Table of Contents

- Bitcoin remains just below the $27,000 mark while Federal Reserve Chair Powell expresses slightly dovish views

- Vega Token experiences a surge in value as the protocol potentially prepares to go live on Monday

- Opera, the web browser, has incorporated the Layer 1 blockchain known as MultiversX

- Sotheby’s successfully auctioned a portion of 3AC’s exceptional NFT collection, generating an impressive $2.4 million in sales

Bitcoin remains just below the $27,000 mark while Federal Reserve Chair Powell expresses slightly dovish views

Bitcoin (BTC) continued to stay below the $27,000 mark while U.S. Federal Reserve Chair Jerome Powell mentioned that stress in the banking sector could lead to a reduction in rate hikes as a measure to control high inflation.

The leading cryptocurrency, with the largest market capitalization, was recently trading at approximately $26,800, showing a 0.3% increase in the past 24 hours according to CoinGecko data.

BTC’s price briefly reached nearly $27,200 on Friday morning following Powell’s statements during the Thomas Laubach Research Conference, where he discussed the potential impact of credit stress on interest rates.

Powell stated that the tools for maintaining financial stability helped stabilize the banking sector, but the developments there are causing tighter credit conditions, which could have adverse effects on economic growth, employment, and inflation.

Consequently, the need for interest rate hikes may not be as significant as initially anticipated to achieve their goals.

Powell emphasized that the assessment of future interest rate decisions will be an ongoing process, echoing his remarks during the press conference after the May Federal Open Market Committee (FOMC) meeting.

Market expectations align with this sentiment, as the CME FedWatch tool indicates that 79% of traders anticipate the central bank to pause rate hikes in the upcoming mid-June policy meeting, with the possibility of a rate cut later this year.

The market analyst Edward Moya from Oanda noted that the Fed Chair’s inclination towards patience in future tightening actions had a positive impact on Bitcoin, which retained its gains amidst the resolution of debt-limit issues.

In the cryptocurrency market, most top assets experienced upward movement during the afternoon, including Ether (ETH), the second-largest cryptocurrency by market capitalization, which was trading at around $1,809 on Friday afternoon, showing a 0.8% increase.

Vega Token experiences a surge in value as the protocol potentially prepares to go live on Monday

Vega Protocol’s native token, VEGA, has experienced a significant surge of more than 20% in the past week, indicating a positive market trend.

The protocol itself is poised to go live as early as Monday.

Vega is a decentralized finance (DeFi) platform designed for the creation and trading of derivatives. In May, it was deployed on the alpha mainnet.

According to data from CoinGecko, VEGA reached a monthly peak of $1.62 on Wednesday but has since stabilized around $1.33, still showing a remarkable 21% increase over the last seven days.

Barney Mannerings, the co-founder of Vega, stated that the community has proposed and approved the inclusion of USDT, USDC, and ERC20 tokens for deposits and withdrawals on the Vega Ethereum bridge.

If these proposals succeed, the protocol may automatically launch markets as early as May 22nd.

Mannerings expressed enthusiasm for the upcoming launch, as well as interest in integrating the protocol into DeFiLlama, a platform that aggregates total locked value across various protocols.

The Vega community is currently experiencing a strong sense of anticipation and positive reception leading up to the launch.

Opera, the web browser, has incorporated the Layer 1 blockchain known as MultiversX

MultiversX, a blockchain platform with a focus on the metaverse, formerly known as Elrond, has formed a partnership with Opera, the cryptocurrency browser, to incorporate support for its expanding ecosystem.

Through this collaboration, Opera users will have the ability to navigate the decentralized internet with the MultiversX network seamlessly integrated into the browser’s interface. Moreover, users will be able to conduct transactions using MultiversX’s native tokens EGLD or ESDT, connect with MultiversX-based non-fungible tokens (NFTs), and access decentralized applications built on the network.

Beniamin Mincu, the CEO of MultiversX, stated that the integration of the network into Opera provides users with a more accessible entry point into the Web3 ecosystem.

Mincu emphasized that by being incorporated into the Opera browser suite, MultiversX takes advantage of the potential of Web3 in a manner that is both user-friendly and familiar.

This integration represents a significant advancement in simplifying and lowering the barriers to entry into the realm of Web3 and blockchain assets.

Users can effortlessly access the new digital economy without needing to comprehend the underlying complexities.

MultiversX will be integrated into Opera’s desktop browser as well as its Android version, granting users access to MultiversX-based websites.

Sotheby’s successfully auctioned a portion of 3AC’s exceptional NFT collection, generating an impressive $2.4 million in sales

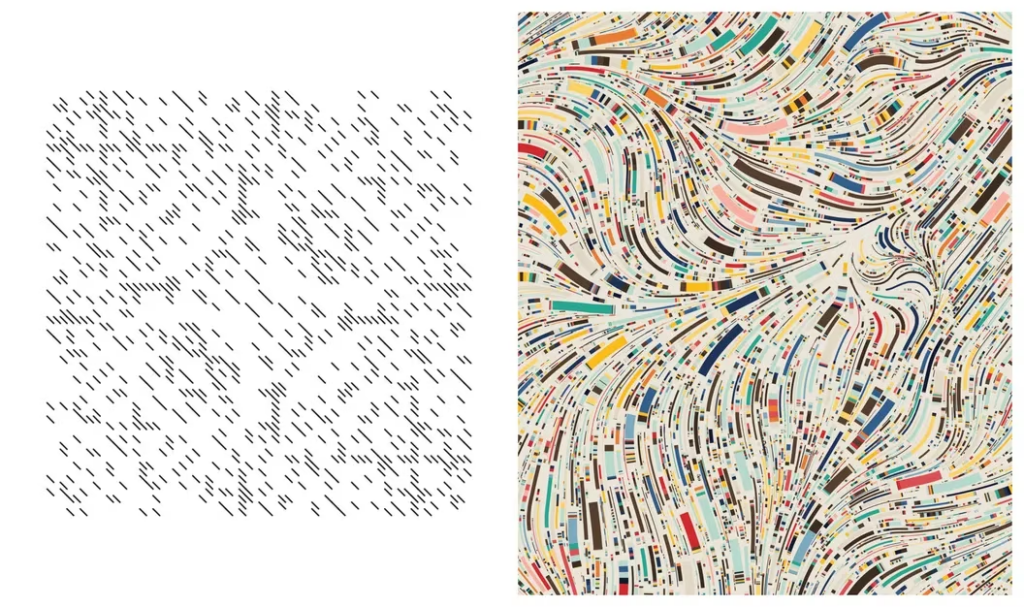

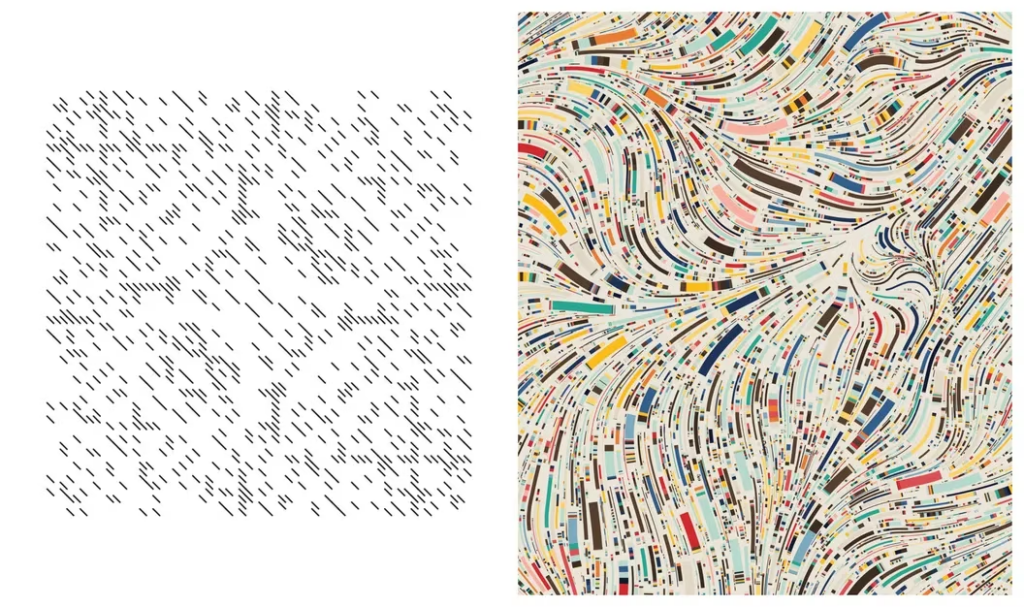

Sotheby’s has successfully concluded the sale of a selection of rare non-fungible tokens (NFTs) obtained from the extensive collection of bankrupt cryptocurrency hedge fund Three Arrows Capital (3AC), generating $2,482,850 in order to recover some of the lost funds.

The auction house initiated a multi-part sale featuring NFTs from the esteemed Grails collection, which had been acquired as part of 3AC’s asset portfolio primarily in 2021.

Following the hedge fund’s bankruptcy filing in July, Teneo, the liquidator of 3AC, announced their intention to sell a vast array of NFTs estimated to be worth millions.

Sotheby’s referred to the contents of the Grails collection as “one of the most notable assemblages of digital artworks ever curated.”

The auction featured various generative art pieces, including Tyler Hobbs’ Fidenza #725 and Dmitri Cherniak’s Ringers #375.

Additionally, the sale included Autoglyph #187 and CryptoPunk #1326, both created by Larva Labs.

Sotheby’s described the collection as a carefully selected showcase of the works of four prominent artists who are pushing the boundaries of contemporary algorithmic art.

A total of seven generative artworks were offered for sale, with further NFTs from 3AC’s collection scheduled for future chapters in subsequent auctions or private sales.

The highest-priced NFTs from Part 1 of the Grails collection were Fidenza #725 and Autoglyph #187, with estimated values ranging from $120,000 to $180,000 each.

The actual sale prices for these NFTs were $1,016,000 and $571,500, respectively.