Table of Contents

- As the PEPE craze takes hold of the market, the Ethereum gas fee has spiked to its highest level in 12 months

- The U.S. has surpassed expectations by adding 253,000 jobs in April, while Bitcoin experienced a decline

- SushiSwap, a decentralized exchange, has launched its V3 liquidity pool on 13 different chains

- The NFT lending platform, Blend, has raised concerns about the liquidity of the ecosystem

As the PEPE craze takes hold of the market, the Ethereum gas fee has spiked to its highest level in 12 months

The latest trend of investing in a frog-themed token called pepecoin (PEPE) has led to a surge in Ethereum gas fees, making it more expensive to use.

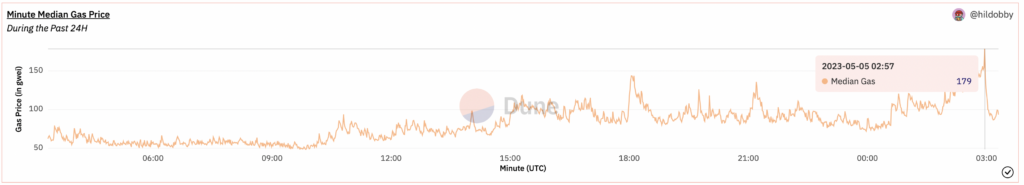

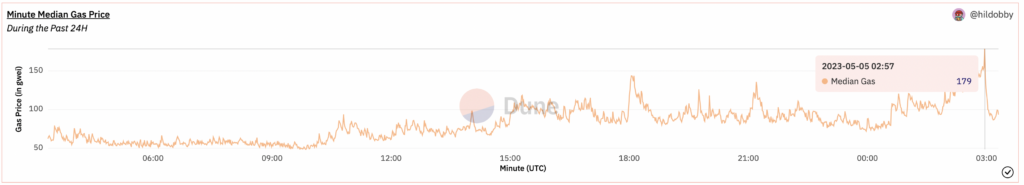

The daily median gas price, which is the transaction cost, reached a 12-month high of 87 gwei at the start of this week and has increased by over 50% since the launch of the PEPE token on April 18, according to the Ethereum Gas tracker on Dune Analytics by @hildobby, a pseudonymous analyst.

At one point on Monday, the one-minute median gas price exceeded 150 gwei, indicating high demand for the Ethereum network, primarily from meme-coin traders, according to analytics firm CoinMetrics.

CoinMetrics also noted that while bitcoin (BTC) is witnessing the birth of a nascent memecoin scene, the ETH ecosystem is generating multi-million dollar altcoins, such as the ERC-20 heavyweight PEPE.

The pepecoin frenzy is so intense that Uniswap’s liquidity pools, where pepecoin-wrapped ether (PEPE-WETH) is traded, have become the most active liquidity pool by the number of transactions.

PEPE traders have accounted for more than 410,000 transactions on Uniswap, burning around $10 million worth of gas, according to data tweeted by Scimitar Capital’s Alex.

The U.S. has surpassed expectations by adding 253,000 jobs in April, while Bitcoin experienced a decline

According to a report from the Bureau of Labor Statistics (BLS), the United States added 253,000 jobs in April, surpassing expectations for 180,000 and up from a revised 165,000 in March.

The unemployment rate also decreased from 3.5% in March to 3.4%, which was lower than the predicted 3.6%.

Shortly after the news, the price of Bitcoin fell by approximately 1% to $28,900.

The employment situation in the country has remained robust, prompting the Federal Reserve to continue raising interest rates to bring inflation down to its target of 2%.

The Fed increased the benchmark fed funds rate to 5.0%-5.25% at its most recent meeting but signaled that it may pause rate hikes.

While the headline jobs number for April is strong, revisions to the February and March reports reduced the total gains by 149,000, with an average job gain of 222,000 over the past three months.

SushiSwap, a decentralized exchange, has launched its V3 liquidity pool on 13 different chains

On Thursday, SushiSwap, a decentralized exchange (DEX), launched new liquidity pools across 13 different networks. This move is expected to enhance trading and liquidity providing across these networks.

The V3 concentrated liquidity pools will be available on popular chains such as Ethereum, Arbitrum, Polygon, BSC, and Avalanche.

The launch aims to offer liquidity providers exposure to larger trading volumes and liquidity while minimizing financial risks.

Additionally, the pools have been designed to provide traders with greater flexibility and control over their slippage tolerance and assets.

According to Alex Shefrin, SushiSwap’s business development lead, the V3 liquidity pools will make the protocol more efficient in terms of rewards.

SushiSwap’s team plans to make the V3 liquidity pools available on over 30 chains in the coming months, which aligns with their vision of increasing support for cross-chain activities.

Shefrin explained that they are building an engine block that enables users to go from “asset a” on “chain a” to “asset b” on “chain b,” allowing users to “bring their own blockchain.”

The protocol is also introducing Tines, a smart-order system, which aims to offer users the cheapest swaps with maximum capital efficiency in conjunction with the protocol’s new route processor.

The NFT lending platform, Blend, has raised concerns about the liquidity of the ecosystem

Blur, a pro-focused NFT marketplace, has entered the NFT lending space with the launch of Blend, a P2P NFT lending platform.

The platform allows NFT holders to lease out their tokens to collectors looking to buy popular NFT collections with a smaller upfront payment, similar to a digital pawnshop.

However, the move has raised concerns about the liquidity of the ecosystem and the potential risks of allowing collectors to purchase tokens with funds they don’t have.

While Blend may help introduce new buyers to the NFT ecosystem by lowering fiscal barriers to entry, it may not be a product that every amateur trader should be eager to “ape” into.

According to Twitter user Carl_m101, founder of NFT collection Sky Scooters, the danger is that after a large price floor jump, a “margin call” event might follow where traders sell off their NFTs and end up tanking the market.

The concern with Blend is that it is a product directly from Blur, one of the leading NFT marketplaces in terms of trading volume, which may lead to its already-eager users being more likely to opt into leasing NFTs rather than purchasing tokens at their full price.