designated liquidity pool. This particular pool serves as the driving force behind the decentralized finance (DeFi) protocol, offering users avenues to lend, borrow, or exchange tokens. The utilization of these platforms results in the generation of fees, which are subsequently distributed among liquidity providers based on their proportional stake in the liquidity pool. While this forms the fundamental framework of how an AMM operates, the actual implementation can vary significantly depending on the underlying network.

Beyond fees, an additional incentive for adding funds to a liquidity pool may come in the form of receiving a new token. To illustrate, suppose there is no direct method to acquire a new DeFi protocol’s tokens from the open market. In such cases, protocols may propose the accumulation of these tokens for LPs providing liquidity to specific pools. Consequently, LPs receive a yield commensurate with the amount of liquidity they contribute to the pool.

Certain protocols generate tokens that mirror the coins deposited within the system. For instance, depositing DAI into a Compound yields cDAI, representing Compound DAI. Similarly, depositing ETH results in cETH.

These tokens can be subsequently utilized in a more intricate yield farming strategy. For example, an investor may deposit cDAI into another protocol, which then generates a third token representing their cDAI. Yield farming strategies can evolve into complex sequences involving multiple steps, necessitating users to comprehend the underlying mechanics of each protocol.

Getting Started with Yield Farming

To partake in yield farming, individuals must establish a connection between their digital wallet and the chosen DeFi platform, deposit the required assets, and adhere to the platform-specific instructions.

How Are Yield Farming Returns Calculated?

The anticipated returns from yield farming are typically computed on an annualized basis, providing investors with an estimate of the expected returns over a one-year period.

Several commonly utilized metrics include the Annual Percentage Rate (APR) and Annual Percentage Yield (APY). Notably, APR disregards the compounding effect, whereas APY incorporates it. Compounding, in this context, involves reinvesting earnings back into the protocol to generate additional returns. It’s worth noting that APR and APY are frequently used interchangeably.

It’s crucial to bear in mind that these figures are merely approximations and forecasts. Even predicting short-term rewards can be challenging due to the intense competition and rapid fluctuations in yield farming. If a particular yield farming strategy proves successful for a period, numerous farmers may seize the opportunity, potentially diminishing the returns.

Additionally, there’s the factor of impermanent loss, which signifies the potential devaluation of cryptocurrency compared to holding the assets outside the pool. This impact is particularly relevant to liquidity providers (LPs) in certain yield farming strategies. Consequently, the returns derived from farming may not sufficiently offset the value loss due to impermanent loss, making the strategy less lucrative or potentially unprofitable.

Typical Varieties of Yield Farming

1. Providing Liquidity

To engage in liquidity provision, deposit equivalent quantities of two cryptocurrencies into a liquidity protocol, where the system groups together all liquidity providers (LPs) sharing the same asset combination. As individuals conduct trades between the two cryptocurrencies, LPs collectively accrue a portion of the trading fees generated by the platform.

2. Staking

Staking entails the commitment of a specific quantity of coins within a blockchain, contributing to the fortification and functionality of the blockchain network. Users who engage in staking their tokens are frequently granted extra coins as a motivational reward. These rewards can emanate from various sources, such as transaction fees, inflationary mechanisms, or other avenues dictated by the protocol. A noteworthy illustration of this process is observed in the Ethereum network, where a Proof of Stake consensus mechanism is employed. In this mechanism, staked funds play a pivotal role in safeguarding the integrity and security of the network.

3. Lending

DeFi enables individuals and projects to access cryptocurrency loans by tapping into a collective pool of lenders. Through the lending protocol, users have the opportunity to extend loans to borrowers, thereby earning interest on their provided funds.

Dangers Associated with Yield Farming

1. Smart Contract Vulnerabilities

Yield farming is contingent upon smart contracts, which may be susceptible to potential vulnerabilities and exploits. The existence of bugs or security vulnerabilities within these smart contracts can lead to financial repercussions, encompassing the potential loss of both deposited funds and accrued rewards. Therefore, it is imperative to thoroughly evaluate the security measures and conduct a comprehensive audit of the protocols you opt to engage in, exercising a high level of caution throughout the process.

2. Protocol Risks

Every yield farming protocol carries a unique set of risks inherent to its structure. These risks include potential vulnerabilities in the protocol design, updates to the smart contract, alterations in the economic model of the protocol, and the looming possibility of abandoning the protocol.

3. Market Volatility

The cryptocurrency markets are renowned for their inherent volatility, a characteristic that can exert influence on both the valuation of tokens held by users and the rewards acquired through participation in yield farming. Unforeseen and abrupt fluctuations in prices have the potential to lead to a decrease in the overall value of assets deposited by users or their earned rewards, thereby posing a potential impact on the overall profitability of the user’s farming strategy.

This phenomenon is further exemplified by the occurrence of impermanent loss. When the prices of tokens deposited into the liquidity pool exhibit substantial divergence during the farming duration, providers of liquidity may encounter a loss when they decide to withdraw their assets from the pool.

4. Liquidity Risks

Engaging in yield farming usually entails the act of locking up a user’s funds for a predetermined duration. The resulting lack of liquidity implies that users might encounter challenges in promptly accessing or withdrawing their funds as necessary. Furthermore, if a specific pool or platform experiences a decline in popularity or user base, the diminished liquidity may result in reduced rewards, complications in exiting the yield farming position, or even the potential failure of the project, consequently causing a decline in its token price.

Popular Crypto Yield Farming Platforms and Protocols

Let’s now delve into an examination of several fundamental protocols that play a crucial role within the expansive yield farming ecosystem.

1. MakerDAO

Maker functions as a decentralized credit platform, facilitating the establishment of DAI, a stablecoin algorithmically tethered to the USD’s value. Individuals have the opportunity to initiate a Maker Vault, wherein they securely lock various collateral assets like ETH, BAT, USDC, or WBTC. Subsequently, they can generate DAI as a form of debt against the collateral they’ve committed. The debt accumulates interest over time, commonly known as the stability fee, and Maker’s MKR token holders determine the interest rate through consensus. For those engaged in yield farming, Maker presents a valuable tool for minting DAI to incorporate into their yield farming strategies.

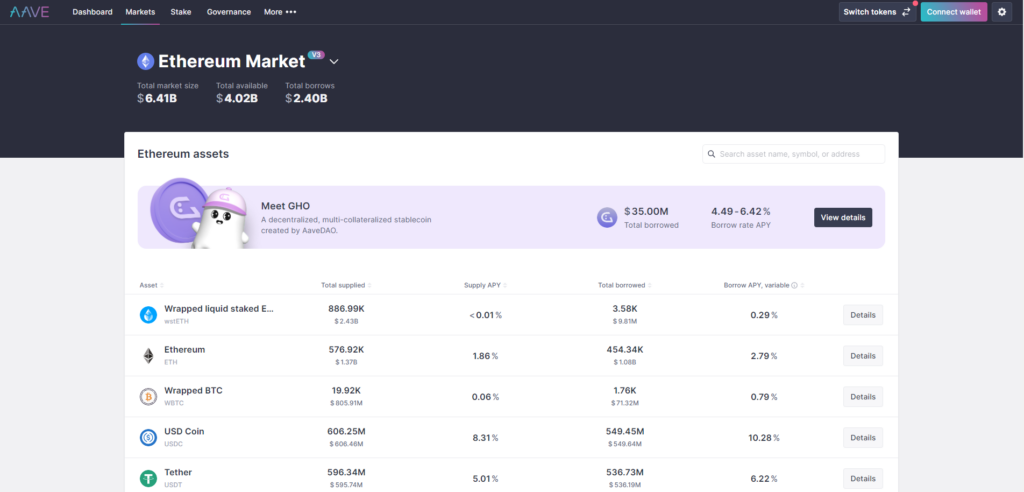

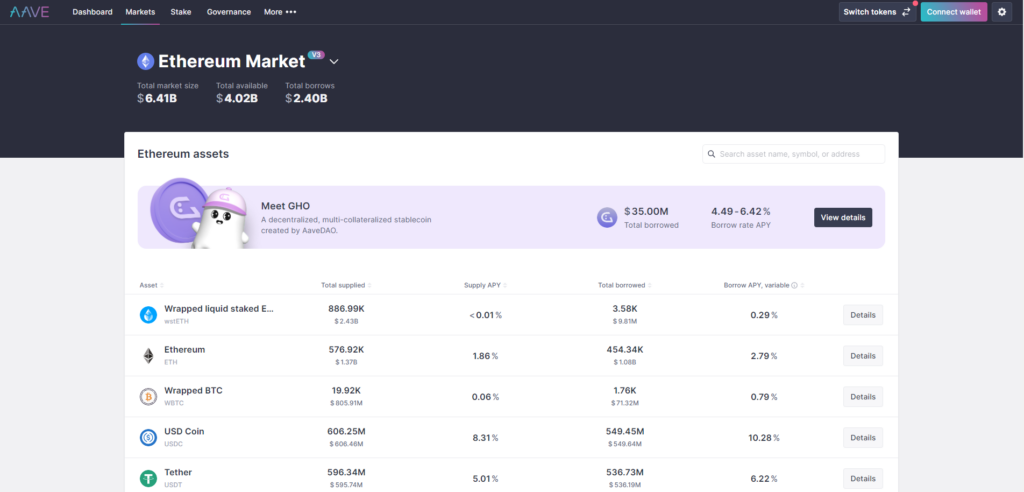

2. Aave

Aave functions as a decentralized lending and borrowing protocol where interest rates dynamically adapt to prevailing market conditions. In return for supplying funds, lenders are issued ‘aTokens,’ which promptly commence accruing and compounding interest upon deposit. Beyond these fundamental functionalities, Aave facilitates additional advanced features, including the provision of flash loans.

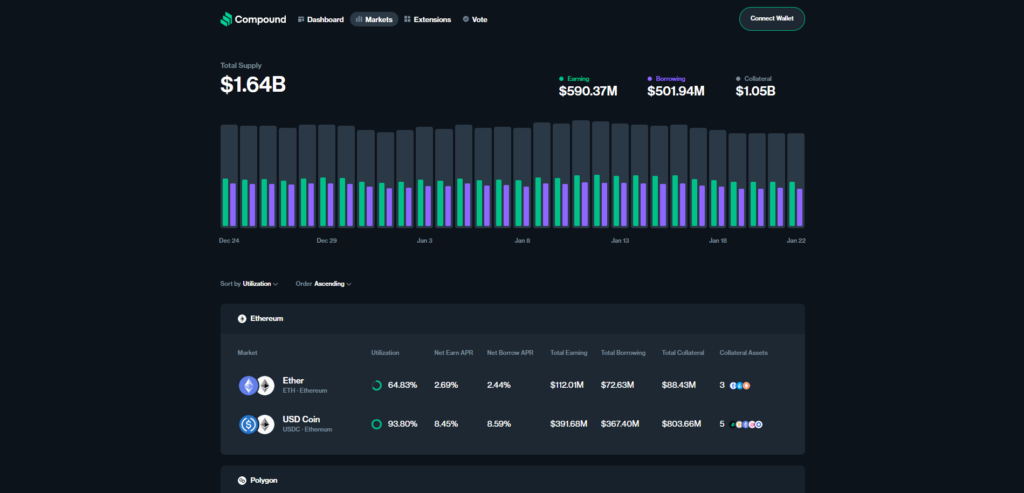

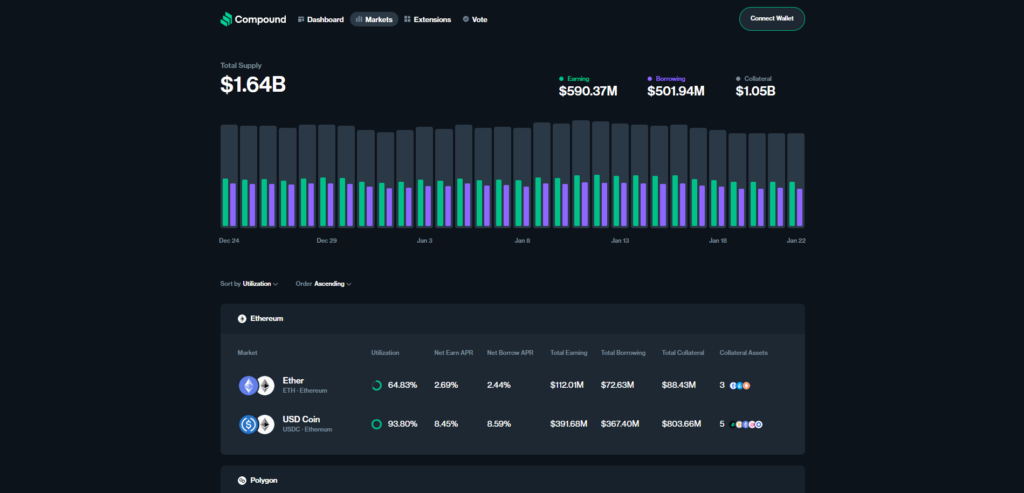

3. Compound Finance

Compound is a sophisticated algorithmic money market platform that provides users with the opportunity to both lend and borrow various assets. Individuals possessing an Ethereum wallet can actively participate by contributing their assets to Compound’s liquidity pool, subsequently unlocking the potential to earn rewards that commence compounding without delay. The platform’s interest rates undergo dynamic adjustments through algorithmic processes, responding to changes in supply and demand within the market.

Conclusion

Participating in yield farming actively engages individuals in the dynamic evolution of the DeFi ecosystem, fostering the creation of innovative financial services. As participants supply liquidity to decentralized platforms, they play a pivotal role in enhancing the overall liquidity and operational efficiency of the DeFi market. Moreover, engaging in yield farming not only facilitates individuals in earning cryptocurrency rewards for their active involvement but also significantly contributes to the broader development of decentralized finance (DeFi).

One of the noteworthy aspects of yield farming lies in its facilitation of financial inclusion, as it opens the doors for anyone possessing an internet connection and cryptocurrency to partake in the transformative DeFi movement. This inclusive approach serves as a compelling alternative to conventional financial systems, empowering individuals with greater autonomy over their funds and the opportunity to generate passive income.