What is IDO?

IDO is short for Initial DEX Offering. It’s an advanced cryptocurrency crowdfunding method using a decentralized exchange.

How exactly does it even work? Benefits of IDO

IDO is similar to an ICO (Initial Coin Offering) concept. Someone comes up with an idea for a project, builds a token with a team, advertises it to potential investors, and then sells it. The main difference is the execution of crowdfunding. While ICO runs through centralized platforms, IDO does everything through a decentralized exchange. That eliminates terrifying fees and the need for permission from a centralized platform.

After a successful IDO, the percentage of the collected funds ends up in the liquidity pool. Upon project launch, the liquidity pool becomes tradable. Anyone can start trading on decentralized exchanges immediately.

No personal information is required to join or launch an IDO because it uses a decentralized exchange. Only a crypto wallet with enough funds in there. Yet, this comes with a disadvantage. As no verification is required, anyone can start a project without revealing themselves and run away with a percentage of the collected funds that were intended to be used for project development. That is called a rug pull*. Make sure to DYOR* before investing in any new projects.

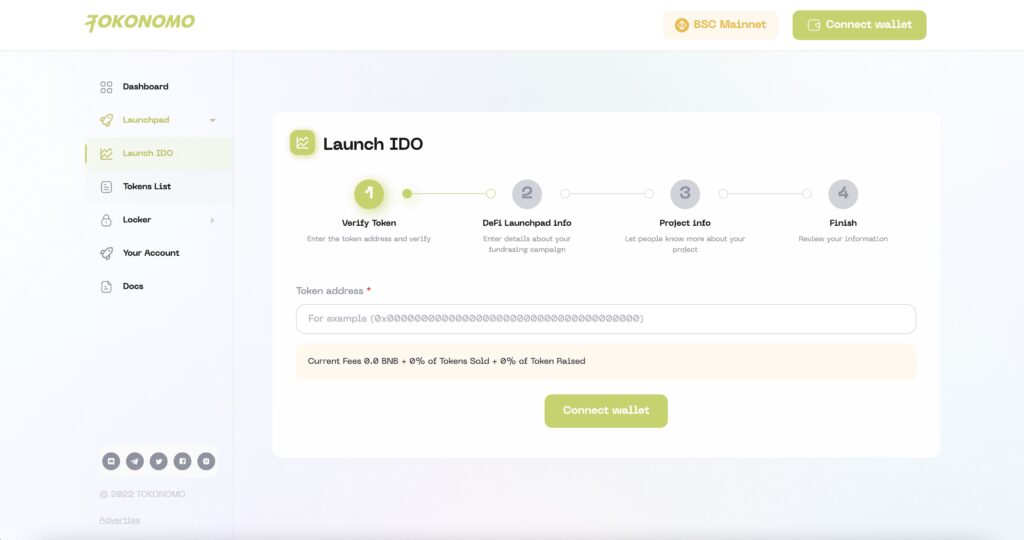

How to create an IDO in 2025?

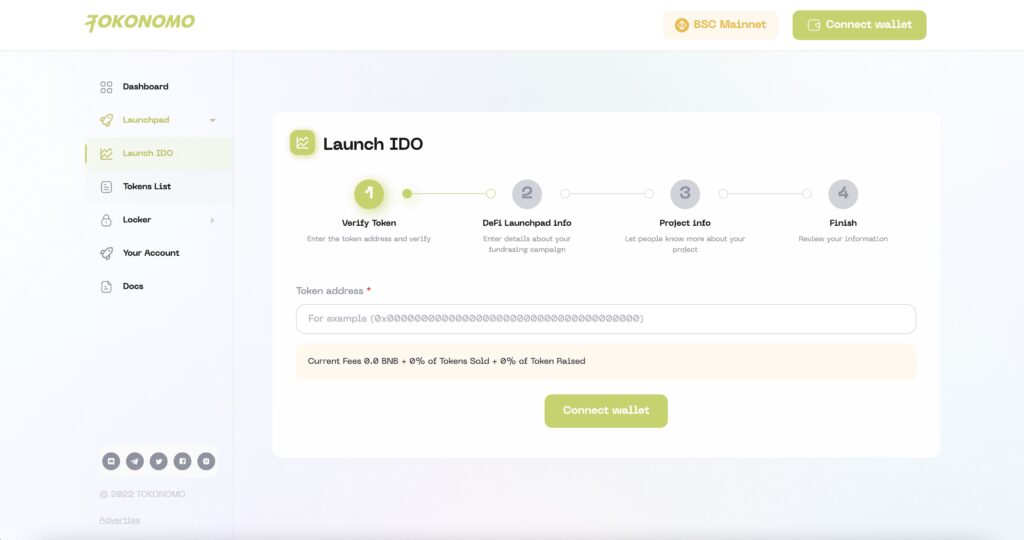

Creating an IDO is easy as 1-2-3. With Tokonomo, you can launch your it in 5 mins. Visit Tokonomo IDO launchpad, connect your wallet, fill out all required information, confirm the transaction and you are ready to go!

For investors, Tokonomo offers a lot of different functions to ensure a safe and smooth experience. Check it out yourself!

Also, Tokonomo Consulting can help you run a successful IDO from idea to DEX listing.

Conclusion

IDO (Initial DEX Offering) has succeeded in resolving the majority of the ICO concept’s issues. With the rapid rise of the DeFi industry, IDOs are becoming more popular and are on the way to becoming the main go-to method for kickstarting a project and gaining investor attention.

*Rug pull – in the crypto world, this term refers to the moment when a development team abruptly abandons a project and sells or removes all of its liquidity. The name is derived from the idiom “take the rug out from under (someone),” which refers to abruptly ceasing support.

*DYOR – DYOR stands for Do Your Own Research. It’s a common phrase in the crypto industry that encourages investors to research a project before investing in it.

FAQs (Frequently Asked Questions)

IDO means Initial DEX Offering. It’s a way for crypto projects to raise funds by launching their tokens directly on a decentralized exchange (DEX).

Both involve selling new project tokens to investors. The key difference: ICOs happen on centralized platforms, while IDOs happen on DEXs. This means no middlemen, lower fees, and faster access to trading.

– No KYC or personal data needed — just a crypto wallet.

– Immediate trading after launch, thanks to liquidity pools.

– Lower costs compared to centralized fundraising.

Yes. Because there’s no verification process, anyone can launch a token. Some projects may be scams or “rug pulls,” where teams abandon the project and take investor funds. Always DYOR (Do Your Own Research).

A portion of the raised funds is locked into a liquidity pool on the DEX. This ensures that tokens can be traded right away once the project launches.

With platforms like Tokonomo, it’s quick and simple: connect your wallet, provide project details, confirm the transaction — and your token sale can go live in minutes.

Yes. Tokonomo Consulting offers full support — from token creation and marketing to exchange listing — making it easier for teams to run a successful IDO.

As DeFi grows, projects and investors prefer decentralized, transparent, and borderless fundraising methods. IDOs have solved many of the issues ICOs had, which is why they’re quickly becoming the go-to launch method.